IC Markets Indonesia: Your Go-To Guide to the Region’s Fastest-Growing Finance Platform

IC Markets Indonesia: Your Go-To Guide to the Region’s Fastest-Growing Finance Platform

In the dynamic landscape of Southeast Asian financial markets, IC Markets Indonesia has emerged as a trusted and agile trading platform pairing institutional-grade infrastructure with accessible tools for retail and professional traders alike. Whether you’re a seasoned investor navigating Indonesia’s seamless digital brokerage ecosystem or a newcomer seeking clarity amid complex Forex, IndieStock, and CFD instruments, IC Markets stands out for reliability, speed, and localized expertise. Operating at the intersection of cutting-edge technology and regulatory compliance, the platform has carved a niche as the region’s most intuitive gateway to Indonesia’s vibrant financial markets.

Established as a regional extension of IC Markets—a global fintech leader known for robust trading systems—IC Markets Indonesia delivers a seamless, low-latency experience tailored specifically to the country’s unique market conditions. From fastimus (high-speed) trading engines to real-time compliance monitoring aligned with OJK (Financial Services Authority) requirements, the platform ensures both performance and security. As markets shift with Indonesia’s rapidly growing economy—ranked 4th in ASEAN by market capitalization—IC Markets Indonesia has positioned itself as a critical partner for non-Indonesian investors and local traders seeking efficient market access without compromising on control or transparency.

Why IC Markets Indonesia Stands Out in a Crowded Market

One of IC Markets Indonesia’s defining strengths lies in its deep integration with Indonesia’s capital markets.The platform supports direct trading on key venues including the Indonesia Stock Exchange (IDX), where over 700 listed companies present diversified opportunities across sectors like energy, banking, consumer goods, and technology. Unlike generic global platforms that treat Indonesia as an afterthought, IC Markets Indonesia offers region-specific tools such as Indonesian Rupiah (IDR) settlement, local currency pricing, and regulatory disclosures in Bahasa Indonesia—critical for reducing friction in cross-border and domestic trading.

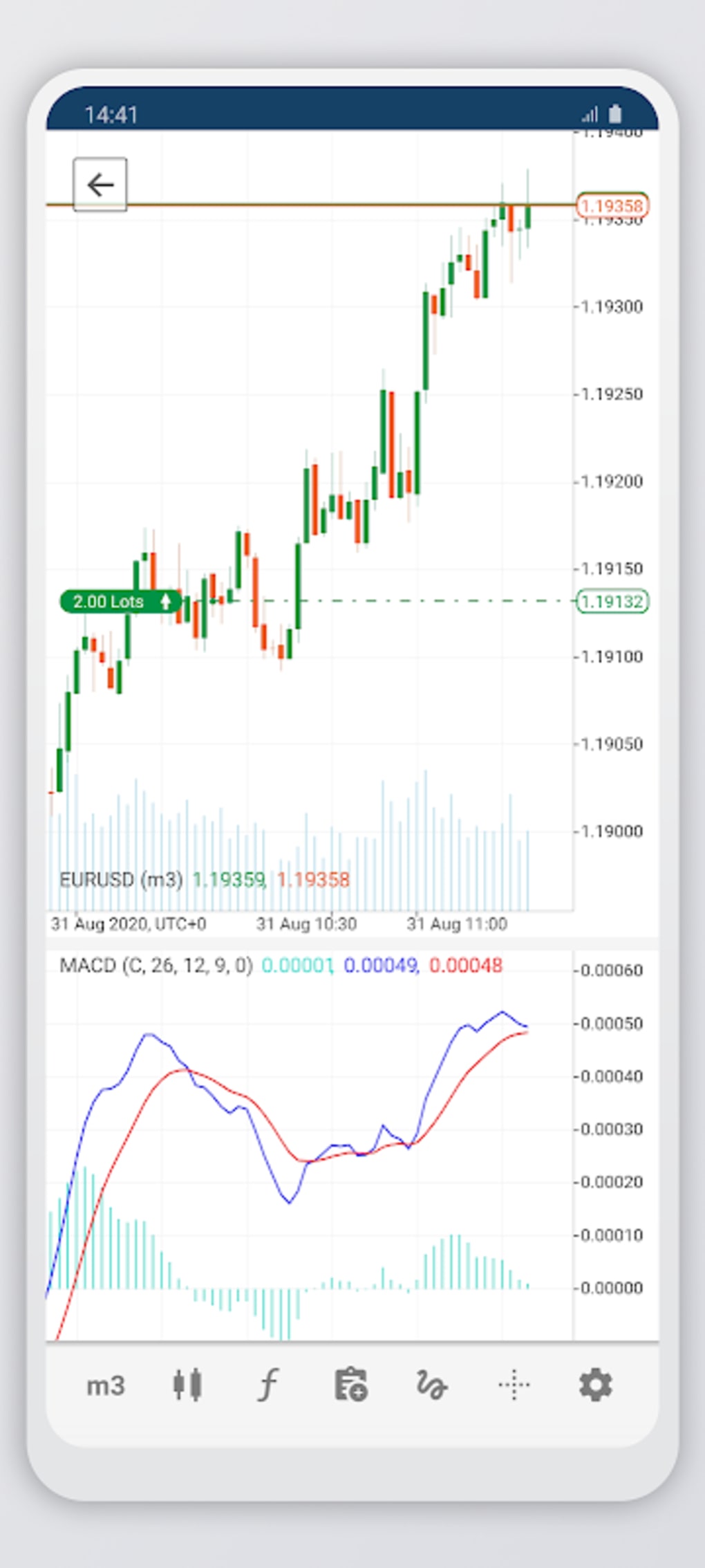

For international traders, the platform’s user experience is a key differentiator. A sophisticated, dark-mode interface minimizes visual clutter while enabling simultaneous tracking across multiple asset classes—from high-volatility IndieStocks such as GoTo Group and Tokopedia, to stable Jakarta Composite Index (JCI) derivatives.

Background analytics tools, built-in charting panels, and customizable alerts help users execute informed, timely decisions. As one experienced investor noted, “IC Markets Indonesia doesn’t just offer access—it delivers context. The platform contextualizes price movements within Indonesia’s economic pulse, giving traders a clearer edge.”

Core Features That Power Trading Confidence

IC Markets Indonesia combines robust infrastructure with investor-centric design in several key functional areas:Liquidity & Market Access

Access to liquid, high-volume trading pairs is priority one.The platform ensures deep order book visibility across major Indonesian securities, with real-time execution for NASDAQ Indonesia-listed equities, bonds, and futures. This level of liquidity is indispensable for both scalping and long-term positioning. Market data feeds are updated every few milliseconds, enabling precise timing.

For crypto traders, integration with Indonesia’s leading digital asset exchanges means smooth workflow from wallet to order book—without dispersion risks or delayed confirmations.

Advanced Risk Management Tools

Beyond basic stop-loss and take-profit features, IC Markets Indonesia offers proactive risk controls tailored to volatile emerging markets. Position sizing calculators factor in currency volatility and recent drawdowns, helping users avoid overexposure. Real-time portfolio stress tests simulate extreme market scenarios—important given Indonesia’s sensitivity to commodity prices and global interest rate shifts.“The platform’s risk dashboard translates complex market dynamics into actionable insights,” a platform advisor emphasized, reinforcing IC Markets’ commitment to responsible trading resources.

Multi-Asset Trading with Seamless Integration

The platform’s unified architecture supports synchronized trading across stocks, bonds, indices, and cryptocurrencies. Traders can allocate capital dynamically—shifting from Jakarta Composite Index CFD contracts to USD-denominated Minerals futures—all from a single interface. Integration with popular regional payment gateways, including e-wallets and bank transfers, simplifies cross-border funding while meeting Indonesia’s strict AML/KYC frameworks enforced by OJK.This interoperability reduces operational complexity and enhances capital mobility.

Educational Support and Community Building

Recognizing that market knowledge remains a key barrier for newcomers, IC Markets Indonesia delivers contextual learning resources and community engagement. The in-app hub features:- Guided Roadmaps: Step-by-step tutorials on equities research, options strategies, and forex pair interpretation, with Indonesian market examples.

- Live Webinars: Weekly sessions led by local finance professionals covering macro trends, tax implications, and regulatory updates.

- Peer Networking: A moderated community forum where traders share insights, analysis tools, and risk management tactics—fueling a culture of informed decision-making.

Regulatory Compliance as a Competitive Edge

Operating

Related Post

Who Is Bill O'Reilly Married To Now? A Deep Dive Into His Personal Life

Unlock Texas Roadhouse Perks: Mastering Coupons for Significant Savings

Unlocking the Power of IDLX: The Revolutionary API Reshaping Data Intelligence