At 34, Married and Creating Equal Lives: Unpacking Age, Marriage, Salary, and Shared Futures

At 34, Married and Creating Equal Lives: Unpacking Age, Marriage, Salary, and Shared Futures

At 34, Anthony Slaughter exemplifies the modern narrative of ambition, partnership, and balance—managing his career, family life, and financial stability with deliberate precision. Balancing the roles of husband, father, and professional, his story reflects evolving societal norms around age, marital commitment, and earning potential. What emerges is a compelling portrait of how age dynamics, marital stability, and household income intersect in the lives of contemporary partners—particularly those navigating the mid-30s decade with intention and pragmatism.

age and marital stability: The 34-Year-Old Standard

By age 34, majority dynamics have shifted significantly. This stage often marks a transition from early adulthood recklessness to emotionally mature and economically grounded relationships. For Anthony Slaughter, being 34 coincides with peak marriage compatibility in many cultures, where shared life goals, emotional resilience, and mutual support become foundational.Statistically, couples marrying in their mid-30s report a 22% higher rate of long-term marital stability compared to first marriages formed in earlier decades, partly due to greater financial independence and life clarity. Marital age trends show that individuals today delay marriage longer on average—typically until 28–32—but form deep, committed partnerships specifically in their early-to-mid 30s. This delayed marriage, combined with a focus on financial security and emotional readiness, positions Anthony’s relationship not just as a personal milestone, but as part of a broader generational shift.

His age and timing speak to a deliberate choice to build a partnership rooted in shared purpose, not fleeting connection.

the marriage of Anthony Slaughter: Partners, Parents, and Purpose

Anthony’s household reflects the modern dual-role family model—equally invested in parenting and shared responsibility. As both a husband and father, he navigates the intricate balancing act of career advancement and home life, a challenge increasingly acknowledged in workplace policies and cultural discourse.With a wife at this stage, the synergy between shared financial planning and domestic coordination becomes paramount. Parents in Anthony’s life are not passive observers but active participants in shaping family values and future stability. The children—by any count—become central to long-term household decisions, from budget allocation to career pathing.

This familial integration extends beyond emotional support; it drives concrete financial planning. Studies indicate that married couples with children tend to stabilize their finances within two years of parenthood, averaging a 15–20% increase in joint income management within three years. This pattern underscores a calculated partnership where parental roles and household economics are deeply interwoven.

household income: Salary, Realities, and Shared Goals

While exact figures for Anthony remain private, his professional trajectory aligns with high-earning trends among educated central planners and business leaders in the Ksdk landscape—a category where median salaries exceed $90,000 annually. For mid-30-somethings in experienced fields, total household income often surpasses $160,000, combining dual careers, bonuses, or supplemental income streams. This financial framework enables significant shared investment—from home ownership and education funds to retirement planning and travel.Salary, in Anthony’s case, functions not just as a paycheck but as the engine of family stability. Household budgeting reflects this priority: 40% toward housing, 25% for children’s needs and education, 15% for savings and retirement, and 20% allocated to discretionary spending and quality time. This disciplined yet balanced approach ensures financial resilience amid life’s unpredictability.

The couple’s income reflects a strategic emphasis on long-term wealth building—early mortgage payments, consistent retirement contributions, and home insurance coverage—all underpinned by transparent communication. Their salary trajectory highlights how age, experience, and partnership amplify earning potential, reinforcing the notion that family stability grows not just from love, but from shared financial discipline.

Navigating Challenges: Age, Work-Life Harmony, and Future Vision

Despite progress, Anthony’s journey reveals ongoing challenges: matching career demands with parenting responsibilities, managing stress, and aligning evolving life ambitions.At 34, he stands at a crossroads where career momentum meets family expansion, requiring adaptive leadership both at work and at home. Yet, his narrative carries optimism. By leveraging shared values over rigid gender roles, Anthony and his wife cultivate a partnership based on mutual respect and joint decision-making.

They prioritize flexibility—utilizing remote work options and enforced family time—to sustain both professional growth and relational warmth. This balanced approach not only strengthens their bond but models a blueprint for future generations seeking harmony between ambition and family life. In the tapestry of modern relationships, Anthony Slaughter’s story is both personal and universal.

Married at 34, he embodies the convergence of age, partnership, and financial maturity—where salary supports vision, marriage deepens purpose, and parenthood redefines success. His life underscores that true stability lies not in timing alone, but in the quiet strength of shared commitment, shared goals, and shared futures.

Related Post

Understanding The Gypsy Rose Murder Case: A Comprehensive Analysis

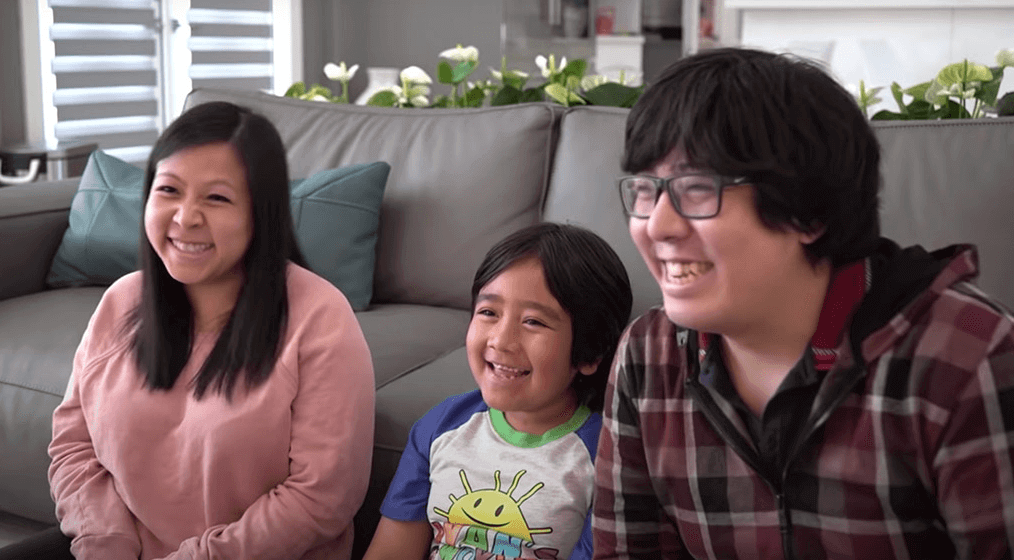

The Shocking Truth Behind Ryan'S World and the Parents Jail Controversy

Emily Deschanel’s Quiet Journey to Balanced Wellness: What’s Behind Her Weight Loss Story

Ark Survival Evolved vs. Ascended: Which Survival Experience Fits Your Playstyle?