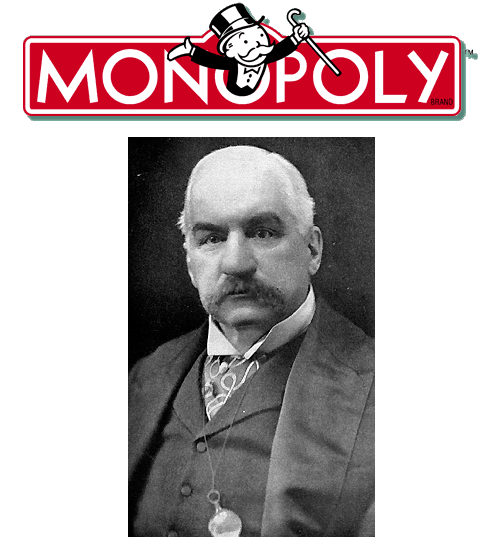

JP Morgan: The Life And Legacy Of A Finance Titan

JP Morgan: The Life And Legacy Of A Finance Titan

J.P. Morgan’s influence on global finance extends beyond any single era—his name embodies the evolution of modern banking, corporate consolidation, and financial stability in the face of crisis. From the late 19th century’s industrial boom to the dawn of 21st-century financial regulation, Morgan shaped institutions, defended markets, and redefined the boundaries of trust in capital.

His life, marked by triumphs of innovation and controversy, remains a cornerstone of financial history, offering enduring lessons on leadership, ethical boundaries, and institutional power. Born John Pierpont Morgan in 1837 into a family with roots in international finance, he inherited not just wealth but a sophisticated understanding of credit and capital flows. His early career with the New York branch of his father’s firm, Drexel, Morgan & Co., laid the groundwork for his vision: a banking system rooted in stability, transparency, and strategic resilience.

By the 1890s, Morgan had emerged as the most powerful private banker in America, orchestrating breakups of monopolistic trusts and rescuing faltering railroads—actions that earned both praise and criticism.

Central to Morgan’s legacy was his role as a financial stabilizer during systemic crises. Perhaps most famously, in 1907, when a wave of bank runs threatened to collapse the U.S.

financial system, Morgan personally organized a rescue mission. Drawing on his unparalleled access to liquidity and relationships with other financiers, he secured emergency funds and coordinated interventions that restored confidence. As historian Rudolph Smith noted, “Morgan’s intervention in 1907 was not merely a bailout—it was a demonstration that a private banker could serve as the nation’s de facto central authority when public institutions lagged.” His actions catalyzed calls for a permanent central bank, ultimately leading to the Federal Reserve’s creation in 1913.

Morgan’s impact transcended crisis management. His firm, J.P. Morgan & Co., pioneered modern investment banking by blending commercial and investment services under one roof—a model that would dominate Wall Street for generations.

He advised on landmark corporate restructurings, including the formation of U.S. Steel, the first billion-dollar corporation, consolidating fragmented steel producers into a dominant industrial force. Economist Mortimer Adler observed, “Morgan didn’t just finance industry—he engineered its transformation from chaotic competition to organized capitalism.” His belief in disciplined consolidation aimed to eliminate wasteful overexpansion, a philosophy that reshaped corporate America’s efficiency and scale.

Yet Morgan’s legacy is complex, marked by the tension between visionary leadership and concentrated power. Critics argue his influence represented a private oligarchy operating with little accountability. He wielded immense sway over government policy, shaping tariffs, currency, and banking regulation from behind closed doors.

In an 1895 editorial, he declared, “The truest public service comes not from voices loud in protest, but from men who understand the weight of capital and the necessity of restraint,” revealing a deep, if uncompromising, sense of responsibility. This duality—engineer and gatekeeper—defines how historians assess his role: a man who saved markets while embodying their most opaque forces.

Beyond his professional feats, Morgan’s personal ethos reflected a blend of discipline, discretion, and relentless curiosity.

He maintained a carefully cultivated public image—dressed in tailored suits, speaking only when necessary, yet deeply interested in art, science, and global affairs. His private library, a repository of rare manuscripts and original financial documents, underscored a lifelong pursuit of knowledge as a foundation for wise stewardship. Colleagues recalled his sharp intellect and calm composure under pressure—qualities that enabled him to navigate volatile markets with precision.

The enduring significance of J.P. Morgan lies in the institutional blueprint he helped establish. Today’s JPMorgan Chase & Co., born from decades of mergers and acquisitions following Morgan’s original firm, carries forward his principles of risk management, client focus, and operational excellence.

More than a symbol of 19th and early 20th-century finance, Morgan’s life illustrates how individual leadership can shape the architecture of entire industries. As financial historian Andrew Rose concludes, “Morgan wasn’t just a banker—he was architecture: building systems so resilient they endured long after he stepped away.”

In an age of ever-evolving finance—high-frequency trading, fintech disruption, and ESG investing—Morgan’s story remains a touchstone. His example underscores enduring truths: that true financial leadership demands both bold vision and restrained power, that stability often arises not from ideology but from disciplined practice, and that legacy is measured not only in profits but in lasting institutional strength.

J.P. Morgan’s life and legacy remind us that the forces shaping global markets were not built by chance, but by hands forged in conviction, crisis, and constant reinvention.

Related Post

Kim Kardashian’s High-Profile Drama Under the Glare: Paparazzi Moments That Defined a Legacy in 2010

Pakistan vs Sri Lanka: A Cultural, Political, and Sporting Clash Under Scrutiny

Rajbhar Nam Ke Kavach: The Timeless Strength of Boys’ Names in H呈现 the Indian Soul

A Closer Look at Robert F. Kennedy Jr.’s Children: Legacy, Activism, and Identity in a Turbulent Era