Commercial Real Estate Analysis: The High-Stakes Edge in Smart Investment Decisions

Commercial Real Estate Analysis: The High-Stakes Edge in Smart Investment Decisions

Investing in commercial real estate demands precision, foresight, and fearless data-driven analysis—without it, even the most promising properties can lurch from opportunity to risk. In a market shaped by shifting tenant demands, evolving urban landscapes, and economic volatility, investors who master commercial real estate analysis gain a decisive advantage, turning luck into legacy. This article unpacks the definitive role of rigorous property evaluation, investment modeling, and market intelligence—revealing exactly how leading analysts and institutional investors build resilient portfolios that thrive, not flounder.

At the core of successful commercial real estate investment lies a methodical, multi-layered analysis process. Unlike residential assets, which often reflect steady household demand, commercial properties—spanning office towers, retail centers, industrial warehouses, and multifamily buildings—respond dynamically to macroeconomic cycles, demographic shifts, and technological disruption. MarketTransformation Partners’ principal, Elena Torres, emphasizes: “It’s not just about square footage or location; it’s about understanding velocity—how quickly a property can adapt to changing tenant needs and economic headwinds.”

Commercial real estate analysis begins with granular market intelligence.

Investors must first dissect supply and demand fundamentals, scrutinizing vacancy rates, rental growth trends, leasing velocity, and absorption rates. For instance, the U.S. office sector faces deep uncertainty post-pandemic, yet data from JLL reveals urban core assets with class-A tenants and ESG alignment have absorbed new leases at 3.5% annual growth—highlighting the power of targeted analysis over broad speculation.

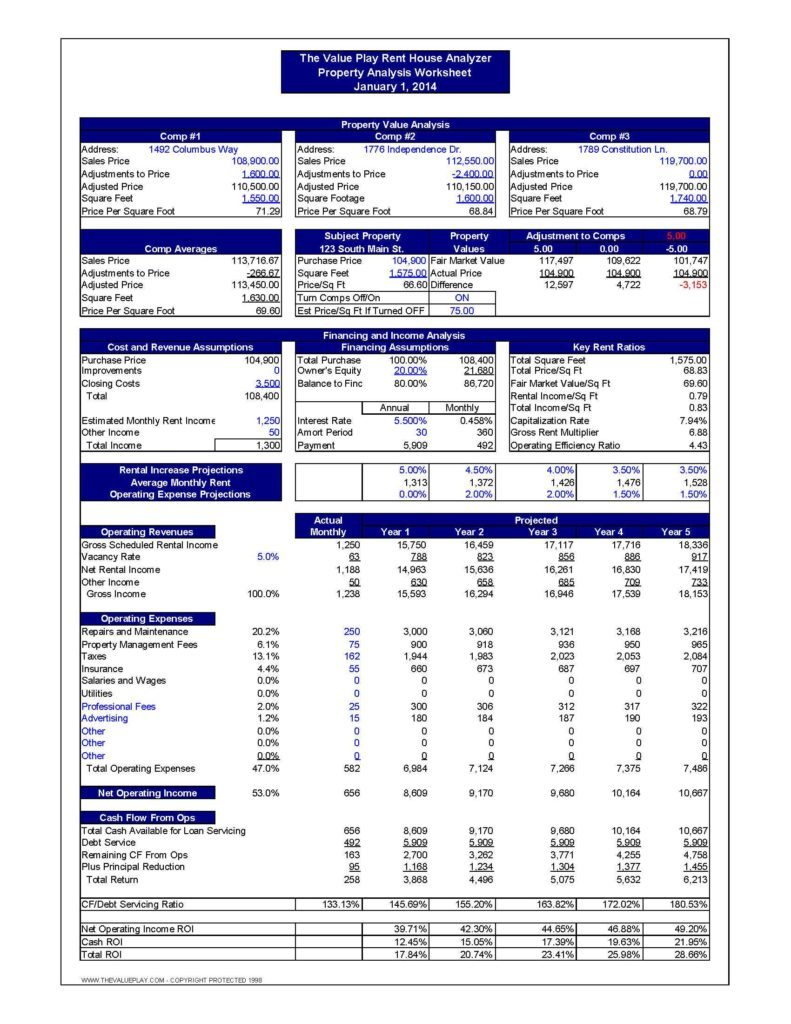

Valuation Beyond the Price Tag: Cap Rates, Cash Flow, and Net Operating Income

Central to investment analysis is capitalization rate (cap rate) assessment, a foundational metric measuring expected return relative to property value.A lower cap rate typically signals stable, low-risk assets; conversely, higher rates may reflect growth potential or distress. “Cap rates tell a story,” says Michael Chen, Director of Capital Markets at CBRE. “An industrial warehouse with $12 operating income and a $3 million purchase price delivering a 6% cap rate might underperform a Class-A office building generating $4 million NOI at 8.5%—but context matters: the office could offer faster rent updates and premium tenant retention.”

Equally critical is cash flow modeling, which moves beyond static metrics to dynamic forecasting.

Investors project rental income over 3–5 years, factoring in tenant lease schedules, operating expenses, tax implications, and reinvestment needs. Sensitivity analysis—running scenarios through interest rate shocks, occupancy dips, or zoning changes—illuminates downside risks and upside potential, enabling proactive portfolio adjustments.

Location and Demographics: The Unseen Drivers of Value

While financial modeling grounds decisions, location remains irreplaceable.Modern analysis goes beyond street addresses: it examines foot traffic patterns, transit access, school districts, healthcare clusters, and urban development pipelines. In Austin, for example, industrial properties near expanding tech hubs and last-mile logistics centers command rent premiums of 15–20% year-over-year, according to a 2024 Urban Land Institute report. “Location today is not static,” notes architect and urban specialist Lila Grant.

“It’s a living indicator of economic momentum—connectivity matters more than ever, especially with hybrid work redefining commuting patterns.”

Industrial and logistics assets have surged as e-commerce cements its dominance, but even within this segment, analysis uncovers nuance. A warehouse in a customs-friendly corridor with proximity to intermodal freight hubs outperforms one in a lesser-connected zone—even at similar cap rates. Similarly, retail properties thrive not by foot traffic alone, but by experiential integration: mixed-use centers anchoring lifestyle departements, cafes, and entertainment venues demonstrate higher retention and revenue resilience.

Industry Trends Reshaping Analysis: ESG, Technology, and Adaptability

Environmental, social, and governance (ESG) factors now anchor investment due diligence.Carbon footprint, energy efficiency, and green building certifications (LEED, BREEAM) directly influence operational costs and tenant desirability. “Sustainability isn’t optional—it’s value creation,” says-risk analyst Sarah Zhou of GreenSpace Capital. “Properties with low-energy systems see 20–30% lower utility bills and attract ESG-focused tenants willing to pay premiums.”

Technology enhances analysis through big data and predictive analytics.

Platforms leveraging AI scan public records, census data, and satellite imagery to forecast demand, monitor construction pipelines, and track tenant movement in real time. PropTech tools now assess micro-market vibrancy, predicting rent growth from neighborhood amenities or transit expansions before they hit mainstream awareness. “Smart buildings that collect occupancy and energy data make richer, more dynamic investment models possible,” Zhou explains.

“Analysis is becoming anticipatory, not reactive.”

Cellular density, walkability scores, and zoning flexibility are emerging as passive yet powerful indicators in site analysis. A building adjacent to fiber-optic networks and within a 10-minute walk of midday amenities commands subtle but compounding advantages. These qualitative metrics, paired with quantitative risk-adjusted returns, form the backbone of next-gen investment frameworks.

Financing and capital structure further define investment capacity. Speculative acquisitions require robust debt service coverage, while value-add plays benefit from tax equity or joint ventures to amplify leverage. Investors must align their capital strategy with market cycles: leaning into distressed opportunities during downturns, or expanding mid-cap portfolios in expansion phases.

Tax implications—depreciation, 1031 exchanges, incentive zones—wield material impact, demanding proactive structuring by seasoned advisors.

Portfolio Diversification: Spreading Risk While Charging Return

Diversification isn’t merely about asset types—it’s about strategic balance. A portfolio integrating office, retail, industrial, and multifamily segments across geographies reduces exposure to sector-specific downturns. Studies by NGN Real Estate show diversified portfolios deliver 8–12% higher risk-adjusted returns than single-sector rivals over full market cycles.Geographic spread—from Sun Belt growth hubs to Tier 2 cities’ revitalization zones—mitigates urban economic hitches, ensuring stability amid shifting macroeconomic winds.

Finally, commercial real estate analysis is not a static exercise—it evolves. Investors who embrace continuous monitoring, real-time data updates, and responsive modeling turn their portfolios into adaptive machines.

Whether navigating post-pandemic workspace transformation, climate resilience mandates, or AI-driven market shifts, the disciplined application of analysis transforms uncertainty into calculated advantage.

In an era where data fuels confidence and adaptability defines value, commercial real estate analysis stands as the cornerstone of successful investing. Those who master its science—balancing hard metrics with human insight—don’t just survive market tides; they rise above them.

Related Post

Exploring The Best Hispanic Hairstyles for Men: Trends, Tips, and Cultural Inspiration

OptumRx Careers Unlock Remote Pathways with 4 Key Roles: Data Entry, Customer Service, and Datavant in High-Growth Health Tech

Unlocking the World: How a Single Map Transforms Global Exploration

From Hammer to Eagle: The Rich History, Symbolism, and Evolution of the US Marine Corps Logo