Log In with Confidence: Master the Chase Business Banking Sign-In Process

Log In with Confidence: Master the Chase Business Banking Sign-In Process

Accessing Chase Business Banking has never been simpler, thanks to its streamlined login system designed for speed, security, and user experience. The Chase Business Banking Login Easy Sign-In Guide offers a step-by-step roadmap to help professionals authenticate quickly without sacrificing safety. With financial tools evolving rapidly, knowing how to sign in with ease while maintaining enterprise-grade security is essential for modern business operations.

At the heart of Chase’s digital banking system is a user-centric design that prioritizes both convenience and protection. The sign-in process integrates advanced authentication methods with intuitive navigation, enabling business users to focus on their workflow rather than wrestling with login hurdles. Chemistry labs, law firms, and tech startups alike rely on this system to manage cash flow, track expenses, and authorize transactions in real time—penetrating the daily rhythm of business with seamless digital access.

Security Meets Simplicity: The Foundation of Chase Business Login

Chase Business Banking employs a layered security model that balances user frictionless access with robust identity verification.This dual focus ensures that only authorized personnel gain entry, even in high-risk environments. Key components of the secure sign-in process include two-factor authentication (2FA), biometric options, and encrypted token management. - **Two-Factor Authentication (2FA):** After entering credentials, users must verify their identity via a secondary method—typically a one-time code delivered via SMS, email, or authenticator apps.

This extra layer stops unauthorized access even if passwords are compromised. - **Biometric Logging:** Mobile users benefit from fingerprint or facial recognition, allowing quick, secure logins on-the-go without remembering complex passwords. - **Automated Session Management:** Inactive sessions timeout automatically, reducing the risk of unauthorized access during extended breaks or shared devices.

“Security shouldn’t be a barrier—it’s a necessity,” says a Chase product strategist. “Our streamlined yet secure login reflects years of iteration backed by threat intelligence and user feedback, ensuring that business customers enjoy both speed and safety.”

These measures collectively create a protective shield that adapts to evolving cyber threats, without compromising the speed critical to business efficiency. Each step reinforces trust in the platform, enabling leaders and frontline staff to conduct financial operations with confidence.

Step-by-Step Guide: How to Log In to Chase Business Banking

Using the Chase Business Banking Login Easy Sign-In Guide, users follow a clear, structured path designed to minimize friction: 1.**Access the Login Portal** Navigate to the Chase Business Banking homepage via the official app or secure web URL. Avoid third-party links to prevent phishing risks. 2.

**Enter Account Credentials** Input your unique username and multi-character password. Passwords must meet Chase’s complexity standards—mixing letters, numbers, and symbols. For enhanced security, consider enabling password managers or using Chase’s passphrase option.

3. **Complete Two-Factor Authentication** Upon entering valid credentials, the system triggers 2FA. A one-time code is sent via preferred channel—SMS, email, or the Chase Mobile Authenticator.

Enter this code promptly to proceed. 4. **Utilize Saved Devices for Faster Access** For repeat daily logins, Chase shortens the process by recognizing trusted devices, cutting sign-in time by up to 70%.

Manual re-authentication is reserved only when detecting unusual activity. 5. **Manage Active Sessions** Regularly review logged-in devices and close unused sessions.

The dashboard displays active sessions, enabling business users and IT admins to audit access in real time.

For first-time users or occasional logins, the guide emphasizes simplicity: “One tap, one verify,” reduces cognitive load while preserving security. Repeat users benefit from automatic anology on trusted devices, reinforcing a frictionless yet vigilant experience.

Troubleshooting Common Login Challenges

Even streamlined systems encounter issues.Common hurdles include forgotten passwords, 2FA notification delays, and browser compatibility problems. Chase provides clear resolution pathways: - **Forgotten Password?** Click “Forgot Password” on the login screen to reset via email or authenticator. Within minutes, access is restored without a visit to a local branch.

- **2FA Delayed or Missing Code?** Check network connectivity. Enable push notifications in app settings for near-instant verifications. Backup codes are available in the account settings for emergency access.

- **Login Frustration on Apps?** Ensure devices run the latest Chase app version. Clear cached data or reinstall the app if persistent glitches occur. Check device storage and security settings—disable passcode-protected embed features if needed.

“Our support infrastructure is built for resilience,” notes a technical support specialist. “From real-time chat branches to AI-driven diagnostic tools, users rarely face prolonged outages. Every login challenge is treated as a call to improve.”

For enterprise users managing fleet logins, Chase supports single sign-on (SSO) integrations and SSO-compatible directory services, enabling centralized identity controls for teams of up to hundreds of employees.

This scalability transforms login management from a daily chore into a controlled, auditable process.

Access Kicks Into High Gear: Organizing Financial Transactions Post-Login

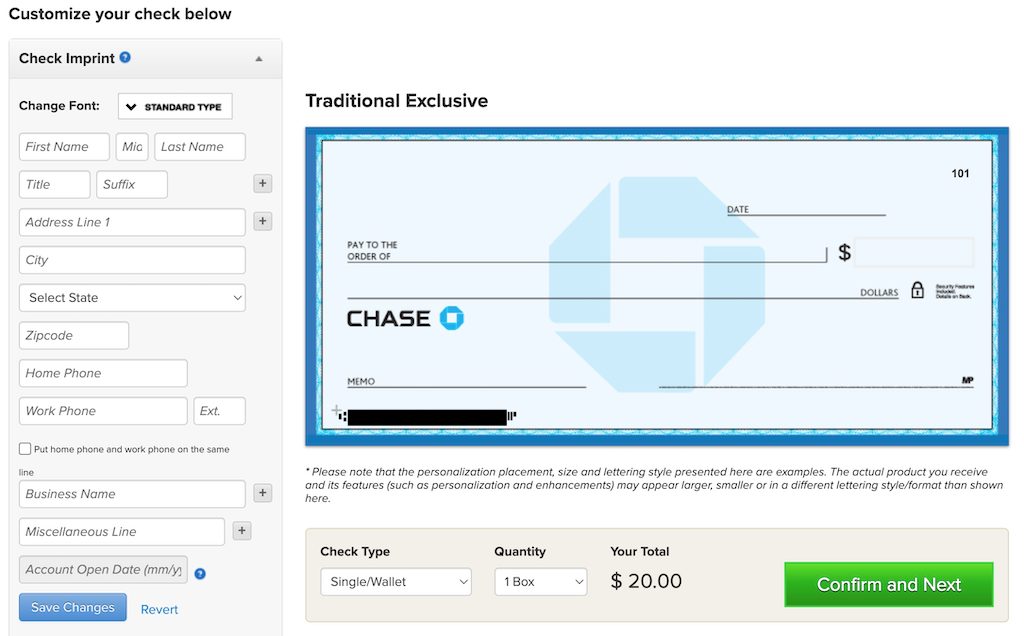

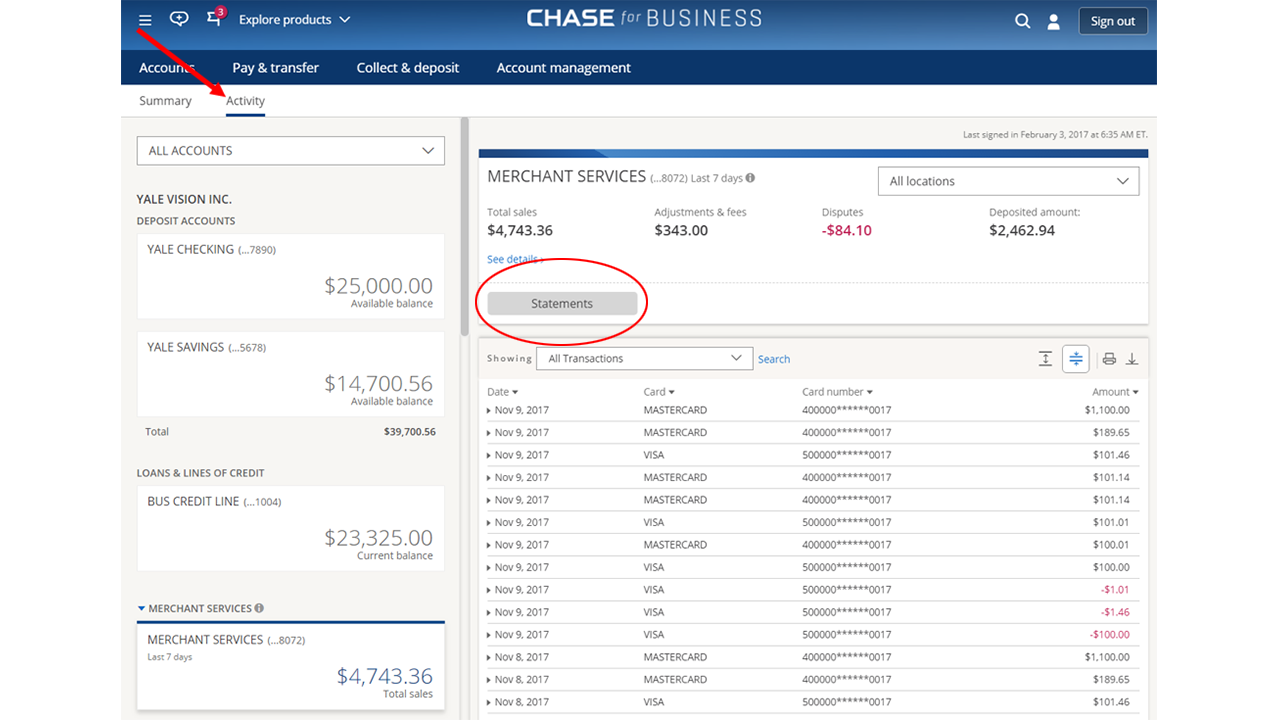

Once logged in, users enter a fully functional interface designed to accelerate daily banking tasks. Cash management, expense tracking, wire transfers, and budget analytics are all accessible with just a few clicks. The dashboard presents real-time account summaries, categorized spending insights, and transaction history, empowering users to make informed financial decisions instantly.- **Real-Time Visibility:** Monitor cash balances, pending transactions, and recent activity—all updated live—not days late. - **Actionable Reporting:** Generate custom reports on spending trends, profit margins, or departmental budgets within seconds. - **Faster Payments:** Send payments or draft checks directly from the dashboard, with auto-complete and frequent sender lists streamlining routine transfers.

This post-login efficiency directly supports business agility, turning banking from a periodic task into a dynamic component of operational execution.

“The login screen is the gateway to actionable finance,” observes a Chase business finance advisor. “By simplifying access without weakening defenses, Chase equips decision-makers to respond faster—whether managing payroll or approving vendor payments.”

Why Chase Business Banking Login Stands Out in the FinTech Landscape

In a market crowded with digital banking platforms, Chase distinguishes itself through reliability, intuitive design, and enterprise-grade security.The login process reflects this philosophy—engineered not just for speed, but for consistency across devices, secure authentication, and seamless integration with broader financial ecosystems. - **Enterprise-Ready UX:** Whether accessed from a desktop, tablet, or smartphone, the interface maintains speed and clarity. No more navigating menus—every commonly used function is a tap away.

- **Adaptive Security:** From passport-level encryption to behavioral analytics detecting anomalous logins, Chase evolves threats into proactive defenses. - **Customer Trust Built Over Decades:** As a leader in business banking since 1942, Chase’s commitment to usability is grounded in decades of feedback from millions of professionals worldwide. “Security, speed, and simplicity—these aren’t mutually exclusive goals,” says a Chase digital banking expert.

“Our Easy Sign-In Guide levels the playing field, letting businesses focus on growth, not technical hurdles.”

This balance proves critical: a login process that frustrates or delays can drive users to competitors. With ongoing updates based on real-world usage, Chase ensures its digital banking interface remains adaptable, secure, and user-focused.

The Chase Business Banking Login Easy Sign-In Guide doesn’t just show users how to log in—it redefines what reliable, smart authentication looks like in modern business finance. By merging enterprise security with seamless usability, Chase sets a new standard for digital banking access, empowering professionals to operate faster, smarter, and with greater confidence.

Related Post

Collier Landry’s Net Worth: From Rising Star to Multi-Millionaire Phenomenon

Piptv on Samsung Smart TV 2022: The Ultimate Guide to Seamless Streaming & Smart Integration

Atlético Grau vs. Universitario: Clash of Ambition and Tradition in Peruvian Elite Football

Exploring The Mystical Universe Of Bad Bunny’s Natal Chart: Cosmic Forces Behind the Global Phenomenon