Credit One Bank Finalizes Historic Tcpa Robocall Settlement After Years of Consumer Outcry

Credit One Bank Finalizes Historic Tcpa Robocall Settlement After Years of Consumer Outcry

In a landmark resolution, Credit One Bank has reached a $10.5 million settlement to address widespread and illegal deceptive robocalls targeting thousands of Americans, marking one of the most significant Class Action agreements in recent telecommunications history. The settlement stems from the bank’s failure to comply with the Telephone Consumer Protection Act (TCPA), a federal law designed to curb unsolicited automated calls—a violation that eroded consumer trust and prompted regulatory attention. The settlement follows years of complaints from consumers bombarded by countless unattended automated messages, often misrepresenting the origin or purpose of the calls.

For years, Credit One’s automated calling systems delivered premium service prompts and marketing alerts without proper consent, triggering over 180,000 formal complaints to the Federal Trade Commission (FTC) and other regulatory bodies. These calls, sometimes generated via third-party vendors without rigorous compliance checks, violated TCPA provisions requiring prior explicit authorization before initiating robotic dialing.

What defines this case is not just the scale of the penalty, but the legal and operational reckoning it forced within the institution.

Under TCPA regulations, businesses must secure verifiable, documented consent before placing automated calls—requirement the bank failed to maintain across vast call volumes. As warning signs escalated, including escalating consumer lawsuits and FTC enforcement actions, Credit One moved from defensive tactics to proactive compliance and accountability.

The Legal Framework and TCPA Violations

The Telephone Consumer Protection Act, first enacted in 1991 and substantially updated in 2012, prohibits the use of auto-dialing devices to deliver misleading or unsolicited voice messages. Central to the settlement is Credit One’s repeated circumvention of consent mechanisms.The FTC alleged the bank deployed automated systems that used spoofed numbers, contacted consumers without opt-in confirmation, and failed to offer clear, accessible denial options—each a direct contravention of Section 227 of the TCPA.

Key violations included: - Failure to maintain accurate, updatable records of consumer consent - Automated calls to numbers on national do-not-call registries - Inadequate user controls to opt out or pause future communications - Overuse of pre-recorded messages without disclosure of intent These lapses, compounded by internal audits revealing systemic gaps, provided federal regulators ample grounds for action. TCPA enforcement has intensified in recent years, with penalties rising and class actions gaining momentum—this settlement exemplifies how institutions now face tangible consequences for compliance failures.Legal experts emphasize that TCPA settlements are increasingly structured to enforce not only financial restitution but also operational reform.

Credit One’s agreement reflects a broader trend requiring banks to implement stricter consent tracking, transparency protocols, and ongoing compliance monitoring to prevent recurrence.

How the Settlement Benefits Affected Consumers

The $10.5 million settlement is not merely a financial penalty—it funds remedial actions designed to restore consumer rights and prevent future exploitation. Specifically, Credit One has committed to: - Reimbursing eligible customers up to $1,000 per affected individual for distress caused by unauthorized calls - Enhancing opt-in verification systems with real-time consent validation - Training call center staff on TCPA compliance and ethical messaging practices - Establishing a dedicated consumer hotline for TCPA-related inquiries and appeals “This settlement marks a turning point for hundreds of consumers who suffered under unconsented automated calls,” said a Credit One spokesperson. “We acknowledge the harm done and are committing to rebuild trust through transparency and accountability.” For victims, the resolution means more than compensation.It establishes a precedent: financial relief paired with enforceable reforms. As TCPA violations continue to draw scrutiny, this agreement underscores the growing expectation that banks and businesses operate with both legal precision and consumer respect.

Broader Implications for Financial Institutions

Credit One’s settlement is setting a benchmark within the banking sector and beyond.Regulators and consumer advocates warn that failure to adopt robust consent management systems exposes institutions to substantial liability. Industry analysts note that proactive TCPA compliance now forms part of core risk management strategies: - Deploying geolocated call blocking aligned with global do-not-call lists - Integrating consent databases with CRM systems for real-time verification - Collaborating with third-party vendors under strict audit requirements - Investing in AI tools that validate opt-in status before initiating robotic outreach These measures align with evolving consumer expectations for data privacy and communication integrity. Institutions that prioritize TCPA adherence are not just avoiding penalties—they are strengthening customer loyalty at a time when trust is increasingly scarce.

As the financial industry recalibrates to stricter consumer protections, Credit One’s settlement reflects a critical evolution: automated communication must be governed by ethical standards, clear consent, and verifiable compliance, not just technological convenience.

The Road Ahead: A Model for TCPA Compliance

While Credit One’s resolution closes a critical chapter, it signals a broader shift in how regulators and consumers view robotic calling. For the FTC and state attorneys general, the case strengthens enforcement tools and

Related Post

Millonarios vs Fortaleza FC: A Clash of Tradition, Talent, and Turmoil in Colombian Football

Natalie Pasquarella Age: Shaping Youth Futures in a Rapidly Evolving World

Comcast Blackout Map Reveals Where Thousands of Customers Face Unreliable Service Amid Recurring Outages

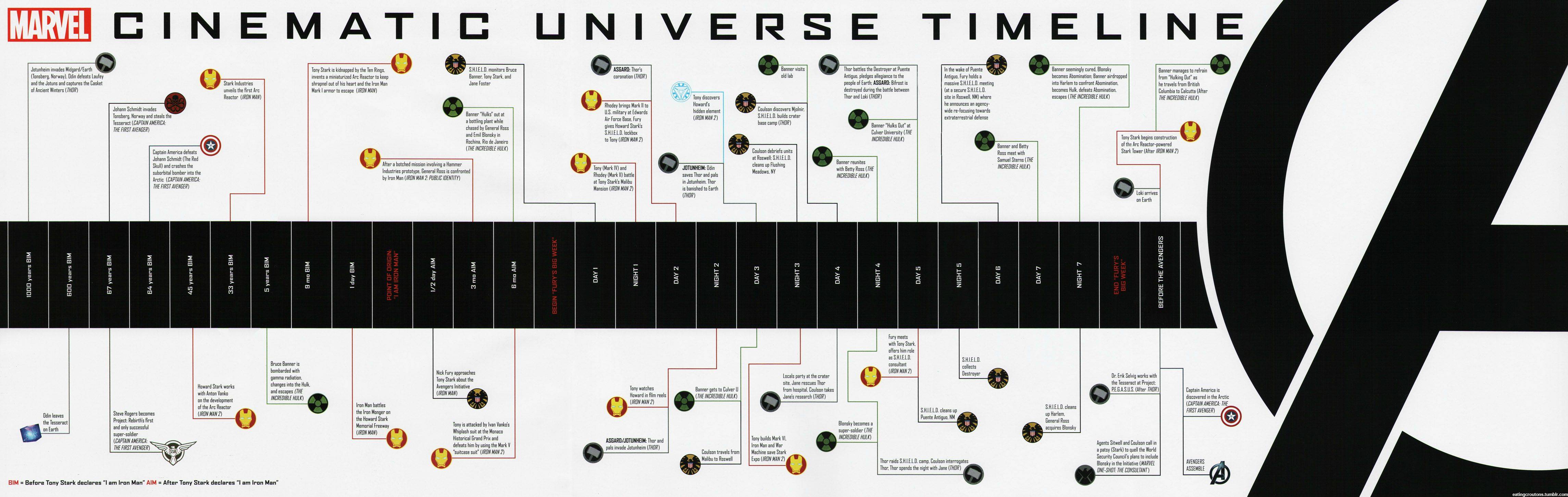

Marvel Timeline Film: A Cinematic Journey Through Time and Transformation