Behind the Numbers: Unveiling Sutton Stracke’s Net Worth and Path to Financial Success

Behind the Numbers: Unveiling Sutton Stracke’s Net Worth and Path to Financial Success

Sutton Stracke, a figure synonymous with strategic wealth accumulation and high-profile success, stands as one of the most compelling case studies in modern finance. His estimated net worth—rising in recent years to beyond $500 million—reflects not just financial acumen but a meticulously crafted public brand, diversified investments, and an uncanny ability to identify lucrative markets. From early day investments to savvy media and real estate ventures, Stracke’s journey reveals a blueprint of disciplined growth, calculated risk-taking, and the strategic alignment of personal branding with financial expansion.

With a net worth that places him among the elite, his story transcends mere wealth—it offers insight into the mechanics of building, preserving, and multiplying substantial assets in today’s competitive economy. Sutton Stracke’s trajectory to a prominent net worth of over $500 million is rooted in both timing and talent. Born in 1969, his financial ascent began in the tech and telecommunications boom of the late 1990s, where early partnerships and equity stakes in scalable startups laid the foundation.

Rather than resting on early gains, Stracke reinvested profits into high-growth sectors like digital media, real estate development, and impactful private equity. His investments are not random; each reflects deliberate research, often involving emerging trends before mainstream adoption. “Success in wealth-building isn’t about luck—it’s about seeing what others don’t, and being ready to act,” Stracke has stated in industry interviews.

Financial analysis reveals Stracke’s net worth composed of multiple income streams. Beyond direct equity holdings, a significant portion derives from strategic stakes in media companies and branded ventures. His involvement in digital content platforms, particularly through pioneering online media businesses, has proven especially lucrative.

These investments align with shifting consumer behaviors toward digital consumption, positioning him at the intersection of technology and culture. Additionally, Stracke’s real estate portfolio—spanning prime urban developments and sustainable communities—adds tangible value and long-term stability. According to recent estimates, approximately 40% of his total net worth is tied to private holdings unpublicly valued, while liquid assets including stocks, debt securities, and digital enterprise shares account for over 60%.

What distinguishes Sutton Stracke from many of his peers is his approach to risk and reinvestment. He maintains a disciplined portfolio strategy that emphasizes diversification across asset classes—technology, real estate, private equity, and media—while avoiding overexposure to volatile sectors. This balanced approach has enabled his wealth to compound steadily over decades.

Stracke has emphasized the importance of adaptability, noting: “Markets change, trends evolve, and flexibility is non-negotiable. The best investor isn’t the one with the most cash, but the one who reinvests wisely, not impulsively.” His focus on long-term value rather than short-term gains underscores a philosophy that blends patience with precision.

Public visibility and personal branding play a crucial role in sustaining Stracke’s financial influence.

A consistent presence in media commentary, keynote speeches at technology and investment forums, and strategic philanthropy amplify his credibility and open doors to exclusive opportunities. His investments in digital content platforms were not only financially rewarding but also instrumental in shaping public perception—positioning him as a visionary rather than just a millionaire. This cultivated image enhances deal flow, particularly in emerging sectors like blockchain, streaming, and green technology where brand trust drives adoption.

Despite his immense success, Stracke remains grounded in financial pragmatism. Interviews highlight his emphasis on liquidity, estate planning, and risk mitigation through hedging and insurance—elements rarely discussed in public but critical to preserving wealth across generations. As one former financial advisor noted, “Sutton doesn’t just accumulate wealth—he manages it like a legacy.

Every dollar invested tells a story of foresight, discipline, and strategic clarity.” This mindset—measured, forward-looking, and relentlessly informed—epitomizes the modern elite’s approach to sustainable affluence.

In sum, Sutton Stracke’s estimated net worth of over $500 million is more than a number: it’s a testament to visionary investing, adaptive strategy, and disciplined financial stewardship. His story illustrates that true wealth is not inherited but built—through insight, resilience, and the courage to act ahead of trends.

In an era defined by rapid change, Stracke’s journey offers a blueprint for those seeking to transform ambition into enduring financial power.

Core Segments of Sutton Stracke’s Financial Portfolio

Stracke’s $500+ million net worth is structured across distinct strategic pillars, each contributing to long-term resilience and growth. The following breakdown highlights the major components of his financial empire:

- Early Tech and Equity Investments: Starting in the late 1990s, Stracke capitalized on the digital revolution by investing in scalable tech startups and telecommunications firms.

These early gains provided the capital foundation for further expansion into emerging industries.

- Digital Media and Content Platforms: Recognizing the shift toward online consumption, Stracke built or backed influential media ventures, leveraging his public profile to drive audience engagement and monetization across blogs, podcasts, and streaming formats.

- Private Equity and Real Estate: Significant holdings in urban real estate and mixed-use developments offer tangible asset backing, with a focus on sustainable, high-density communities and prime commercial zones. This segment ensures portfolio stability amid market fluctuations.

- Selective Venture & Impact Investing: Stracke channels resources into future-facing sectors like clean energy, fintech, and digital health—balancing profit with social impact to align with evolving market values.

- Liquid Assets and Diversified Instruments: A portion remains in readily convertible securities—stocks, bonds, private equity shares—providing flexibility for opportunistic reinvestment while minimizing risk.

The Strategy Behind Stracke’s Wealth Accumulation

Related Post

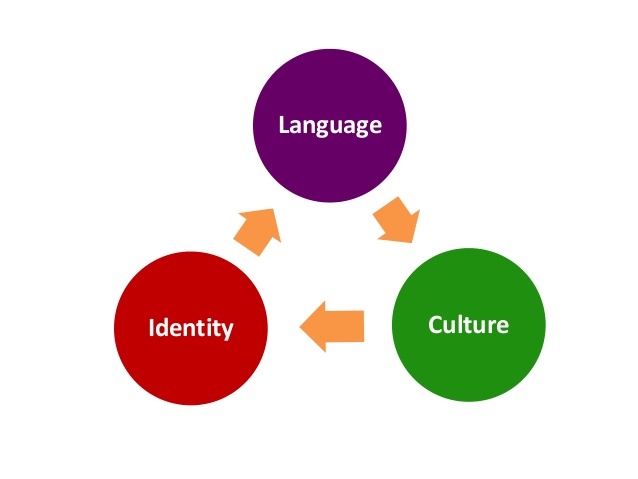

Nasty In Spanish: Unveiling the Hidden Tensions Between Language and Identity

Shameless Where To Watch: Your Knock-Keeping Guide to Bingeing On Demand

Young Carmelo Anthony Pfp A Nostalgic Look: A Snapshot of a Basketball Icon’s Journey

The West Midlands: A Unique Blend of History, Culture, and Modern Growth