Absorption Of A Company: The Livewire of Corporate Transformation and Industry Consolidation

Absorption Of A Company: The Livewire of Corporate Transformation and Industry Consolidation

When a company absorbs another, it is far more than a financial transaction—it is a strategic realignment that reshapes markets, redefines competitive landscapes, and redirects corporate trajectories. Absorption, in the context of business, refers to the formal integration of one firm (the acquiring entity) into another (the target), often through ownership control, asset consolidation, and operational alignment. From mergers that spark industry-wide shifts to subtle buyouts executed behind closed doors, absorption remains a cornerstone of corporate evolution.

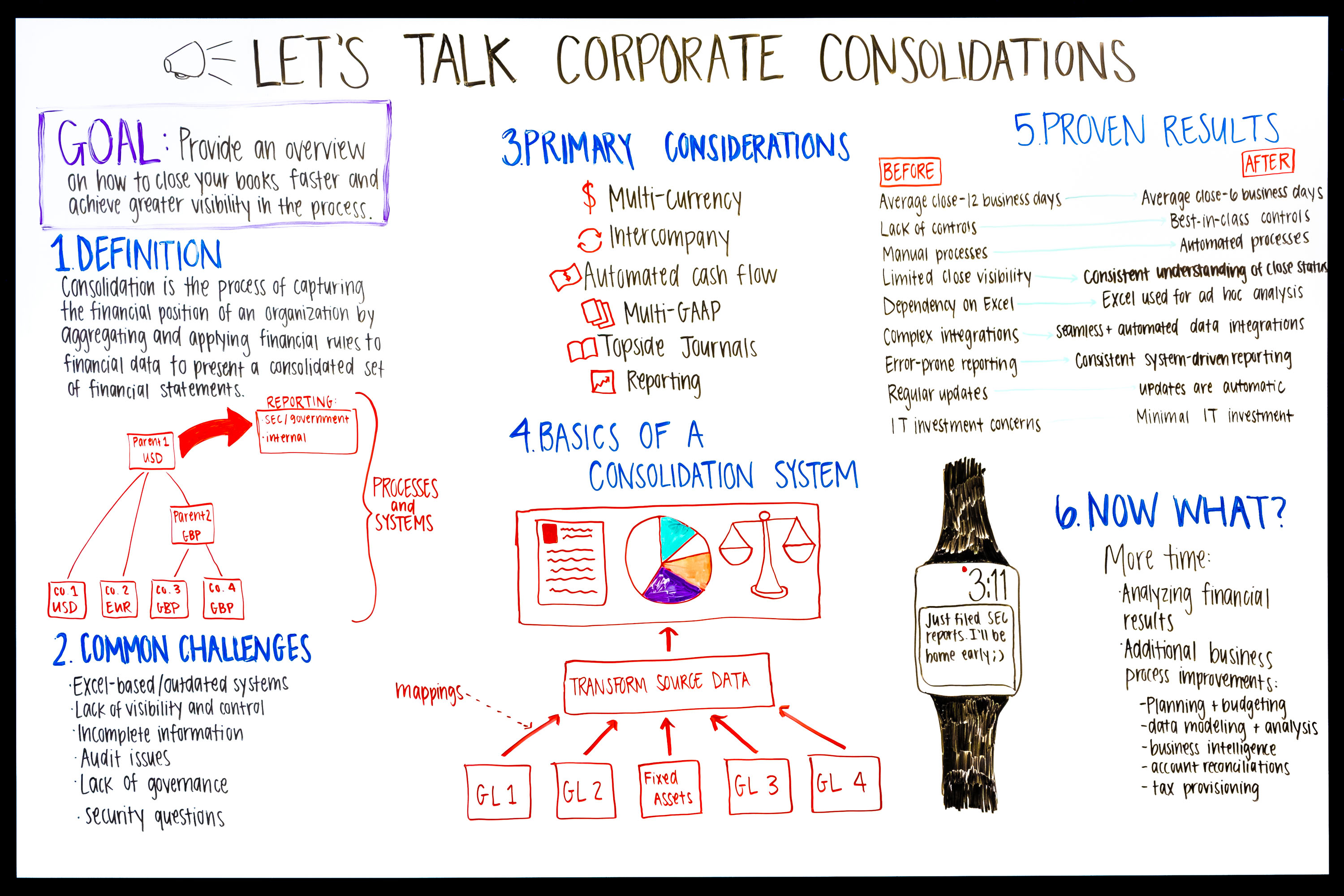

This process enables scalability, eliminates redundancies, and strengthens market positioning—yet it also demands careful navigation of legal, cultural, and operational complexities. Understanding absorption requires unpacking its mechanisms, motivations, and real-world applications. At its core, absorption is the legal and operational merging of legal identities and business functions.

While full mergers typically create new entities, pure absorption occurs when one company takes sole control, rendering the target company either dormant or fully subsumed. “Absorption isn’t just about balance sheets—it’s about execution,” notes industry analyst Maria Chen. “It’s about aligning systems, systems, and the people who drive value.” This subtle yet profound difference underscores why absorption strategies are increasingly critical in fast-evolving markets.

What Characterizes a Successful Absorption Strategy?

A successful absorption goes beyond mere ownership—it hinges on meticulous integration planning and cultural synergy. Companies must identify clear objectives before acquisition: cost synergies, expanded market access, technological leveraging, or talent acquisition. Post-deal integration is where many initiatives falter, yet those structured around phased implementation tend to thrive.Key elements of a robust absorption strategy include: - **Clear Strategic Alignment:** The acquiring firm must articulate how the absorbed entity fills a strategic gap—whether entrepreneurship, IP, geographic reach, or economies of scale. For example, a tech giant acquiring a niche AI startup bolsters innovation pipelines, not just balance sheets. - **Financial Structure & Funding:** Transactions are commonly funded via cash, stock swaps, or debt.

Optimal capital structure balances risk and reward—over-leveraging can undermine long-term stability, while underfinancing may lead to transaction failure. - **Cultural Integration:** Perhaps the most underestimated factor. Studies show up to 70% of acquisitions underperform due to cultural mismatches.

Companies that prioritize cross-team collaboration, leadership continuity, and transparent communication boost retention and morale. - **Operational Rigor:** System interoperability—IT infrastructure, supply chains, and legacy workflows—must be assessed and realigned efficiently to avoid productivity collapse. A case in point: in 2021, Alphabet absorbed Fitbit not just for its wearable device sales, but for its large health data assets and user engagement platform—showcasing absorption as a tool for strategic foresight.

Types of Absorption: Full Mergers, Stock Acquisitions, and Behind-the-Scenes Deals

Absorption manifests in multiple forms, each tailored to legal, financial, and strategic intent. The most visible form is a full merger, where two legal entities dissolve into a single corporation. This structure suits large-scale transformations, such as when pharmaceutical behemoths consolidate R&D arms to accelerate drug development.Less obvious are stock acquisition absorption models, where one company gradually increases its ownership in another through equity purchases—often favored when full control is pursued incrementally. “Percentages matter,” warns corporate strategist David Lin. “A 100% acquisition locks control; temporary stakes allow influence without bureaucracy, though layering ownership demands careful governance.” Equally significant are behind-the-scenes absorption, where a parent company exerts control via contractual agreements, board representation, or financial leverage—common in private equity buyouts or supplier-owned enterprises.

These models thrive in sectors where operational autonomy remains critical but strategic direction is non-negotiable, such as luxury brands or regional distributors. Market responses vary by absorption type: full mergers spark immediate volatility in stock prices due to clear ownership shifts, while incremental stock purchases may signal confidence without disrupting day-to-day operations. Realizing absorption’s full potential requires matching structure to long-term goals.

Challenges and Risks in Integration Post-Absorption

Even well-planned absorptions face substantial hurdles in the integration phase. Cultural clashes remain a top preventable risk. When differing corporate values, communication styles, or work ethics collide, employee disengagement and talent attrition often follow.“People don’t leave companies—they leave leaders, systems, and shared purpose,” explains organizational psychologist Elena Rios. “An absorption without people-first planning risks losing the very assets it seeks to preserve.” Operational integration presents another front. Merging disparate IT systems, supply chains, or product lines demands technical precision and project management rigor.

Legacy infrastructure incompatibility, data migration errors, or workflow duplication can stall synergies—eroding anticipated cost savings. Legal and regulatory scrutiny adds another layer. Antitrust concerns frequently arise, especially in concentrated markets, prompting prolonged reviews or mandated structural concessions.

In 2023, Microsoft’s absorption of Nuance Communications triggered antitrust reviews in multiple jurisdictions, highlighting absorption’s increasing regulatory oversight. EPA compliance, data privacy laws, and contract renegotiations further complicate post-acquisition stability. Proactive risk assessment, phased integration timelines, and dedicated cross-functional teams are essential to mitigate these pitfalls.

Performance Metrics: Measuring Success in Absorption Outcomes

Evaluating whether an absorption achieved its purpose demands a structured framework. Key performance indicators (KPIs) extend beyond short-term financials to encompass long-term strategic alignment. Financial metrics dominate: - Cost synergies realized, measured against projected targets - Return on investment (ROI) over time - Earnings before interest, taxes, depreciation, and amortization (EBITDA) growth - Market share shifts post-transaction Non-financial indicators are equally vital: - Employee retention and engagement surveys - Customer satisfaction and churn rates - Innovation output (patents filed, new products launched) - Time-to-synergy benchmarks Organizations with integrated measurement systems report 40% higher absorption success rates, according to a 2024 McKinsey study.Regular audits and adaptive feedback loops ensure continuous alignment with core objectives.

Absorption of a company is not merely a corporate maneuver but a strategic transformation—one that reshapes industry dynamics, redefines value creation, and determines long-term resilience. When executed with precision, vision, and human insight, absorption becomes the engine driving industries forward, turning acquisitions into lasting competitive advantages.

As global markets evolve and technological disruption accelerates, the ability to absorb, integrate, and innovate will distinguish industry leaders from laggards. In the end, the most powerful absorptions are those that honor both legacy and evolution, merging strengths not to erase identity—but to build something greater.

Related Post

Breakfast Jackson Wy: Redefining Morning Fuel for a Productive Day

Jackson Hole Airport Photos Reveal Stunning Serengeti of the Sky

Andmesh Kamaleng’s “Hanya Rindu”: A Lyrical Journey Into Indonesia’s Soul Through YouTube

Behind the Lens: A Closer Look at Laura Ingraham’s Wife and the Quiet Power She Represents