Is Carvana Legit? The Truth About Buying a Car Online in a Digital Age

Is Carvana Legit? The Truth About Buying a Car Online in a Digital Age

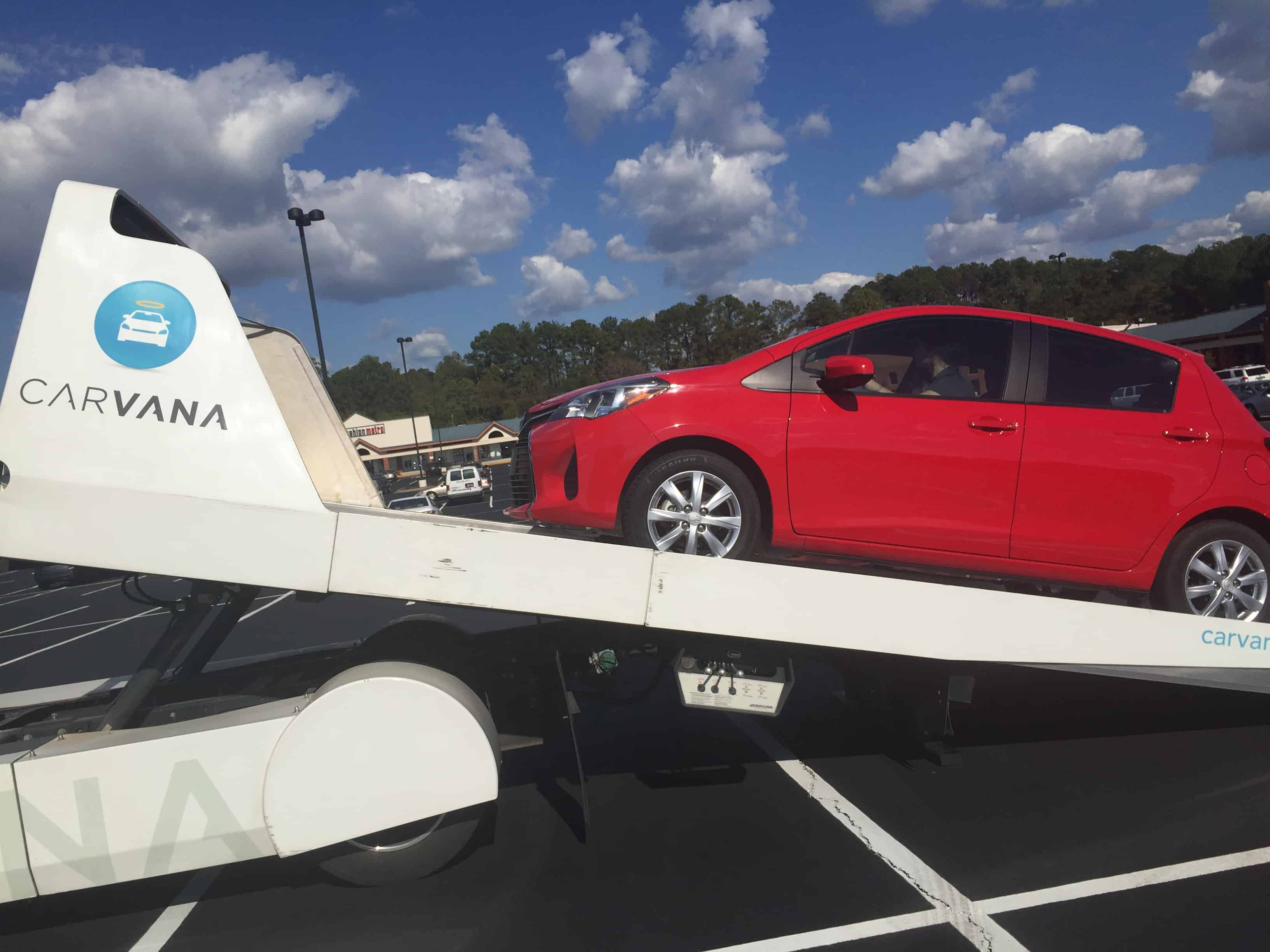

Carvana has emerged as a disruptor in the auto-buying landscape, advertising a seamless, fully digital car-buying experience that challenges decades of traditional dealership norms. But behind the sleek website, fast financing offers, and "no-haggle" promise lies a complex reality: Is Carvana truly legitimate, or is it a marketing narrative built on promise and scale? With millions of cars sold online and a valuation exceeding $4 billion at its peak, Carvana’s business model raises compelling questions about transparency, reliability, and the evolution of car purchasing.

As more buyers turn to digital platforms, the line between innovation and hype continues to blur—making it essential to examine whether Carvana stands up to scrutiny or operates more as a digital myth than a dependable marketplace.

The Rise of Carvana: Revolutionizing the CAR-BUYING Prozess

Launched in 2012, Carvana positioned itself as the first fully online car sales platform, aiming to eliminate the friction of visiting physical dealerships. At its core, the company’s premise is deceptively simple: consumers browse inventory, test-drive via video or virtual tours, arrange delivery or in-person pickup, and close the deal—all online.By digitizing the process, Carvana claimed to offer faster transactions, competitive pricing, and a level of convenience unmatched by traditional retailers. Core Features Driving Digital Appeal: - **Online Inventory & Virtual Engagement:** Buyers access high-resolution photos, 360-degree vehicle views, and comprehensive vehicle histories—information typically available only after a dealership visit. - **Self-Service Mechanism:** From financing approvals to scheduling inspections, the entire journey is managed through a mobile app or website, reducing head-of-line delays.

- **Logistics Support:** Carvana handles not just the sale, but also pickup or delivery logistics, offering localized towing and moving services to ease placement. - **Innovative “Vroom” Financing:** A proprietary digital loan process that promises instant approvals and transparent terms, targeting tech-savvy buyers eager to skip protracted negotiations. This model resonates in an era where convenience drives consumer expectations.

For younger generations, particularly, the idea of buying a car without walking into a brightly lit lot feels revolutionary. But convenience alone does not confirm legitimacy.

Behind the Facade: Is Carvana Built on Transparent Practices?

While Carvana’s operational efficiency and technological investment are undeniable, its legitimacy has drawn skepticism from industry watchdogs, consumer advocates, and former buyers.The company’s rapid growth—selling over 250,000 vehicles in peak years—should raise red flags when paired with recurring complaints about hidden fees, inconsistent vehicle quality, and tight delivery timelines. Common Concerns Raised: - **Hidden Fees & On-Time Delivery Issues:** Multiple reports highlight hidden costs such as destination fees, delivery enhancements, and early termination penalties not fully disclosed during initial quoting. - **Vehicle Condition Discrepancies:** Some buyers discover inconsistencies between advertised mileage, service history, and actual condition upon pickup—issues that undermine trust in Carvana’s vehicle vetting process.

- **Limited Regional Positioning:** Carvana maintains sparse physical infrastructure compared to traditional dealers, relying heavily on third-party logistics and third-party inspection networks, raising questions about consistent quality control. - **Customer Service Bottlenecks:** Many users report delayed responses during critical drop points—financing approval, delivery scheduling, or problem resolution—indicative of scalability strain in fast-paced digital operations. These patterns suggest a company optimized for scale but strained in personalized service delivery.

Legitimacy, after all, hinges not just on technological innovation, but on sustained reliability and ethical transparency.

Industry Validation: Is Carvana Trusted by Benchmarks and Regulators?

Carvana operates within regulatory frameworks, holding necessary dealer licenses across most states and participating in standard industry rating systems. Its financing arm holds national “BBB Accredited Business” status, and vehicular history reports are often verified through TORO or similar services—standard safeguards for any reputable creditor or seller.Independent reviews and consumer feedback platforms offer mixed signals. While TechCrunch and The Wall Street Journal initially commended Carvana’s early disruption, more critical analyses—particularly from Consumer Reports and the Better Business Bureau—cite inconsistent experiences, with some vehicles arriving with unresolved service needs or documentation gaps. Notable Industry Observations: - **Market Growth Amidst Scrutiny:** Despite controversy, Carvana reached a $4.4 billion peak valuation in 2021, reflecting investor confidence in its digital-first model—though this dropped sharply amid post-pandemic market corrections and operational hurdles.

- **Comparable Models in Retail:** Like Amazon’s evolution, early hype often precedes operational refinement. Carvana’s trajectory mirrors that of digital disruptors who gained traction before resolving friction points, suggesting momentum doesn’t equate to legitimacy. - **Regulatory Compliance:** The company complies with FCRA and HUD disclosure laws, but audits reveal room for improvement in proactive fraud prevention and clearer communication of total costs.

No single metric confirms or refutes legitimacy—only a constellation of evidence warns that innovation must be matched with accountability.

The Human Factor: Balancing Convenience with Caution

For buyers navigating this digital landscape, Carvana exemplifies both promise and peril. The elimination of jugging to lots or navigating aggressive sales tactics appeals deeply.Yet the anonymity of online transactions demands heightened vigilance. Success stories—like timely digital closings and transparent inspections—highlight Carvana’s potential, but numerous cautionary tales reveal risks when human oversight is minimized. Ultimately, legitimacy at Carvana is best judged not by bravado or valuation, but by consistency: How reliably does it deliver on promises?

Can it guarantee both speed and accuracy? And for buyers, how far does the digital interface go in supporting vulnerable transactions away from face-to-face verification? In a market hungry for disruption, Carvana sits at a crossroads: a visionary force redefining car sales—if it partners transparency with momentum—or merely a cautionary tale of scale outpacing trust.

The answer lies not in bold claims, but in sustained, real-world performance.

![Is Carvana Legit? [Is It a Ripoff? Complaints, Pros and Cons]](https://roadsumo.com/wp-content/uploads/2022/03/is-Carvana-legit-for-selling-a-car-768x512.jpg)

Related Post

RS Blic: Saying Yes to Reconciliation in a Fractured Europe

Laird Hamilton: A Deep Dive Into His Net Worth And Legacy

Iwgp Unveiled: What the Acronym Really Stands For and Why It Matters

.webp&w=1920&q=75)

Unlocking the Power of Translation: How “Translate 100 Times” Transforms Global Communication