Medical Insurance: Mastering Revenue Cycle Processes with Strategic Insight

Medical Insurance: Mastering Revenue Cycle Processes with Strategic Insight

Navigating the complex interplay between healthcare delivery and financial sustainability hinges on a precise understanding of the medical insurance revenue cycle. For providers, insurers, and administrators alike, mastering this cycle—from claim submission to reimbursement—is no longer optional but essential to operational success. This article unpacks the core components of the medical insurance revenue cycle, highlights critical challenges, identifies best practices, and emphasizes how a structured process approach, supported by reliable educational resources like the free download “Medical Insurance: A Revenue Cycle Process Approach PDF,” can transform financial outcomes.

In a landscape marked by rising administrative burdens and evolving payer policies, optimized revenue cycle management directly enables cash flow stability, reduces denial rates, and strengthens patient care delivery. This comprehensive guide serves as a foundational reference for professionals seeking to align their operations with industry benchmarks and regulatory expectations.

The Medical Insurance Revenue Cycle: A Multifaceted Process

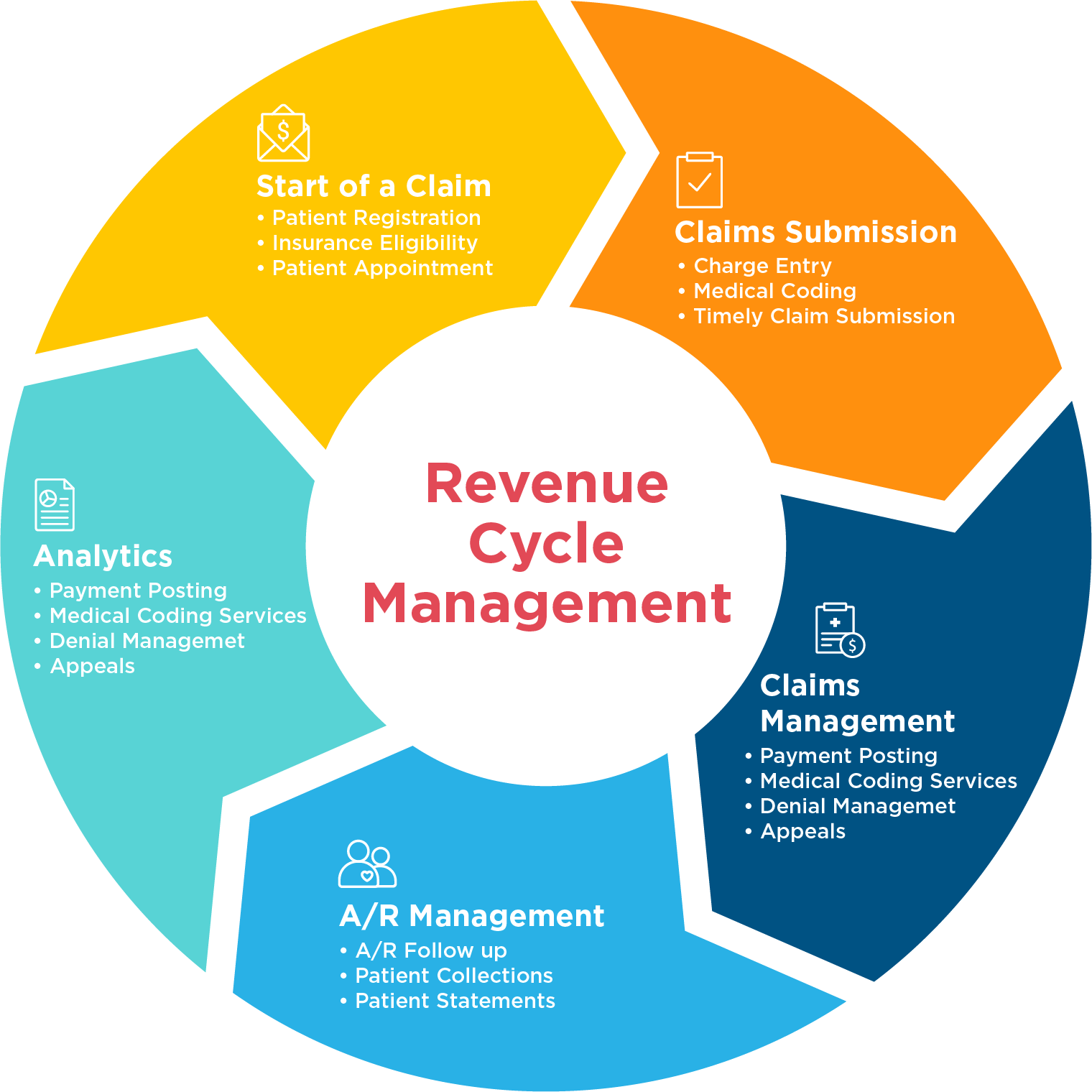

The medical insurance revenue cycle encompasses all financial and administrative activities involved in securing and collecting payment for healthcare services. It begins at the moment of patient registration and extends through claim adjudication, payment posting, follow-up on denied claims, and final financial reconciliation.

Unlike a linear sequence, this cycle is dynamic and interconnected—each phase influences downstream results. As noted in the free PDF on medical insurance revenue cycles, “Every touchpoint impacts revenue integrity, making process precision non-negotiable.”

Core stages include: - **Eligibility Verification and Pre-Registration:** Confirming patient insurance coverage before service delivery to avoid claim rejection. - **Claim Preparation and Submission:** Accurately coding diagnoses (ICD-10), procedures (CPT), and clinical documentation to meet payer requirements.

- **Adjudication and Payment Processing:** Insurers evaluating claims to determine payment eligibility, which may involve medicaid.gov-level scrutiny or private payer rules. - **Denial Management and Appeals:** Addressing rejected claims through data correction, documentation requests, or formal dispute processes. - **Reporting and Financial Reconciliation:** Monitoring key performance indicators (KPIs) such as days in accounts receivable (DAR) and denial rates to inform strategic decisions.

Each step demands precision, compliance, and coordination—especially amid shifting regulations from CMS, CMS-MEDICARE.gov, and commercial payers.

Critical Challenges in Modern Revenue Cycle Management

The operational environment for medical insurance revenue has grown markedly more complex. Providers face systemic challenges that erode margins and slow liquidity.

- **Persistent Denial Rates:** Industry benchmarks report denial rates averaging 10–15%, with administrative errors—such as coding inaccuracies or missing documentation—leading the list. - **Frequent Payer Policy Changes:** Commercial and government payers continuously revise contracts, reimbursement rates, and prior authorization rules, requiring real-time adaptation. - **Technology Fragmentation:** Multiple billing platforms, EHRs, and payer portals often operate in silos, increasing manual work and error risk.

- **Labor Shortages and Skill Gaps:** Revenue cycle specialists remain in short supply, amplifying workload and stress on teams. These pressures compound under tight reimbursement margins, making process optimization a financial imperative. As margins narrow—especially for small and mid-sized practices—efficiency gains directly translate to survival and sustainability.

Best Practices for Optimizing Revenue Cycle Performance

To counter these challenges, healthcare organizations are adopting process-driven redesigns anchored in operational excellence. Key strategies include: - **Early and Continuous Eligibility Confirmation:** Validating insurance status at point-of-care prevents late or rejected claims. Leveraging real-time eligibility tools reduces costly follow-ups.

- **Standardized, Compliant Documentation:** Strict coding adherence using ICD-10, CPT, and HCPCS standards reduces denials. Automated clinical documentation improvement (CDI) tools support accurate coding. - **Integrated Revenue Cycle Systems:** Cloud-based platforms unify claims management, payment posting, and reporting, enabling real-time visibility and faster resolution of issues.

- **Proactive Denial Monitoring:** Implementing dashboards to track denial trends, root-cause analysis, and trend-driven interventions accelerates recovery. - **Patient Engagement Initiatives:** Clear pre-service communication on out-of-pocket costs and insurance responsibility improves collections and satisfaction. “The most successful cycles treat revenue as a managed process, not an afterthought,” states a lead expert in practice management.

“Integration, automation, and data-driven oversight create a resilient revenue engine.” Available resources like the free PDF “Medical Insurance: A Revenue Cycle Process Approach” offer detailed templates, workflow diagrams, and case studies illustrating how leading facilities have reduced denial ratios by 20–30% through systematic upgrades.

The Opening of Access: Free PDF Download as a Strategic Asset

For professionals seeking to build internal expertise or train teams, the free PDF titled “Medical Insurance: A Revenue Cycle Process Approach” serves as an essential operational toolkit. This comprehensive resource outlines end-to-end revenue cycle frameworks, grounded in real-world implementation成功案例, regulatory compliance, and current payer expectations.

Available for immediate download through verified medical administration repositories, the PDF synthesizes decades of industry data into actionable guidance—covering everything from credentialing to final cash application. “This is more than a guide—it’s a roadmap,” notes one administrator from a large health system. “It translates abstract processes into practical steps, helping teams align daily tasks with strategic financial goals.” Paired with practice-specific training modules, the PDF becomes a force multiplier for staff competence and process consistency.

Real-World Impact: Success Metrics from Process-Driven Practices

Organizations embracing a structured revenue cycle approach report tangible improvements. For example, a regional hospital network reduced DAR from 38% to 18% within 12 months by standardizing coding workflows and deploying denial analytics. Similarly, a primary care chain achieved a 250 million annual rebate by shortening claims turnaround to under 14 days—directly boosting liquidity.

“This isn’t magic—it’s method,”> says a revenue cycle director. “When every claim follows a proven path, and every team understands their role, revenue flows more predictably—supporting better care, not just better books.”These metrics underscore that the revenue cycle, when managed with precision and continuity, transforms financial risk into sustainable resilience across healthcare institutions.

In summary, medical insurance revenue cycle management is a high-stakes, high-reward domain where process mastery equates to financial longevity.

Through strategic adoption of integrated tools, proactive denial management, and continuous training informed by resources like “Medical Insurance: A Revenue Cycle Process Approach,” providers can turn administrative hurdles into competitive advantages. The future of healthcare revenue hinges not on chance, but on disciplined execution—one that this free, downloadable guide helps operationalize with clarity and confidence.

Related Post

Kash Patel: The Global Voice Redefining Digital Fitness and Health Technology

Iwisdom Capital: Redefining Switch Trading with a Debut Platform That Blends Power and Precision

Decoding the Power of 2No O₂ → 2NO₂: The Fundamental Chemistry Behind a Critical Atmospheric Transformation

Wendy’s Debuts Bold New Drink Line: Refreshment Redefined