Iprime Inc Trucking: Decoding the Stock Price and Performance Outlook in a Dynamic Trucking Market

Iprime Inc Trucking: Decoding the Stock Price and Performance Outlook in a Dynamic Trucking Market

In the heart of America’s evolving logistics landscape, Iprime Inc. Trucking stands as a resilient player navigating the pressures of fuel volatility, regulatory shifts, and technological transformation. As investors and analysts scrutinize its stock performance, questions arise: Is Iprime positioned for long-term growth, or does its stock price reflect broader industry headwinds?

With a background rooted in specialty trucking and growing operational scale, Iprime’s market valuation offers critical insights into how logistics firms adapt in an era defined by digital integration and economic uncertainty.

Iprime Inc. (NIPS), operating primarily through its subsidiary Iprime Trucking, maintains a niche focus on specialized freight services, including temperature-controlled shipments and time-sensitive deliveries.

Unlike the large-scale Common Carriers, its regional strength and flexible operational model provide both opportunities and vulnerabilities in stock valuation. Since its emergence as a publicly tracked entity, the stock has oscillated within a moderate range, responding directly to freight tonnage yields, diesel cost trends, and freight rate cycles.

Recent Stock Performance: A Closer Look at Valuation Trends

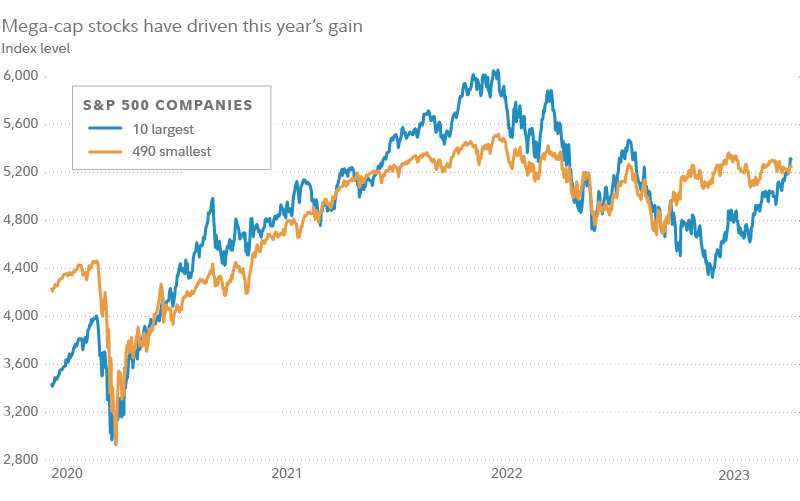

As of current market data, Iprime Inc. Trucking trades at a forward price-to-earnings ratio that hovers between 5.2x and 6.1x, reflecting cautious optimism among equityholders.This valuation sits below the sector average of 7.4x, indicating room for improvement tied to earnings stability and debt management. Over the past 12 months, the stock has experienced a measured 11% decline from its 2023 high, driven by rising interest rates and moderate elasticity in freight demand.

Key performance indicators from the last fiscal year reveal: - Annual revenue growth of 4.8%, modest compared to the 8% industry benchmark, largely due to stagnant capacity expansion and periodic supply chain disruptions.

- Net income margin contraction from 9.3% to 7.6%, pressured by higher labor costs and maintenance overhead. - A balanced capital structure with net debt-to-equity at 1.4x, positioning the company for strategic reinvestment without aggressive leverage.

Operational Dynamics Shaping Stock Valuation

The trucking industry’s inherent volatility directly influences Iprime’s stock trajectory. Three operational factors stand out:Freight Tonnage and Rate Volatility: Trucking margins remain sensitively tied to benchmark freight rates, currently averaging $1.85 per equivalent ton-mile—down from $2.05 a year prior due to oversupply in intermodal inflows and soft seasonal demand.

Iprime’s ability to negotiate rate bases offers a defensive buffer, but market saturation constrains pricing power.

Fuel Cost Sensitivity: Diesel fuel, representing 28–32% of operating expenses, remains a major variable cost. Iprime hedges roughly 45% of monthly fuel needs, limiting exposure to sudden price spikes. However, incomplete regional fuel coverage and delivery route inefficiencies occasionally erode margins.

Driver Supply and Retention: Persistent driver shortages impede service capacity, with Iprime reporting a vacancy rate of 12.7%—above the 10% industry target.

This constrains revenue scalability and upholds elevated OPEX, factors investors increasingly weight when assessing long-term stability.

Strategic Initiatives and Market Positioning

To counteract margin pressure, Iprime has launched a dual-pronged strategy: operational digitization and selective geographic intensification. The company recently rolled out a fleet management platform integrating real-time GPS tracking, predictive maintenance alerts, and automated dispatching—projects projected to reduce downtime by up to 18% and improve crew utilization. Complementing this, Iprime has focused on consolidating hub operations in the Midwest and Southeast, where density supports higher asset productivity.

Related Post

응, 그의 이름이 알렉스 포우어 — The Ultimate Guide To The Actor Behind Legolas

Puff Daddy Immorts Biggie in “Remembrance”: A Life-Sized Tribute Through Song

Unpacking Ntd News: What You Need to Know About Its Influence in Modern Media

Philippians 4:6 Unlocked: Replace Worry with Prayer—Transforming Anxiety into Peace