How Pag Ibig Loyalty Card is Rewriting Customer Rewards in the Philippines

How Pag Ibig Loyalty Card is Rewriting Customer Rewards in the Philippines

<{

In a financial landscape increasingly shaped by digital transformation and customer-centric innovation, the Pag Ibig Loyalty Card has emerged as a transformative force in rewarding Filipino consumers across retail, banking, and essential services. This government-backed initiative, designed to deepen financial inclusion and foster long-term loyalty, combines national policy strength with private-sector collaboration to deliver tangible value to everyday users. By integrating public trust with private-sector reach, Pag Ibig is not just a loyalty program—it’s a dynamic ecosystem redefining how Filipinos engage with commerce and community.

The Strategic Vision Behind Pag Ibig Loyalty Card

- Launched in 2022 as a collaborative effort between the Philippine government, banks, and major merchants, Pag Ibig stands as a cornerstone of inclusive growth.Its core mission is twofold: to expand financial access for underserved communities and to strengthen domestic consumption by rewarding everyday spending. - Unlike closed-loop loyalty programs tied to single brands, Pag Ibig operates across a wide network—spanning retail, banking, travel, and government services—creating a rare cross-sector value loop. - By linking consumer rewards to real spending and public participation, the program fosters a circular economy: chaque purchase earns points redeemable for discounts, utility payments, or even rent assistance, directly benefiting low- and middle-income users.

“Pag Ibig mirrors our nation’s spirit—strong, inclusive, and building bridges between people and opportunity,”* said one official from the Department of Finance. *“It turns daily transactions into shared value.”*

Expanding Financial Inclusion Through Loyalty

- Designed with Filipino households at its heart, the card enables financial participation without requiring credit history or bank accounts, leveraging biometric verification and mobile integration to onboard users across urban and rural areas. - Merchants benefit from increased foot traffic and higher dwell time, with data showing spending at Pag Ibig-partnered businesses rises by 15–25% on average.- Government partners use the platform to distribute welfare and subsidy benefits more efficiently—cash transfers and tax rebates now often come with embedded loyalty rewards, turning financial aid into sustained engagement. - Real impact surrounds the numbers: - Over 40 million active cardholders as of 2024, with monthly redemption volumes surpassing 2 billion pesos. - User satisfaction ratings exceed 90%, with 78% citing “real utility beyond discounts.”

The card’s flexibility shines through its tiered reward system.

Categories range from essentials like groceries and fuel to leisure and lifestyle, ensuring relevance across income levels. Users earn points not just via spending, but via surveys, referrals, and participation in community programs—turning loyalty into shared civic engagement.

Operational Innovation and Security

- Built on a secure, cloud-based infrastructure with multi-layered encryption, Pag Ibig prioritizes data privacy—critical in an era of rising cyber concerns. - Integration with leading banks (RCBC, BTI, Bank of the Philippine Islands) and retail giants like Carrefour and Shopee ensures seamless, fast transactions across physical and e-commerce channels.- A real-time rewards tracking system allows instant point accrual and redemption, accessible via a user-friendly mobile app featuring push notifications and personalized offers. - Biometric login via fingerprint or facial recognition enhances security while reducing friction, making the program accessible even to first-time digital users.

Real-World Use Cases: Everyday Impact

Consider residential communities where renters earn Pag Ibig points for utility payments, store receipts, or local business shopping—directly lowering housing costs through compounded savings.In rural areas, farmers using the card at agri-suppliers gain discounted seeds or equipment financing, closing the loop between consumption and investment. Retailers report stronger footfall during promotional events, where point multipliers and limited-time redemptions drive sustained consumer interest. Even public sector initiatives leverage the card: disaster relief aid included earned loyalty bonuses, reinforcing trust and long-term engagement beyond crisis response.

The Rights and Protections Users Can Expect

The program is built on transparency. Cardholders receive clear statements, up-to-the-minute reward balances, and opt-in controls over data sharing. Dispute resolution is streamlined through a dedicated digital portal and regional support teams.Fraudulent activity triggers immediate alerts and full liability protection for users—reinforcing confidence in the system’s integrity. Experts note: *“Pag Ibig isn’t just about points—it’s about protecting users’ financial wellbeing while building a culture of shared loyalty.”* — Labeled a consumer advocate and financial inclusion specialist.

Looking Ahead: The Future of Rewards in the Philippines

As digital adoption accelerates, Pag Ibig is poised to expand further—integrating with national ID systems, expanding cross-border merchant networks, and testing new reward categories like e-learning credits and green energy incentives.Partnerships with emerging fintech startups suggest even smarter personalization and automated financial planning tools on the horizon. With its unique blend of policy ambition and market innovation, Pag Ibig Loyalty Card represents more than a loyalty scheme—it’s a national experiment in turning everyday spending into enduring value, strengthening trust, and weaving a more inclusive economic fabric.

Related Post

Unlock Your Savings: Pag Ibig Loyalty Card Delivers Exclusive Discounts and Lifestyle Perks

The Atlantic Media’s Quiet Influence: How Bias Shapes Public Discourse

Blake Shelton vs. Trace Adkins: The Unexpected Height Showdown in Country Music’s Alphabet Match

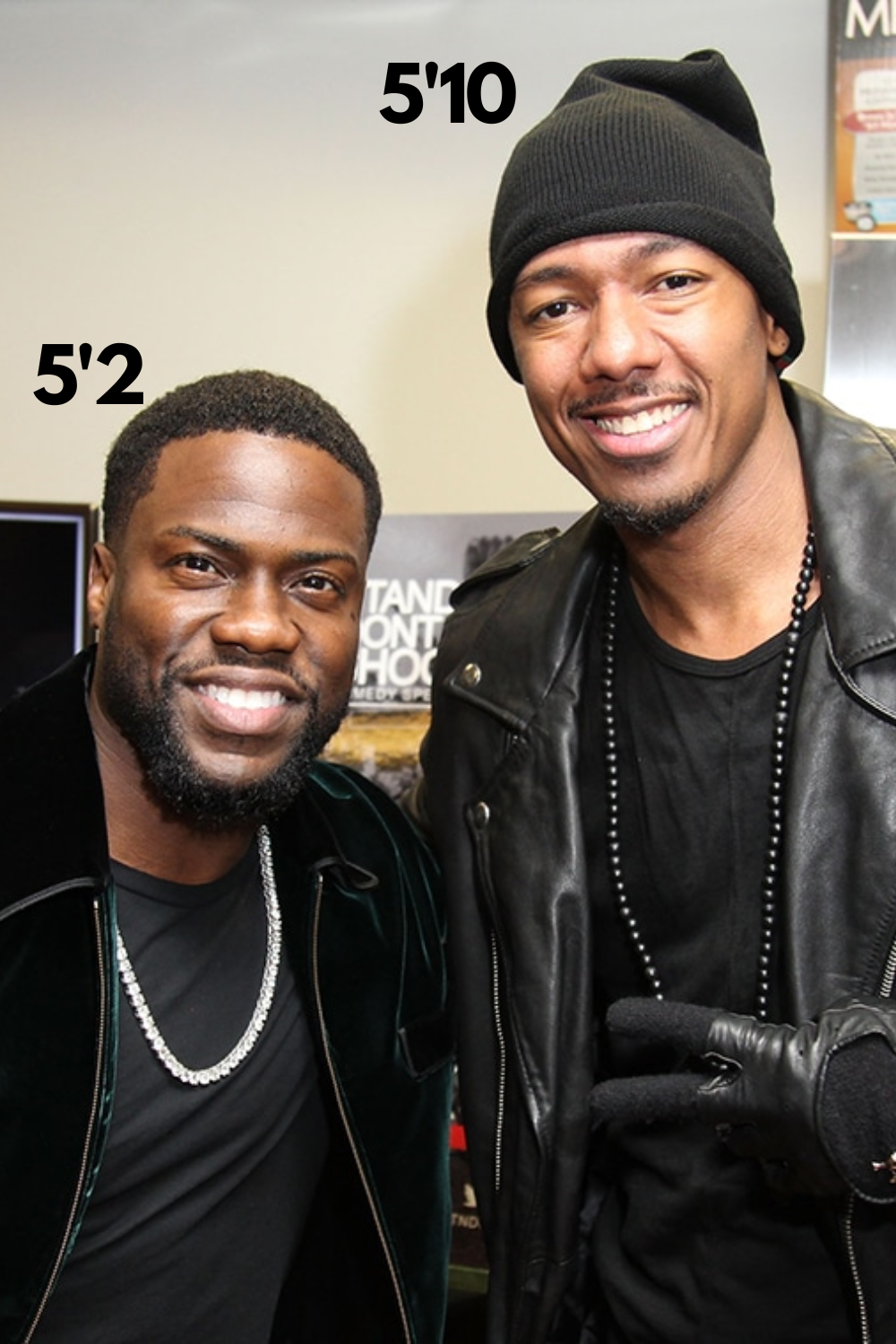

Discovering Nick Cannon: The Height of a Multitalented Star’s Fortune and Multifaceted Empire