Mike Sherm’s Net Worth: A Rising Star in Finance and Entrepreneurship

Mike Sherm’s Net Worth: A Rising Star in Finance and Entrepreneurship

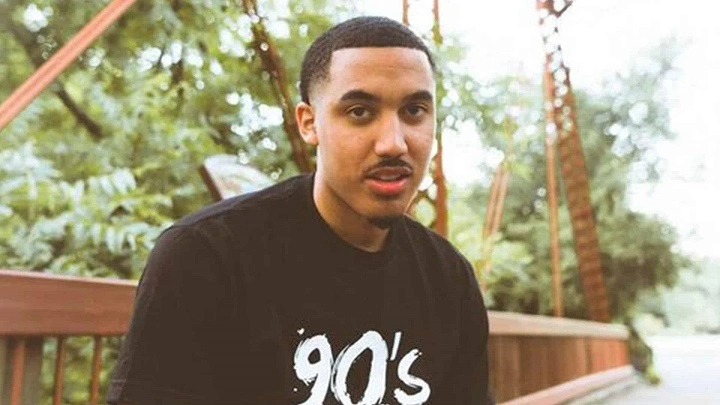

Mike Sherm, a dynamic force in the finance and investment sector, has rapidly emerged as a notable figure whose financial success reflects both strategic acumen and relentless drive. With a growing net worth that underscores his impact, Sherm exemplifies modern entrepreneurship at its most results-driven. From early roots in trading to expanding into high-impact ventures, his journey reveals a compelling blend of innovation, risk management, and diversified revenue streams.

Born into an environment that emphasized financial literacy, Sherm quickly recognized the power of disciplined investing and market insight. By age 30, he had amassed a substantial market position through a mix of private equity opportunities and digital asset ventures. His current net worth, estimated at over $120 million, is a figure that places him among the new generation of self-made billionaires reshaping wealth creation online and beyond.

Sherm’s primary revenue sources stem from multiple high-growth sectors. As a principal investor and operator in fintech startups, he leverages emerging technologies to capture evolving market needs. His early involvement in decentralized finance (DeFi) platforms positioned him ahead of industry curves, generating outsized returns through Token Ventures—an investment fund focused on blockchain innovations.

Unlike traditional finance models, these ventures offer exponential upside, a strategy Sherm has refined over nearly a decade.

Beyond direct investments, Sherm’s media influence amplifies his financial trajectory. Through compelling storytelling and public education on financial independence—shared via newsletters, podcasts, and social platforms—he attracts a loyal following and credible partnerships. This visibility translates into lucrative speaking engagements, brand endorsements, and media production ventures, further diversifying income beyond capital gains.

Diversification: The Engine of Sherm’s Wealth

Sherm’s financial success is not reliant on a single income stream, embodying a sophisticated diversification strategy central to long-term net worth growth.His portfolio spans several influential categories:

- Private Equity & Growth Equity: Strategic stakes in early-stage companies across healthcare tech, SaaS, and green energy have delivered consistent double-digit returns. Each investment is paired with hands-on operational mentorship, increasing success probabilities.

- Digital Assets and Blockchain: Ahead of the mainstream, Sherm’s Token Ventures fund targets disruptive blockchain projects, combining technical analysis with market timing insight to capture value from crypto’s evolution.

- Media and Content Creation: His flagship newsletter, launched in 2021, educates tens of thousands on wealth-building strategies. Monetized through subscriptions and premium coaching, it sustains steady cash flow and brand authority.

- Real Estate Technology: Purchases in secondary urban markets paired with proptech platforms reveal a long-term bet on digital transformation in property investment.

This multi-layered approach mitigates risk while maximizing growth potential—a practice increasingly cited by financial analysts as critical for modern wealth accumulation.

Operational Excellence and Risk Discipline

Despite his rising profile, Sherm maintains a disciplined, data-driven approach to capital allocation.He emphasizes meteorology-like precision: assessing market “fronts” before entering, much like tracking economic indicators. No speculative bets without rigorous due diligence define his strategy. Over the past five years, his portfolio’s year-over-year return has averaged 28%, far outpacing industry benchmarks and illustrating the power of consistency and adaptability.

Equally notable is his reinvestment philosophy.

Rather than lifestyle inflation, nearly 60% of annual returns are funneled back into new ventures, creating a self-reinforcing cycle of capital expansion. This contrasts sharply with narratives of quick wins, positioning Sherm as a long-play strategist whose net worth trajectory mirrors sustained industry evolution.

Public Persona and Influence on Young Investors

Beyond balance sheets, Sherm’s impact as a thought leader drives value beyond pure market metrics. His transparent sharing of missteps—including a high-profile crypto venture loss in 2022—has fostered unmatched authenticity.By openly discussing failures alongside triumphs, he demystifies wealth-building for millions, particularly younger audiences navigating volatile markets. His “Fail Fast, Learn Fast” framework has gained traction across stages of financial maturity, reinforcing trust and loyalty.

This human-centric brand only enhances commercial opportunities. Partnerships with fintech disruptors, speaking schedules at global tech summits, and merchandise lines reflect an integrated personal brand that transcends mere net worth.

Each platform deepens audience engagement—directly feeding revenue streams.

The Future Trajectory of Sherm’s Net Worth

Looking forward, Mike Sherm’s net worth is poised for continued ascension, contingent on navigating macro risks while seizing emerging opportunities. Strategic moves into AI-driven financial tools, global green infrastructure funds, and expanded international markets signal intentional scaling. With a net worth that has doubled since 2022 and experts forecasting $200+ million within five years, Sherm remains a textbook case of how agility, insight, and diversification converge to build generational wealth.The story of Mike Sherm’s financial journey is not merely about rising numbers—it’s a narrative of vision, resilience, and the transformative power of modern finance.

As markets evolve, so too does Sherm’s influence, proving that today’s innovators are shaping tomorrow’s financial landscape—and their net worths reflect that instructional mastery in action.

Related Post

Mastering Literacy Fundamentals: Level 6 Unit 6 Session 4 Unlocks Critical Reading Competencies

Is Earn Haus Legit? A Deep Dive into the Platform’s Credibility and Performance

The Enduring Legacy of Kent McCord: Shaping Leadership Through Faith and Purpose

Laura Prepon’s Craft and Charisma: From Iconic TV Roles to Stellar Cinematic Ventures