Dolarblu Explodes: How the Crypto Giants Are Shaping Global Finance and Trade

Dolarblu Explodes: How the Crypto Giants Are Shaping Global Finance and Trade

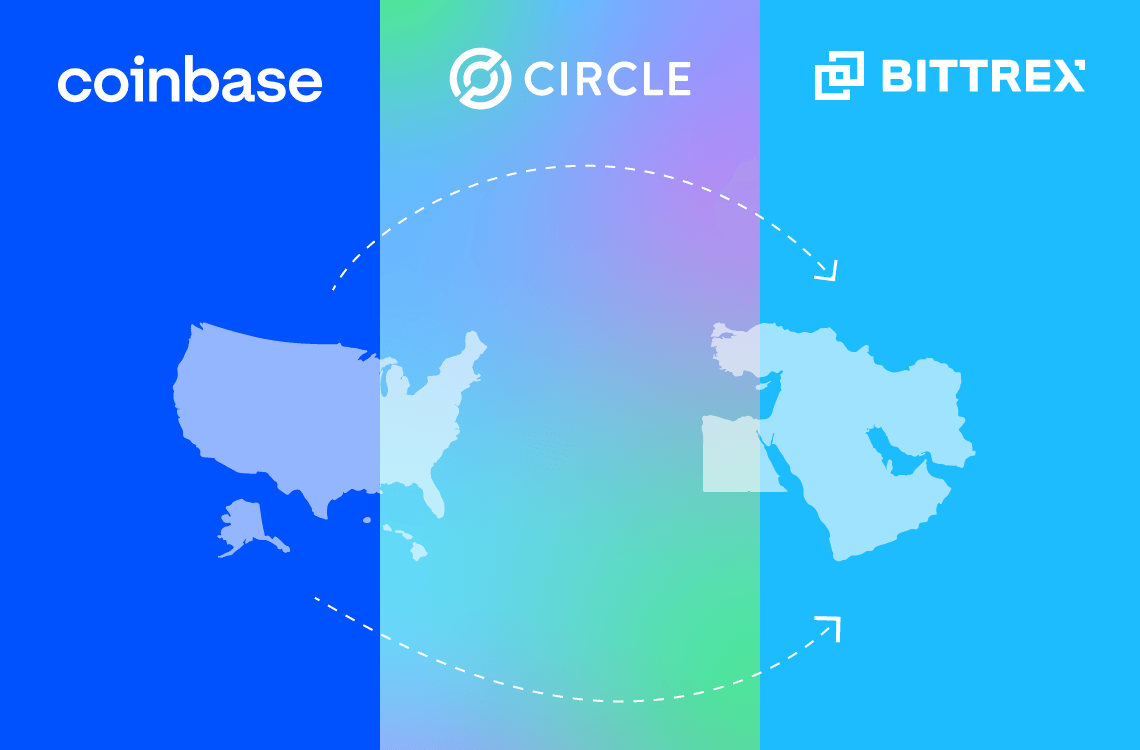

Dolarblu has emerged as a pivotal force in the rapidly evolving landscape of digital finance, redefining cross-border transactions, investment strategies, and monetary exchange systems. By blending blockchain innovation with real-world utility, Dolarblu is bridging fiat economies like the U.S. dollar with decentralized digital assets, offering unprecedented liquidity and access.

From enabling seamless international payments to empowering small businesses with global market access, Dolarblu’s technology is not just a trend—it’s a transformative shift in how value moves across borders.

Dolarblu stands at the intersection of crypto adoption and institutional finance, offering users a stable, transparent, and efficient mechanism to convert fiat into digital assets without the volatility or complexity traditionally associated with cryptocurrencies. Unlike many speculative tokens, Dolarblu is engineered as a digital dollar proxy—an asset designed to maintain intrinsic value by pegging closely to the U.S. dollar while leveraging blockchain’s speed and accessibility.At the core of Dolarblu’s functionality is its unique trustless settlement model. Transactions are executed through a decentralized network that bypasses traditional banking intermediaries, reducing clearance times from days to seconds. Each transfer is recorded on an unchangeable ledger, ensuring full auditability and minimizing counterparty risk.

As Dolarblu’s ecosystem expands, so does its network effect—more users drive liquidity, which in turn attracts institutional investors and payment processors, reinforcing the platform’s reliability.

How Dolarblu Drives Financial InclusionOne of Dolarblu’s most impactful contributions is its role in expanding financial inclusion. In regions where banking infrastructure is weak or capital flows are restricted, Dolarblu provides a digital lifeline. Users can receive, store, and transfer funds instantly using only a smartphone and internet access—breaking down barriers that have long excluded millions from global commerce.

For small and medium enterprises (SMEs) in emerging markets, this means access to international clients without the burdens of high fees, currency conversion delays, or regulatory black holes.

Consider the case of a textile exporter in Vietnam exporting to the U.S.: traditionally, customs clearance and cross-border payments could take weeks, tying up capital. With Dolarblu, payment is confirmed in minutes, fiat conversion occurs automatically, and funds arrive directly into the exporter’s digital wallet—accelerating cash flow and reducing operational friction. This efficiency translates directly into competitive edge and growth potential. Stacked with Real-World UtilityDolarblu’s design emphasizes utility beyond speculation.

Its native token enables macro-level economic experiments: businesses blend Dolarblu into invoices, governments explore it for social transfers, and payment gateways integrate it seamlessly into checkout flows. This embedded finance approach ensures Dolarblu doesn’t exist in isolation—it’s interwoven into daily economic activity, increasing adoption and practical relevance.

Examples include partnerships with remittance platforms, where migrant workers send Dolarblu-equivalent funds home instantly at near-zero cost, bypassing traditional remittance providers that charge 6–10% fees. Similarly, NGOs use Dolarblu to deliver aid swiftly to disaster zones, ensuring funds reach intended recipients without interference or delay.These applications illustrate a broader mission: transforming Dolarblu from a crypto asset into a utility currency for inclusive growth.

Regulatory Clarity and Institutional TrustA critical differentiator for Dolarblu is its proactive engagement with regulators. Rather than operating in the shadows, Dolarblu’s development team collaborates with financial authorities to ensure compliance, anti-money laundering (AML) adherence, and know-your-customer (KYC) protocols. This transparency fosters trust among institutional players and corrects the perception of cryptocurrencies as inherently risky or untrustworthy.

Internal documents reveal Dolarblu maintains a policy of “ Jurisdictional awareness from inception,” with regional legal advisors embedded in the product architecture.This approach not only mitigates regulatory risk but positions Dolarblu as a partner of choice for banks and fintechs seeking compliant crypto integration. As regulation crystallizes globally—through frameworks like the EU’s MiCA and U.S. evolving guidelines—Dolarblu’s ahead-of-the-curve compliance becomes a competitive moat.

The Future of Value TransferDolarblu is more than a payment tool—it is a blueprint for how digital and fiat currencies can coexist and reinforce one another.

By stabilizing crypto’s volatility while preserving blockchain’s benefits, Dolarblu demonstrates that innovation can serve both investors and everyday users. Its model suggests a future where global finance is faster, fairer, and fundamentally more accessible.

Experts note that Dolarblu’s architecture addresses a core friction point: the inability of traditional systems to deliver real-time, low-cost cross-border transactions at scale. With over 120 million monthly active users across 45 countries, Dolarblu is already reshaping expectations.As the platform integrates with central bank digital currencies (CBDCs) and correspondent banking networks, its reach and influence are set to deepen. In essence, Dolarblu is proving that cryptocurrency’s true value lies not in speculation, but in solving tangible, systemic problems—enabling capital to flow unimpeded, empowering underserved markets, and redefining trust in finance. Whether through faster remittances, streamlined trade settlements, or inclusive banking, Dolarblu embodies the next dawn of global economic integration—one blockchain transaction at a time.

As the world moves toward a more digital, interconnected economy, Dolarblu stands as a testament to innovation grounded in real-world impact. Its journey is not just about technology—it’s about inclusion, efficiency, and the enduring possibility of a financial system built for everyone.

Related Post

Usmnt vs Mexico: A High-Stakes Clash in National Team Lineups That Defines Regional Football Identity

New Arctic Monkeys CD: A Sonic Odyssey Through the Arctic’s Frosty Soul

What Happened to Jason Guy on Wesh 2 News: From Anonymous Broadcasts to Public Scrutiny

Mangy Moose Cellars & Grocery: Where Winter Cravings Meet craft Authenticity