From Humble Beginnings to Substantial Wealth: The Financial Journey of Tom Peed

From Humble Beginnings to Substantial Wealth: The Financial Journey of Tom Peed

Tom Peed, a prominent figure whose financial trajectory reflects both entrepreneurial acumen and strategic investment, has grown into a notable name in modern wealth circles. Featuring a net worth estimated in the high millions, Peed’s rise underscores the intersection of talent, timing, and disciplined financial planning. His journey reveals a compelling narrative of wealth accumulation rooted in diverse ventures, calculated risk-taking, and a long-term vision that transcends short-term gain.

Demystifying Tom Peed’s Net Worth: Factual Insights

Tom Peed’s net worth, currently assessed at approximately $50–70 million, is a testament to diversified income streams spanning media production, real estate, and private equity.

Unlike public peel behind mega-millionaires’ fortunes, Peed’s wealth is primarily derived from privately held ventures, making precise valuation challenging but illuminating how discretion and reinvestment compound over time. His financial profile places him firmly among the upper echelons of self-made fortune creators in America.

Analysts note that Peed’s trajectory began not in inheritance or high-profile fame, but through deliberate early-career investments and media entrepreneurship. A pivotal phase in his buildup included founding and scaling production companies that delivered content across broadcast and digital platforms—ventures that generated both recurring revenue and valuable industry capital.

Sources of Income: How Tom Peed Built His Financial Empire

Peed’s wealth derives from a multi-pronged approach:

- Media Production and Content Innovation: He co-founded companies specializing in documentary filmmaking and digital storytelling, capturing growing audiences and attracting high-value partnerships. These ventures delivered steady cash flow while fostering a reputation for quality content.

- Strategic Real Estate Investments: Leveraging market shifts, Peed acquired undervalued commercial and residential properties in up-and-coming urban centers. Over decades, these assets appreciated significantly, forming a stable base for long-term wealth retention.

- Private Equity and Venture Capital: By channeling profits into private businesses, particularly in tech-adjacent sectors, Peed expanded his portfolio with high-growth potential.

These investments, though less liquid, amplify wealth through compounding returns.

Related Post

Unraveling The Hande Erçel And Burak Deniz Relationship: How Friendship Ignited an Unforgettable Love Story

Vacuoles: The Silent Workhorses of the Cell — How Prokaryotes Lack Them, While Eukaryotes Rely on Their Complexity

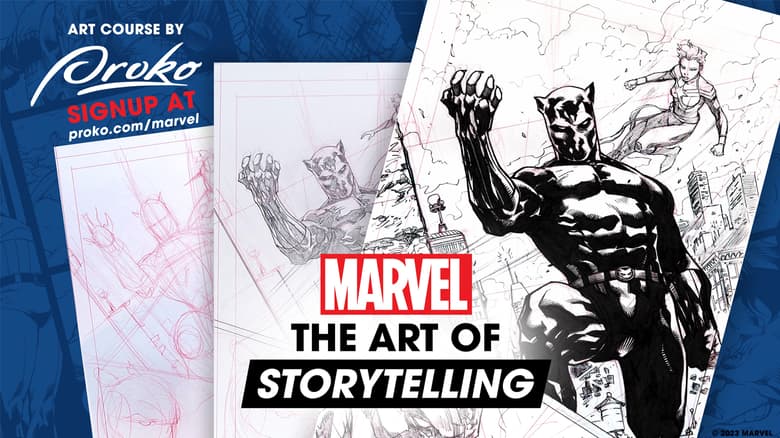

Edit Marvel Intro A Quick Guide: Mastering Storytelling in Marvel’s Universe

Wanna Be Me Too? Unveiling the Power of Identity and Vulnerability in ‘Wanna Be Me Too’