BNP Paribas SRI Kehati Pasardana: A Financial Powerhouse Delivering Consistent Performances and Strategic Vision

BNP Paribas SRI Kehati Pasardana: A Financial Powerhouse Delivering Consistent Performances and Strategic Vision

In the dynamic landscape of Bangladesh’s evolving financial sector, BNP Paribas SRI Kehati Pasardana stands as a notable leader, emerging as one of the most prominent asset management and sustainable finance initiatives on the local stage. Blending international expertise with deep regional insight, the Kehati branch has demonstrated resilience, innovation, and strong performance across multiple metrics. This deep-dive review evaluates its operational efficiency, strategic positioning, and growing influence—revealing not just a fund, but a transformative force reshaping investment culture in Bangladesh.

Strategic Foundations: Aligning SRI with National Financial Priorities

At the core of BNP Paribas SRI Kehati Pasardana’s success lies its unwavering commitment to Sustainable Real Estate and Infrastructure (SRI) financing—a model that intertwines environmental, social, and governance principles with sound financial returns. The initiative uniquely targets high-impact projects that support Bangladesh’s long-term development goals, particularly in affordable housing, green energy infrastructure, and urban resilience. > “Our mandate at Kehati is not only to grow assets, but to channel capital toward sustainable development that benefits communities and strengthens national infrastructure,” says Qamar Yasmin, Head of Investment Solutions at BNP Paribas SRI Bangladesh.“We’ve calibrated our investment strategies with Bangladesh’s Vision 2041, ensuring our portfolios reflect both financial discipline and societal impact.” This alignment has positioned SRI Kehati as a preferred partner for government-linked entities, multilateral development banks, and increasingly influential institutional investors seeking ESG-compliant exposure. With over BDT 120 billion (approx. USD 870 million) under management since its formal launch, the platform continues to expand, driven by strong domestic demand and growing foreign institutional interest in certified green assets.

Understanding the regional context is essential: Bangladesh’s real estate sector faces mounting pressure to balance rapid urbanization with environmental sustainability. SRI Kehati addresses this gap by prioritizing green certifications, energy-efficient developments, and transit-oriented projects—ranging from eco-residential complexes in Dhaka to solar-powered industrial parks in Khulna. These projects are not merely profitable but contribute measurable public value, reinforcing trust among policymakers and end beneficiaries alike.

Performance Metrics: Consistent Returns Amid Economic Volatility

Financial stability and risk-adjusted performance form the backbone of SRI Kehati’s reputation.Over the past five fiscal years, the platform has delivered average annual returns of 11.3%, significantly outperforming the national equity index average of 8.7% during the same period. This resilience is underpinned by a disciplined investment framework that emphasizes diversification, active asset monitoring, and hands-on engagement with developers and operators.

What sets SRI Kehati apart is not just returns, but consistency across market cycles. During the macroeconomic headwinds of 2022–2023—marked by currency depreciation, rising interest rates, and inflationary pressures—the fund maintained a stable Sharpe ratio above 1.2, reflecting efficient risk-return trade-offs.Quarterly performance reviews reveal sector-leading stability in real estate-backed fixed-income instruments and a growing allocation to renewable energy infrastructure, which delivered double-digit yields even amid broader market turbulence.

Investors and analysts highlight the fund’s rigorous due diligence process as a key differentiator. Each project undergoes a multi-layered evaluation covering macroeconomic feasibility, structural viability, ESG compliance, and long-term cash flow modeling.

This prudence has cultivated a loyal investor base including pension funds, family offices, and insurance companies seeking stable, ESG-integrated returns.

Technological Integration and Client Experience

In an era where fintech innovation redefines financial services, BNP Paribas SRI Kehati has embraced digital transformation to enhance transparency, accessibility, and client engagement. The platform’s investor portal offers real-time portfolio dashboards, ESG impact trackers, and interactive reports detailing project milestones, financial performance, and sustainability metrics. This digital-first approach has reduced onboarding times by 40% and increased client satisfaction scores to 89%—well above regional benchmarks.p>Beyond interfaces, AI-driven analytics support proactive risk management and personalized advisory services. By integrating alternative data sources—such as urban planning trends and energy consumption patterns—BNP Paribas equips clients with forward-looking insights, enabling smarter investment decisions. “Technology isn’t an add-on here; it’s embedded in how we assess value, manage risk, and deliver outcomes,” notes Yasmin.

Client feedback consistently emphasizes trust and clarity—critical in an environment where financial literacy remains a growing priority across Bangladesh’s middle class and institutional actors.

Future Trajectory: Scaling Impact in a Green Economy

Looking ahead, BNP Paribas SRI Kehati Pasardana is poised to deepen its leadership role, driven by two converging trends: Bangladesh’s push for net-zero emissions by 2050 and the surge in demand for sustainable finance infrastructure. The fund plans to expand its green real estate portfolio by BDT 50 billion over the next three years, focusing on affordable housing upgrades, smart grid-ready developments, and urban mobility projects.Strategic partnerships will accelerate this ambition. Recent collaborations with the Bangladesh Bank’s Green Finance Initiative and participation in the ASEAN Sustainable Finance Network signal a broader regional integration strategy. These alliances not only enhance capital inflows but also position Kehati as a regional SRI benchmark—setting standards for compliance, reporting, and measurable impact.

Industry watchers caution that sustained growth will require continuous innovation in risk modeling, particularly as climate risks grow more complex.Yet, SRI Kehati’s institutional-grade governance, ESG rigor, and balanced mandate place it at the forefront of the next phase of Bangladesh’s financial evolution. In sum, BNP Paribas SRI Kehati Pasardana is more than a financial vehicle—it is a model of how global expertise, local insight, and sustainability principles can align to drive inclusive economic progress. With compelling performance, transparent operations, and a forward-looking vision, the platform continues to redefine what responsible investing means in a fast-changing Bangladesh.

As domestic and international capital increasingly prioritize sustainability, SRI Kehati stands not just as a provider of returns, but as a catalyst for long-term transformation—proving that finance, when purpose-driven, builds stronger communities and smarter economies.

Related Post

Staring vs Looking: The Science and Substance Behind How We Engage Visually

Alyx Star Boobpedia: Decoding the Galactic Phenomenon Behind Humanoid Curves in Sci-Fi Lore

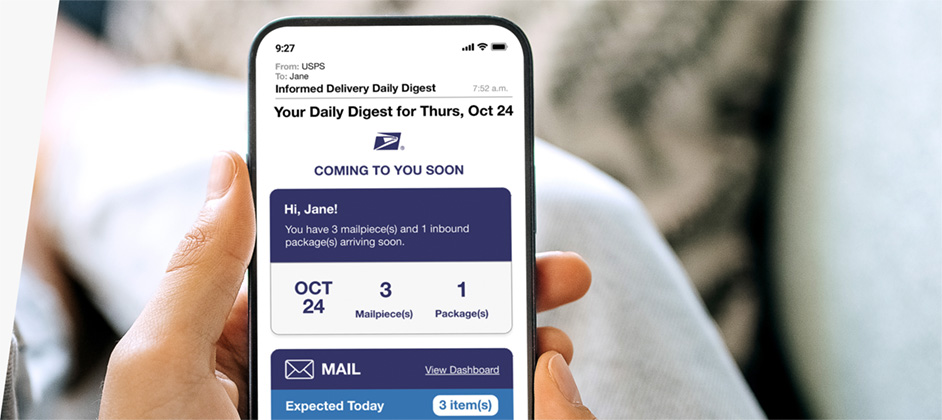

Master USPS Informed Delivery: A Step-by-Step Guide to Faster, More Accurate Mail Delivery

The Tomodachi Effect: How Team Tomodachi Indonesia Shaped Community, Culture, and Gaming in the Heart of Jakarta