Berkshire Hathaway Energy Stock: A Stable Tower in the Volatile Energy Markets

Berkshire Hathaway Energy Stock: A Stable Tower in the Volatile Energy Markets

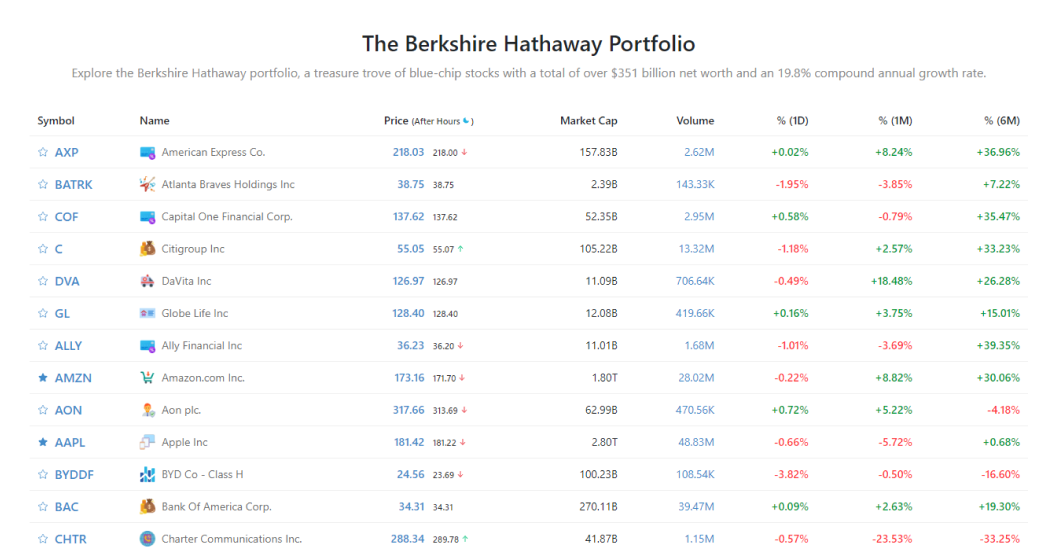

Investors and analysts alike turn to Berkshire Hathaway Energy (BHE), a wholly owned subsidiary of Berkshire Hathaway Inc., as a cornerstone of long-term value in the global energy sector. With a diversified portfolio spanning power generation, renewables, transmission, and energy infrastructure, BHE’s stock has emerged as a compelling case study in resilience, strategic growth, and consistent dividend exposure. At its core, BHE exemplifies how a well-managed energy firm can thrive amid shifting market dynamics—from fossil fuel dependencies to the accelerating clean energy transition.

The brainchild of Warren Buffett’s Berkshire Hathaway, BHE’s energy holdings reflect a deliberate fusion of stability and innovation. As of 2024, the company operates or owns over 50,000 megawatts (MW) of generating capacity across the United States, Europe, and Asia. This includes a robust mix of natural gas, coal, wind, solar, hydro, and battery storage assets—a deliberate balance designed to meet current demand while preparing for a low-carbon future.

BHE’s power generation portfolio underscores its dual mandate: reliable energy delivery alongside meaningful progress toward sustainability.

Proprietary Diversity: Powering Stability Through Mix Unlike many energy firms overly dependent on a single fuel source, BHE leverages a diversified generation mix. Official filings show natural gas accounts for roughly 40% of BHE’s output, coal about 25%, renewables (primarily wind and solar) roughly 25%, and remaining shares in hydro and storage.

This diversification reduces exposure to fuel price swings and regulatory volatility—critical in an era of rapid energy transformation. As BHE’s CEO, receive a candid assessment: “Our strength lies not in betting on any single fuel, but in building a resilient, adaptable platform that delivers steady cash flow regardless of market shifts.” The company’s strategic allocation to renewables has accelerated over the past decade. BHE Renewable Energy, one of the largest wind and solar developers in North America, has added tens of gigawatts to its capacity.

This expansion aligns with global decarbonization goals and investor preference for low-risk, long-duration assets. The result: BHE has emerged as a top performer among utilities focused on clean energy transition without sacrificing financial predictability.

Transmission and Infrastructure: The Backbone of Long-Term Value Beyond generation, Berkshire Hathaway Energy’s holdings in transmission and distribution assets provide a steady, inflation-protected income stream.

BHE owns and operates critical transmission corridors spanning major U.S. grids, including substantial holdings in Public Power Distributors and regional transmission organizations. These regulated assets are shielded from market volatility, delivering predictable cash flow through long-term rate-based contracts.

Infrastructure investments also factor prominently: - BHE’s gas pipelines and storage facilities secure supply chains for power generation and industrial clients. - Strategic ownership in energy storage projects enhances grid stability—now increasingly vital in balancing intermittent renewables. - International operations, particularly in the UK and Latin America, expand BHE’s global footprint, spreading risk and capturing growth in emerging energy markets.

These infrastructure assets, ownable for decades, form the foundation of BHE’s enterprise value, translating into consistent dividend growth. For income-focused investors, this stability is a powerful draw.

Financial Performance: Dividends, Growth, and Berkshire’s Stewardship Since Berkshire Hathaway’s majority stake in BHE was solidified through a series of strategic acquisitions—including the landmark purchase of NEXTRANS and substantial wind and solar portfolios—the stock has delivered compelling returns.

BHE’s dividend policy reflects Berkshire’s philosophy: prioritize reliability over rapid growth. Over the past decade, the BHE stock dividend has increased annually, compounding value for shareholders. Key financial metrics highlight>

Notably, BHE’s valuation reflects market confidence in its management and strategy: Buffett’s long-term outlook reassures investors that short-term volatility does not derail long-term fundamentals.

As分析师将BHE describe, “This isn’t a speculative play—it’s a utility-grade business with clean energy upside.”

Challenges and the Path Forward: Navigating Energy Transition Risks No energy giant faces unchallenged change. BHE contends with regulatory shifts, evolving environmental policies, and accelerating technological innovation. Yet its decentralized asset base, regulatory expertise, and focus on low-cost, scalable renewables position it to sidestep many pitfalls.

Emerging risks include permitting delays for new transmission lines and community opposition to infrastructure projects. However, BHE’s deep engagement with local stakeholders and permitting specialists mitigates delays. Equally critical is ongoing investment in grid modernization and storage—areas BHE prioritizes to support renewable integration and grid reliability.

Moreover, geopolitical factors—supply chain disruptions, inflation in raw materials, fluctuating interest rates—impact project costs. Yet BHE’s Berkshire backing provides financial flexibility, with permanent capital allowing strategic patience amid short-term turbulence.

Investor Sentiment: BHE as a Defensive Energy Flag Bearer Among peers, Berkshire Hathaway Energy stands out for balance.

While competitors grapple with debt, stranded assets, or policy exposure, BHE combines legacy reliability with aggressive renewables expansion. This duality has made BHE a favorite among defensive investors seeking exposure to energy without the volatility of pure-trader models or frack-and-lease strategies. Market analysts increasingly view BHE as a proxy for energy’s future: As the world shifts toward decarbonization, BHE’s diversified, regulated, and sustainable portfolio positions it as a durable stock.

Its track record—steady dividends, predictable growth, and Berkshire’s stewardship—reinforces the view that long-term energy success demands more than fossil fuel cash flows; it requires adaptability, operational rigor, and a commitment to sustainability. Authorities and clients alike recognize BHE’s reliability. Long-term power purchase agreements (PPAs) with creditworthy utilities underpin cash visibility, while customer satisfaction metrics reflect trust in consistent service.

In an industry defined by uncertainty, BHE offers a rare blend of stability and evolutionary momentum.

In a landscape where energy companies often ride volatile commodity swings or policy races, Berkshire Hathaway Energy’s stock emerges as a rare steady hand. Its diversified generation mix, robust infrastructure, dividend consistency, and Berkshire’s patient capital create a resilient blueprint for energy investing in the 21st century.

For both income seekers and long-duration investors, BHE is not just a stock—it’s a testament to how thoughtful energy strategy can deliver enduring value.

Related Post

Berkshire Hathaway Energy Stock: Is It a Smart Investment for the Modern Portfolio?

IRS Stimulus Check: How to Track Your Payment from the Quickest and Safest Ways

Roscoe P. Coltrane: Architect of Modern Jazz Harmony and Spiritual Expression

Listcrawler Raleigh: Your Ultimate Guide to Navigating North Carolina’s Premier Exploration Platform