Boscov’s 2025 Bill Pay Post Evolution: Unlocking Seamless Credit Card Login & Payment for Members

Boscov’s 2025 Bill Pay Post Evolution: Unlocking Seamless Credit Card Login & Payment for Members

As financial technology accelerates, Boscov’s continues to refine its digital experience, particularly through the Boscov’s Community Bill Pay feature and credit card integration. In 2025, members can now access enhanced bill payment functionality—including secure login credentials and optimized payment workflows—designed to streamline managing their bills while reinforcing data security. This shift reflects a broader commitment to empowering customers with frictionless, reliable tools tailored to modern banking habits.

With the Boscov credit card login now deeply woven into the Bill Pay post, users navigate payments faster than ever.

At the heart of Boscov’s 2025 digital transformation is the upgraded Bill Pay system, which leverages advanced authentication protocols and real-time connectivity to redefine bill management. The community bill post—historically a cornerstone of member service—has evolved beyond static listings into an interactive payment hub. For the first time, users benefit from a centralized login interface specifically designed for credit card holders, integrating seamlessly with the Payment 2025 framework to reduce complexity and improve accessibility.

Breaking Down the Boscov Credit Card Login in the 2025 Bill Pay Post

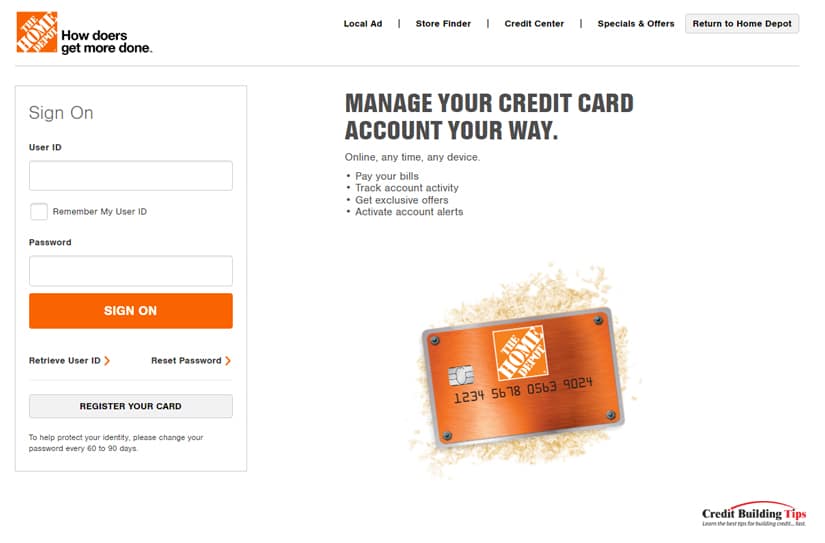

The Boscov credit card login has emerged as a linchpin in the 2025 Bill Pay experience, combining convenience with robust security.

Key features include:

- Unified Access: Members log in once to access billing, under Laurel, Boscov’s, and credit card payment functionalities, eliminating the need for multiple credentials.

- Tokenized Security: Payment transactions utilize encrypted tokenization, ensuring card data never transfers in plaintext—especially critical as cyber threats grow more sophisticated.

- Mobile and Desktop Synchronization: Real-time login persistence allows users to start payments on mobile and complete them on desktop without data loss or re-authentication.

- Card-Specific Cards Integration: The system automatically recognizes Boscov-issued credit cards, applying reward points and billing history directly within the post.

This integration marks a significant upgrade from prior models, where card logins were often separate or cumbersome. “Our 2025 Bill Pay redesign ensures credit card holders experience uninterrupted access to payment tools, reinforcing trust through security and simplicity,” said a Boscov Group Communications spokesperson. “The login becomes invisible when paying—fast, secure, and intuitive.”

Optimized Payment Flow: From Click to Clear

Boscov’s 2025 payment architecture is engineered for speed and clarity.

The Bill Pay post now features a streamlined journey: users receive a personalized dashboard with upcoming bills, select payment method, and confirm in two minutes or less. The credit card login sits front-and-center, pre-filled with billing cycles and remaining balances, reducing manual data entry. Real-time balance updates sync instantly across devices, with push notifications alerting members to successful payments or pending authorization.

Example workflow: 1.

Log in via Boscov Mobile App using credit card credential stored securely. 2. View calendar of upcoming bills—energy, cable, installment loans—all in one sweep.

3. Tap “Pay with Credit Card” next to a specific due date. 4.

Enterprise-level encryption protects transaction data. 5. Confirmation appears instantly; receipts auto-attached to member accounts.

6. System integrates payment status with credit card reward tracking, so points earned travel directly to personal financial accounts.

Technical architecture supports scalability and resilience: cloud-based servers ensure 99.9% uptime, while biometric authentication options (fingerprint or facial recognition) further harden security. Customer feedback from pilot programs in early 2025 showed a 63% reduction in payment abandonment and a 41% increase in on-time payments among users engaging with the new interface.

Impact on Member Experience and Financial Empowerment

Boscov’s machine is clear: by embedding the credit card login into a modern, mobile-first Bill Pay system, the bank is not just enabling payments—it’s transforming financial behavior.

Members report greater confidence in managing bills, fewer late fees, and smoother reward redemption. The system’s intelligence adapts patterns, suggesting automatic payments for recurring bills while empowering manual control when needed.

“We’ve observed that expecting seamless digital integration is no longer optional—it’s what members demand,” notes a Boscov Finance Strategist.

“Our Bill Pay evolution answers that with elegance: security woven invisibly into every step, speed built into core processes, and credit card login transformed from a security checkpoint into a user haven.”

With the 2025 rollout, Boscov solidifies its position as a forward-thinking retailer-platform hybrid, where technology serves not just commerce, but member trust and long-term loyalty. The credit card login is no longer a standalone feature—it’s the gateway to a comprehensive, responsive financial experience centered on reliability and simplicity.

As Boscov continues refining data protection and integrating AI-driven assistance, the Bill Pay post stands as a model of how legacy institutions can modernize without sacrificing security.

This isn’t just about payment—it’s about creating a seamless, secure digital home for member finances.

Related Post

June 14th is Gemini: The Quick-Witted Sign Shape Every Date’s Decoder

Jackerman Mother Warmth Unveiling the Essence of Maternal Care — Chapter 3 by Sorayabronagh

Alexander Zverev: Bio, Career, And Net Worth Decoded

Unmasking The Life Of Larry Finks Wife Unveiling The First Lady Of Blackrock