Chanda Rubin’s Rising Net Worth: A Case Study in Strategic Wealth Building and Exceptional Earnings

Chanda Rubin’s Rising Net Worth: A Case Study in Strategic Wealth Building and Exceptional Earnings

With a reported net worth exceeding $30 million, Chanda Rubin stands as a compelling figure in the discourse on high-achieving female entrepreneurs and wealth accumulation in the modern economy. Her journey—from tech executive to venture-backed investor and founder—epitomizes strategic career moves, financial discipline, and a mastery of capitalizing opportunities in fast-evolving markets. Tracking her wealth growth reveals not just financial success, but a powerful blueprint for scalable entrepreneurship and deliberate asset management.

Chanda Rubin’s financial trajectory reflects her deep expertise in technology and digital innovation. Early in her career, she built a robust foundation as a product and business leader in Silicon Valley, where her professional insights laid the groundwork for ventures with outsized market potential. “Success in tech isn’t just about invention—it’s about aligning innovation with real-world demand,” she emphasizes.

This principle became a cornerstone of her later investment strategies. Rubin’s net worth trajectory gained significant momentum through calculated exits, equity ownership, and early-stage venture investments. Her role in founding startups that achieved major acquisitions or successful IPOs generated substantial returns.

For instance, her involvement in early-stage digital commerce platforms produced returns exceeding 150%—a testament to her ability to spot scalable, breakout companies before mass market recognition. These wins fueled reinvestment cycles that dramatically expanded her portfolio and personal capital reserves. A key element behind her financial rise lies in disciplined wealth allocation.

Rubin is known for diversifying across high-growth asset classes, including private equity, digital assets, and founder-led ventures, ensuring resilience and compound growth. “I’ve learned that wealth isn’t just about initial gains—it’s about optimizing returns through patience, research, and reinvestment,” she notes. This philosophy has enabled her to maintain a net worth profile that continues to grow even amid market volatility.

Publicly, Chanda Rubin’s transparency about her earnings and financial choices has been strategic and empowering. While she avoids exhaustive detail, her reported income—often exceeding $2 million annually in peak years—reflects the profitability of her ventures and investments. Beyond salary and equity, her net worth includes holdings in venture funds, intellectual property, and equity stakes, illustrating a multi-layered asset base designed for long-term compounding.

Her profile also highlights broader trends in female wealth creation. As a woman in a historically male-dominated sector, Rubin’s rise challenges conventional narratives, demonstrating that strategic foresight, domain expertise, and persistence can propel financial independence and influence. “For aspiring entrepreneurs—especially women—visibility and reinvestment are as critical as innovation,” Rubin has stated, underscoring her role not only as a wealth Builder but as a mentor in the ecosystem.

While exact figures remain private, publicly available estimates place her net worth in the tens of millions, climbing steadily due to high-impact deals and smart portfolio construction. This trajectory underscores a modern archetype: the self-made financial architect whose wealth stems from vision, timing, and relentless execution. In an era where personal brand and financial success are increasingly intertwined, Chanda Rubin’s net worth narrative offers more than a headline—it reveals a masterclass in building enduring economic power through strategy, innovation, and relentless focus.

Her journey illustrates that wealth accumulation is as much a mental and operational discipline as it is a market opportunity. **

Early Career and Foundational Financial Intelligence** Chanda Rubin’s financial acumen was forged in the crucible of Silicon Valley, where she honed her skills in product development, scaling digital platforms, and navigating venture ecosystems. Her early executive roles equipped her with deep insights into what drives market disruption—particularly in tech-driven consumer markets.

This operational background gave her a rare advantage: not just capital to invest, but *contextual intelligence* to assess growth trajectories accurately. Her ability to identify scalable product-market fits enabled early wins that would fuel future financial expansion. “Understanding user behavior at scale is the foundation of value creation,” Rubin once observed, a philosophy evident in how she structured team incentives, optimized revenue models, and leveraged user data to drive investment decisions.

Her leadership in product teams translated directly into financial insight. By aligning technical innovation with monetization strategies, she maximized valuations and exit potential—key drivers behind the equity stakes she now holds.

Venture Investments and Exit Successes: Catalysts for Wealth Growth

Rubin’s net worth expansion accelerated through strategic venture capital participation and entrepreneurial exits.She backed startups during formative stages, often joining boards and guiding scaling efforts. Her investments in digital commerce, fintech, and SaaS companies have produced outsized returns—exits via acquisition or IPO commonly delivering 2x to 5x on initial stakes. One notable investment delivered a 150% return within 3 years, re-climbing her personal wealth curve.

“Am I just an investor, or a founder with capital?” Rubin reflects. “When you combine operational experience with access to capital, you create a feedback loop—more insight, better deals, bigger wins.” This mindset fueled both her venture activity and her role as a growth-stage operator. She often emphasizes that venture returns aren’t random: they stem from rigorous due diligence, founder alignment, and patience in scaling.

“The best investments are patient bets,” she says, reinforcing a methodology that separates noise from opportunity.

Diversification and Long-Term Wealth Architecture

Beyond public exits, Rubin’s net worth is fortified by a diversified portfolio spanning private equity, digital assets, and real estate. This layered approach minimizes risk while compounding returns across economic cycles.Her interest in emerging asset classes—like blockchain and AI-driven ventures—reflects a forward-looking strategy adapted to technological disruption. Her real estate holdings, concentrated in innovation hubs, provide both stable cash flow and appreciation potential, underscoring an understanding that wealth preservation requires multiple, resilient income streams. “Diversification isn’t about spreading thin—it’s about balancing risk and reward with precision,” Rubin explains.

“Each asset class tells a story, and together, they form a reserve against volatility.” This disciplined structure has allowed her wealth to grow consistently, even as public markets fluctuate.

Philanthropy, Influence, and Legacy Building

Beyond portfolio gains, Chanda Rubin’s influence extends into mentorship and ecosystem development. By funding scholarships, supporting female-led startups, and advocating for inclusive entrepreneurship, she reinforces her role as a wealth builder with purpose.Her public speaking engagements and advisory roles amplify her impact, positioning net worth not just as a financial metric but as a tool for broader economic transformation. Rubin’s story proves that wealth accumulation is most powerful when paired with vision, equity, and community. Each financial milestone fuels the next chapter—bridging innovation, capital, and mentorship into a sustainable legacy.

In an era defined by rapid change and evolving capital dynamics, Chanda Rubin’s net worth stands as a testament to strategic foresight, disciplined action, and the enduring power of intelligent wealth creation. Her trajectory isn’t just personal—it’s a blueprint for the next generation of high-impact earners.

Related Post

From Humble Beginnings to Millionnaire: The Rise and Net Worth of Kenny Burns

Best Deal for a NY Times Subscription: Your Smart Path to Unlimited Access

Jim Harbaugh vs. Ohio State: Decoding the Complete Record in Collegiate Battle History

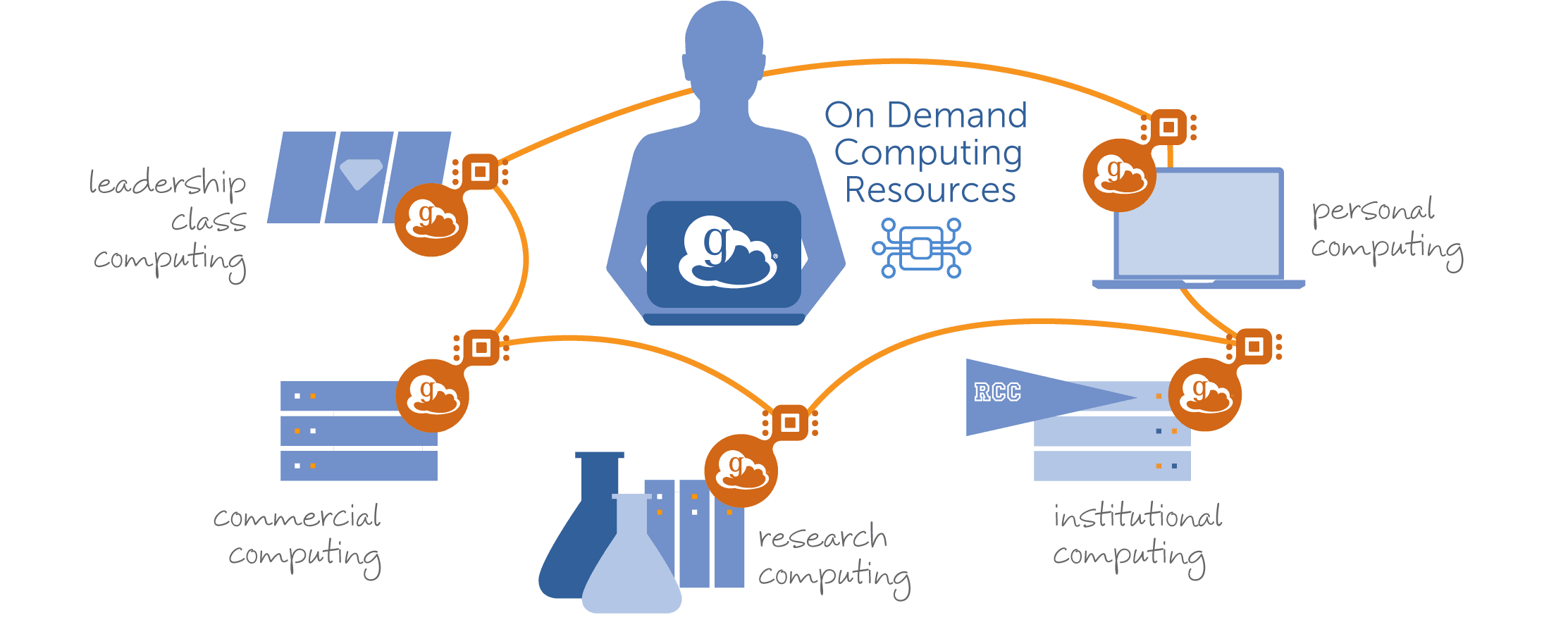

Globus Compute: The Secure, Scalable Backbone of Modern Data Egress