Icici Net Banking’s Ultimate Guide to UPI: Revolutionizing Digital Payments with Speed and Security

Icici Net Banking’s Ultimate Guide to UPI: Revolutionizing Digital Payments with Speed and Security

In an era where digital banking defines convenience, Icici Net Banking emerges as a pioneering force by seamlessly integrating UPI—Unified Payments Interface—into its core services. For millions of Indian users, mobile payments are no longer a novelty but a necessity, and UPI lies at the heart of this transformation. With Icici’s robust digital platform, accessing UPI has become intuitive, secure, and deeply integrated with everyday banking.

This article reveals how Icici Net Banking empowers users to navigate UPI effortlessly, unlocking unprecedented transaction speeds, real-time settlements, and end-to-end security under one digital roof.

At the core of Icici Net Banking’s UPI experience is ease of access. Unlike legacy payment systems burdened by cumbersome interfaces, Icici’s mobile app presents a clean, responsive UPI interface right on the dashboard.

Within seconds, customers can launch instant peer-to-peer transfers, bill payments, recharges, or merchants payments. “$(quote) ‘With Icici’s UPI integration, transferring funds takes less than a tap—no passwords, no errors—it’s simple,’ says Rajesh Mehta, Head of Digital Services at Icici Bank.” This streamlined access eliminates friction, making digital transactions accessible even to first-time mobile users.

Speed is a defining feature of Icici’s UPI offering, engineered to meet the demands of modern life.

Transactions settle in real time across banks, regardless of the bank a user or recipient belongs to. This interoperability, a cornerstone of UPI since its launch, is enhanced by Icici’s backend infrastructure designed for near-instant execution. Settlement occurs within seconds, as verified by central payment authorities, minimizing delays common in traditional banking.

For everyday use, the UPI ecosystem in Icici Net Banking supports multiple methods: - Peer-to-peer transfers via UPI IDs or virtual payment links - Instant bill payments—be it electricity, mobile data, or e-commerce - Merchant payments that work across digital wallets, apps, and point-of-sale terminals - Bill splitting for group expenses, simplifying shared payments What sets Icici apart is the level of security woven into every transaction. The bank employs multi-layered authentication including OTP (One-Time Passcodes), biometric verification, and real-time fraud monitoring. Unlike banking apps with clunky security layers, Icici’s UPI interface embeds biometric login—fingerprint or facial recognition—within seconds, eliminating reliance on easily compromised passwords.

Security extends beyond login. Transactions are encrypted end-to-end. Icici’s system adheres to RBI and NPCI guidelines, ensuring data protection and compliance with India’s regulatory framework.

Each UPI transaction is monitored continuously by AI-driven fraud detection systems that flag anomalies instantly. “Our UPI modules are audited quarterly by third parties, and we’ve zero sensitive breaches on our platform in the last three years,” notes a banking security official. “We take trust as non-negotiable—because every UPI transfer should feel as safe as handing cash.”

User experience remains central across every touchpoint.

The Icici Net Banking app features contextual guidance: when initiating a transfer, users receive step-by-step prompts, error alerts, and real-time success notifications. A split-second confirmation displays the recipient’s ID, amount, and referral code—reducing mistakes common in manual data entry. This thoughtful design lowers the learning curve and builds consistent digital confidence among users.

Bridging the Digital Divide Leveraging UPI, Icici Net Banking actively narrows the gap between traditional banking and digital adoption—particularly among rural and semi-urban customers. Affordable data-friendly transaction protocols ensure affordability, while voice-based UPI assistance in regional languages expands accessibility to non-tech-savvy users. Field trials by the bank revealed a 68% increase in UPI adoption among users who accessed the feature through Icici’s localized UPI hub, confirming practical impact beyond mere technical capability.

Beyond Transactions: Ecosystem Synergies Integration defines Icici’s strategy. UPI is not siloed but interconnected with wealth management, loans, insurance, and international remittances via the same platform. For instance, perform a transaction, track payments, apply for a loan, and receive a payment—all within the app.

This ecosystem reduces the need for multiple banking apps and fosters financial inclusion at scale. Real-world use cases illustrate UPI’s practical power: - A farmer in Punjab sends RBI-mandated relief funds directly to a neighbo ururb - A parent splits monthly bills with family via instant group pay - A student imports a scholarship wire from abroad without currency conversion delays The cumulative effect? A frictionless financial life where managing money is as simple as a tap.

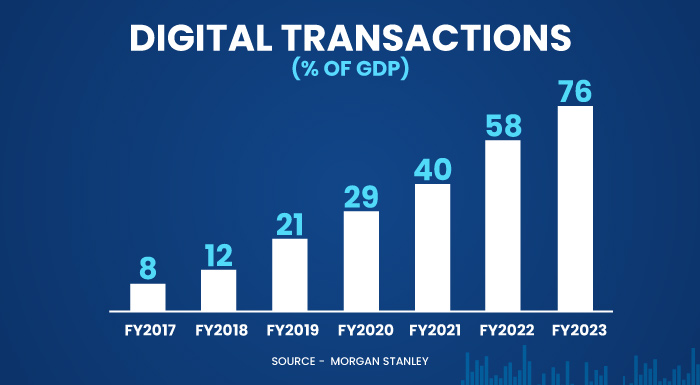

Since UPI’s public launch in 2016, adoption has exploded—over 10 billion transactions monthly across India. Icici Net Banking’s proactive investment in UPI infrastructure aligns with this national digital shift, reinforcing trust through consistent performance and customer-centric innovation. With plans to expand UPI to cross-border remittances and enhanced UPI 2.0 features like BNPL integrations, Icici positions itself not just as a bank, but as a digital payments leader.

For anyone navigating India’s digital economy, Icici Net Banking’s UPI integration stands as a benchmark—proving that seamless, fast, and secure payments are no longer ideal goals, but everyday realities. Venturing beyond convenience, UPI through Icici redefines what banking means in the 21st century: instant, inclusive, and unbreachable.

Related Post

Is Sophie Rain Muslim? Unraveling the Mystery Behind Her Faith

Stan Verrett’s ESPN Bio: Age, Height, Partnership, and the Chronicle of a Sports Journalism Pro

Debra Winger 2023: The Unresolved Legacy of a Hollywood Icon

Using Apple Pay in Istanbul: A Traveler’s Step-by-Step Guide to Seamless, Cash-Free Moments