Indonesia’s Securities Market at the Crossroads: A Deep Dive Through PSE, IOSCO, CSCS, EVAL, and ESCSE Standards

Indonesia’s Securities Market at the Crossroads: A Deep Dive Through PSE, IOSCO, CSCS, EVAL, and ESCSE Standards

Indonesia’s financial landscape is undergoing a transformative phase, with its capital markets navigating complex regulatory evolution shaped by global benchmarks and domestic strengthening. From the indomitability of the Lindau Securities Exchange (PSE) to the disciplined oversight of the Capital Market and Financial Services Supervisory Agency (CSCS), the nation’s securities ecosystem reflects a strategic push toward alignment with international best practices. By integrating frameworks from the International Organization of Securities Commissions (IOSCO), Input Output Evaluation (EVAL), Registration Certification System (RCS), and rigorous assessment (EVAL) protocols—alongside industry-standard evaluations (CSCS)—Indonesia is reinforcing investor confidence, transparency, and market integrity.

This deep dive examines how these interrelated systems operate within the Indonesian context to elevate market efficiency, reduce systemic risk, and align national regulation with evolving global expectations.

PSE: The Engine of Indonesia’s Equities Market with IOSCO’s Global Vision

The Lindau Securities Exchange (PSE) serves as Indonesia’s primary venue for equities trading, managing over 400 active listed companies across diverse sectors including banking, energy, and consumer goods. As the backbone of the domestic market infrastructure, PSE has embraced International Organization of Securities Commissions (IOSCO) principles to enhance investor protection and market integrity.PSE’s adoption aligns with IOSCO’s core objectives: ensuring fair, efficient, and transparent markets where all participants operate on a level playing field. Key operational upgrades reflect IOSCO’s credibility-focused agenda. For example, PSE implemented stringent disclosure requirements modeled on IOSCO’s Rule 108, mandating timely, accurate, and comprehensive financial reporting.

This ensures public companies meet international standards for information transparency, reducing information asymmetry that undermines market confidence. Equally vital is the integration of electronic trading platforms and real-time surveillance systems, which mirror IOSCO’s guidelines on market conduct and fraud prevention. > “PSE’s evolution is not just technological—it’s a reaffirmation of Indonesia’s commitment to global best practices,” noted Dr.

Budi Santoso, Dean of Finance at Universitas Indonesia. “By embedding IOSCO’s principles, we enhance credibility and open doors for foreign institutional participation.” Moreover, PSE’s investor education initiatives, including mandatory training for corporate issuers and public awareness campaigns, underscore a proactive approach to market literacy—an area increasingly emphasized by IOSCO as critical to sustainable market development.

CSCS and IOSCO: Indonesian Gatekeepers of Market Integrity

At the core of Indonesia’s securities regulation lies the Capital Market and Financial Services Supervisory Agency (CSCS), the principal overseer responsible for licensing intermediaries, monitoring compliance, and enforcing market conduct rules.CSCS functions as the nation’s chief guardian of financial stability, echoing IOSCO’s dual mandate: regulating markets efficiently while safeguarding investors. A defining aspect of CSCS’s operations is its rigorous registration and ongoing supervision process, which reflects IOSCO’s emphasis on licensed intermediary accountability. All brokers, fund managers, and investment advisors must undergo continuous training, ethical vetting, and performance reviews—measures designed to minimize conflicts of interest and market abuse.

Beyond licensing, CSCS activates EVAL frameworks—formal performance assessments used to evaluate compliance, risk management, and operational soundness. These evaluations are not mere rubber-stamping exercises but deep dives into organizational practices, mandated by both domestic law and IOSCO’s supervisory standards. For example, CSCS’s annual audits of registered entities assess adherence to ESG disclosures, margin requirements, and client suitability protocols—areas increasingly vital in modern capital markets.

> “EVAL isn’t just a compliance check—it’s a diagnostic tool that uncovers vulnerabilities before they escalate,” explained Arief Wibowo, former Director of Supervision at CSCS. “By combining CSCS oversight with structured evaluations, we create a proactive, forward-looking regulatory culture.” CSCS also plays a central role in aligning Indonesia with international data reporting standards, particularly through its participation in standardized forms recognized under IOSCO’s cross-border cooperation mechanisms. This ensures seamless information sharing with foreign regulators, strengthening anti-money laundering (AML) and counter-terrorist financing (CTF) capabilities.

EVAL and Registration Certification System (RCS): Precision in Market Oversight

Integral to Indonesia’s layered regulatory framework is the Registration Certification System (RCS) working hand-in-hand with Evaluation (EVAL) protocols. While RCS defines the formal pathway for market participants to legally operate, EVAL serves as the critical assessment engine that validates readiness and compliance. The RCS mandates structured qualification stages, including initial registration, ongoing renewal, and performance-based reevaluation—each gatekeeping layer calibrated to mitigate risk and ensure operational competence.These stages are reinforced by standardized evaluation rubrics that align with IOSCO guidance on market participant qualification, client asset protection, and conduct of business rules. For instance, investment funds seeking certification must demonstrate robust governance frameworks, transparent reporting mechanisms, and adherence to fiduciary duties—metrics closely mirrored in IOSCO’s RAM (Regulation of Alternative Investment Funds) principles. Fund managers undergo periodic third-party audits to verify operational integrity, and non-compliant entities face de-registration or suspension.

The RCS-EVAL nexus also facilitates enhanced cross-referencing by CSCS, enabling swift identification of misconduct or systemic weaknesses. This integration supports Indonesia’s ambition to reduce regulatory arbitrage and strengthen investor confidence through consistent enforcement. > “By binding RCS eligibility to rigorous EVAL, we close the loop on oversight—not just on paper,” said Dr.

Siti Aminah, an EVAL specialist at the Institute for Financial Regulation. “It’s a dynamic feedback system that evolves with market developments.” Moreover, simplification efforts in RCS documentation—now digitized and accessible via a centralized portal—demonstrate Indonesia’s push for operational efficiency without compromising rigor, a balance increasingly emphasized by IOSCO in its technical assistance programs.

Assessment (EVAL) and ESCSE: Ensuring Technical Competence and Market Readiness

Beyond organizational oversight, Indonesia’s regulatory ecosystem places strong emphasis on technical competence and market literacy—areas addressed through structured Assessment (EVAL) protocols and the Education and Supervision Compliance System (ESCSE).These components ensure that not only institutions but also individuals operating in the capital markets meet high professional standards. EVAL extends to assessing broker-dealers, financial analysts, and advisors on technical skills, ethics, and risk awareness. Candidates undergo scenario-based simulations, written exams, and real-time monitoring to validate adherence to market conduct rules.

For example, mandatory maintained

Related Post

Pseisarase Finance Course: Is It Worth It? A Deep Dive into Value and Return

Lee Ingleby’s Family Life: A Quiet, Authentic Glimpse Behind the Camera

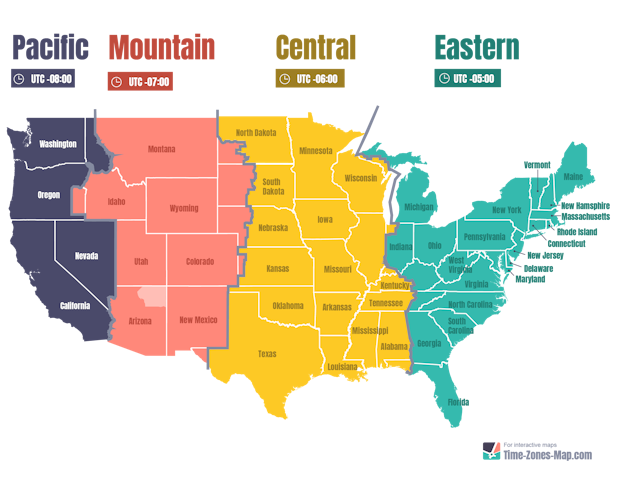

Navigating America’s Time Zones: The Psi-estamford Square Challenge of Cross-Time Travel

PSE Breaking News: What’s Shaking Slidell, LA? Flash Floods, Road Closures, and a Community on Edge