Los Angeles Sales Tax: The City’s Financial Lifeline Powers Schools, Roads, and Services

Los Angeles Sales Tax: The City’s Financial Lifeline Powers Schools, Roads, and Services

Deep beneath the glitz of downtown Los Angeles, a quiet economic engine hums: the city’s sales tax. Covering nearly 11% of total annual revenue—just shy of 40 billion dollars annually—the Los Angeles County Sales Tax is far more than a consumer levy; it fuels the sprawling infrastructure and public services that shape daily life across the region. From bustling commercial districts to quiet neighborhoods, this tax underpins everything from road maintenance and public safety to education and affordable housing.

Understanding its mechanics reveals not just how Los Angeles funds its future, but also how residents bear and benefit from shared responsibility.

Understanding the Structure: How Los Angeles Sales Tax Is Organized

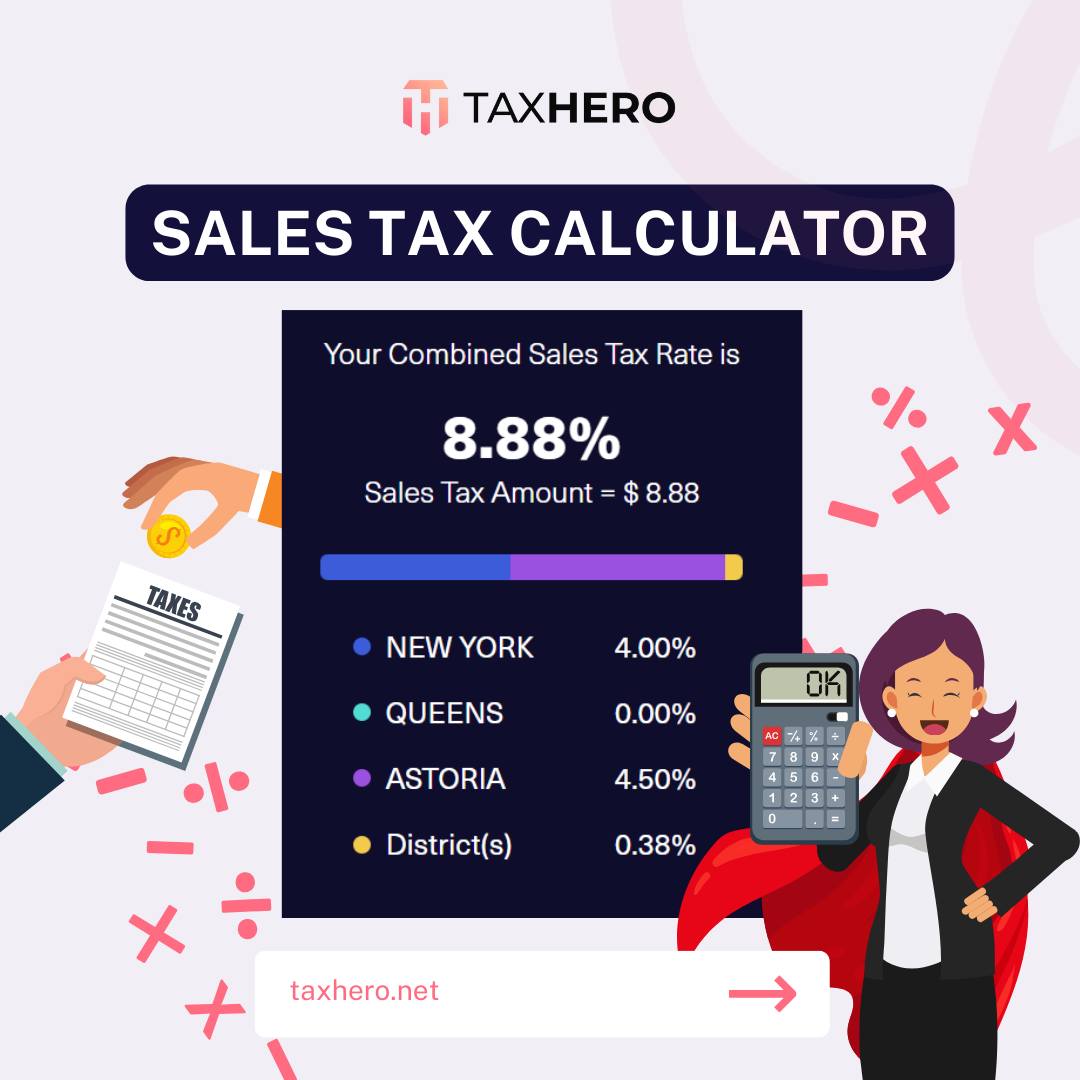

The Los Angeles sales tax operates under California’s broader system, with the state setting a base rate of 7.25%. Local jurisdictions—led by Los Angeles County and the City of Los Angeles—add a supplemental vote of 0.25%, enabling cities within the county, including LA, to boost total collections.As of 2024, the combined rate stands at 7.5%, making Los Angeles one of the highest-taxed urban centers in the nation. The revenue flows into several key funding streams, managed through entitlements and voter-approved measures. Crucially, the tax is levied only on retail sales of tangible goods and certain services, excluding most meals eaten in restaurants, hotel accommodations, and digital transactions—distinctions that significantly shape its reach and impact.

The Revenue Machine: Key Uses and Funding Streams

Los Angeles municipal leaders emphasize that sales tax revenue is channeled directly into core public services, with strict accounting enforced by the Internal Revenue Service and the California Department of Tax and Fee Administration. The largest portion—approximately 56%—flows to the California School Fund, supporting over 2,000 public schools serving more than 600,000 students across the state, including Los Angeles Unified School District, the nation’s second-largest school system. This funding enables classroom resources, transportation, and teacher salaries critical to student success.Beyond education, 14% of sales tax revenue supports local public safety agencies. The Los Angeles County Sheriff’s Department and several city police departments rely on these funds to maintain patrol operations, investigate crimes, and manage emergency response. Additionally, nearly 10% feeds into transportation infrastructure, including roads, bridges, and local transit improvements managed by Metro—essential for a city where 1.2 million vehicles commute daily.

Other allocations cover public health initiatives, community development, and environmental programs such as water conservation and emissions reduction.

Who Bears the Tax Burden? Who Really Benefits

While the tax is collected at the point of sale, its economic incidence spans a broader swath of community life.Consumers nationwide face a 7.5% sales tax on purchases—higher than most states—but in Los Angeles, the burden is tempered by exemptions and rebates targeted at vulnerable populations. For example, clothing, medical devices, and groceries are tax-exempt. Low-income households benefit indirectly through sales tax-funded programs: free school meals, subsidized housing, and job training—services that cushion financial strain.

“Sales tax is often seen as regressive, but LA’s targeted allocations help offset that,” explains Dr. Elena Martinez, an economic policy researcher at USC. “Every dollar collected doesn’t just pay for infrastructure—it pays for access to education, safety, and opportunity, especially for those least able to afford them.” This redistribution reflects a deliberate policy vision: the tax is not merely revenue generation, but a tool for equity.

The Voter Vote and Transparency: How Accountability Is Maintained

A key feature distinguishing Los Angeles’ sales tax system is the requirement for direct voter approval before new levies or rate hikes take effect. Since 1979, over 200 local ballot measures have altered the tax rate—some increasing it, others freezing it through ballot initiatives. Most recently, Measure A (2022) maintained the 7.5% rate but expanded spending commitments, particularly in affordable housing.Voter oversight ensures that any increase reflects broad public support and transparent planning. Moreover, the county’s Office of the Controller maintains public dashboards displaying monthly tax collections, expenditures, and projected budget shortfalls. This level of transparency builds trust and informs residents about how their money moves from wallet to service.

Comparing Perspectives: Sales Tax in the Global and National Context

At 7.5%, Los Angeles’ sales tax rate ranks among the highest in the United States, surpass

Related Post

Unlock Apple Savings: Student Discounts Making Waves in China’s Backed Education Tech Growth

Comcast Pay Bill One-Time Business Make-A-Ment Feature Lets Enterprises Simplify Payments with Instant Ment Grants

Derrick Henry & Lamar Jackson-Inspired Fantasy Teams: The Year’s Most Electrifying Top Lineups

Unleash Your Inner Animal: Dive Deep with the Ultimate Fursona Quiz