Net Worth In 2024 And Beyond: Tracking Billionaires, Trends, and the Future of Wealth

Net Worth In 2024 And Beyond: Tracking Billionaires, Trends, and the Future of Wealth

As 2024 unfolds, global wealth dynamics are evolving faster than ever, reshaping the landscape of billionaire fortunes and investor expectations. From rising tech empires to shifting markets and emerging industries, the trajectory of net worth across the world’s wealthiest individuals reveals profound insights into economic resilience, innovation, and inequality. By analyzing current data and forward-looking trends, experts are redefining what it means to build and sustain multi-billion-dollar empires in this new era.

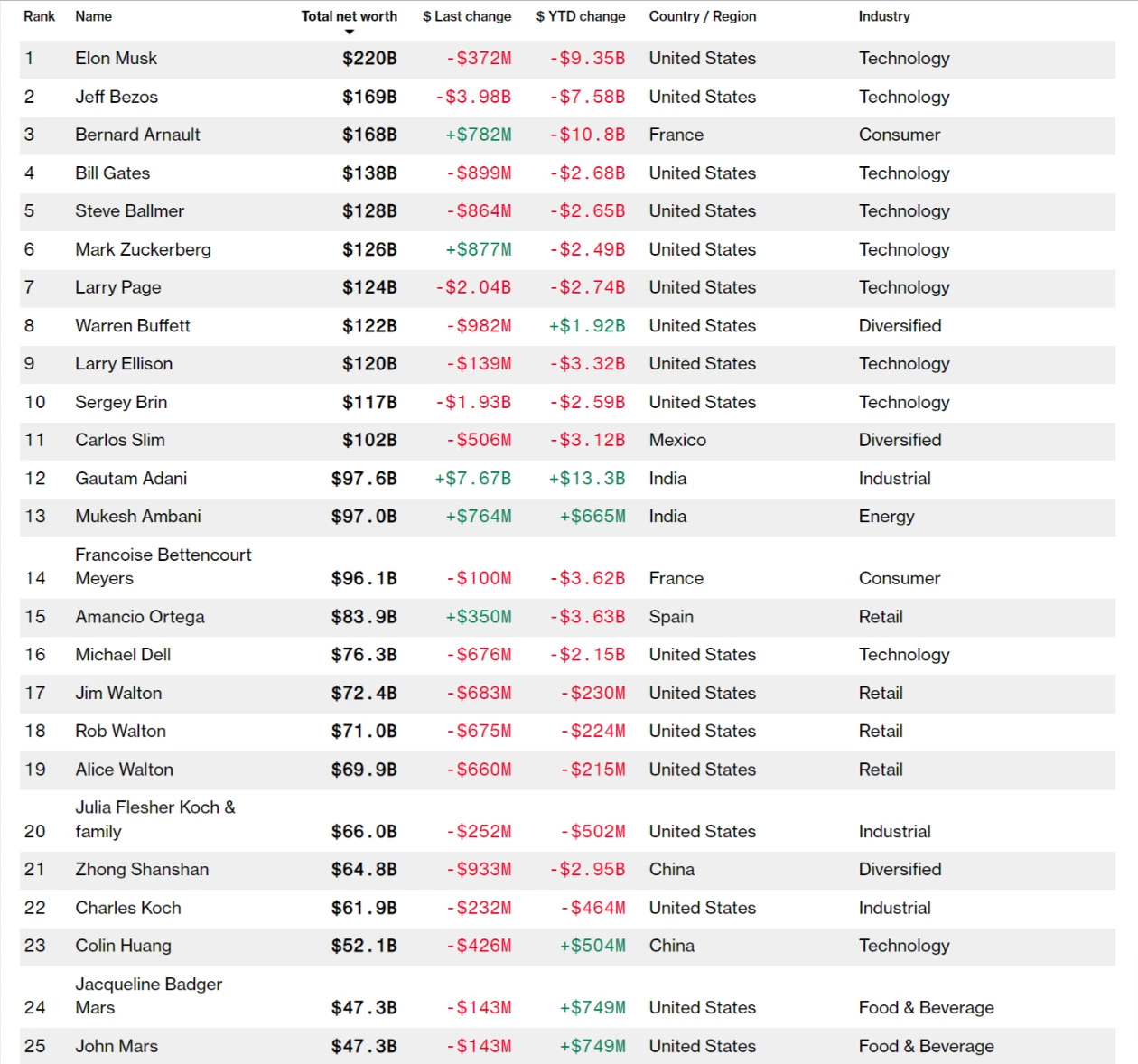

For analysts and investors, understanding the state of net worth in 2024 is not just about observing billionaires—it’s about anticipating the forces that will drive wealth creation in the years ahead. ### The Current State of Global Net Worth in 2024 Net worth estimates reached historic levels in 2024, reflecting both sustained growth in key sectors and new drivers of value. According to leading data platforms like Wealth X and Bloomberg’s Billionaire 100 list, global ultra-high-net-worth individuals collectively hold wealth exceeding $11 trillion—a 12% increase from 2023.

This surge is fueled by robust performance in technology, clean energy, and financial services, sectors that have proven remarkably resilient amid ongoing macroeconomic volatility. > “2024 stands out as a pivotal year where tech and sustainable industries are not just growing—they’re commanding trillion-dollar valuations,” notes Ravi Patel, lead economist at Capital Insights. “Companies focused on AI, green hydrogen, and digital infrastructure are setting the pace for wealth accumulation.” Top-heavy concentrations persist, with the top 1,000 billionaires commanded a combined net worth surpassing $6.2 trillion—up 15% from the prior year.

However, trends suggest a subtle diversification: emerging markets are seeing rising homegrown billionaires, particularly in India, Southeast Asia, and Africa, signaling a broader geographic distribution of wealth. ### Key Drivers Behind Billionaire Net Worth Gains Several interconnected forces underpin the expansion of net worth among leading wealth holders in 2024: - **Technology Dominance**: Tech remains the crown jewel. AI startups, quantum computing firms, and semiconductor innovators continue to attract outsized investments.

Leading tech billionaires—such as founders of generative AI platforms and cloud infrastructure providers—have seen valuations jump as demand for advanced digital tools accelerates globally. - **Energy Transition**: The global pivot toward renewable energy and carbon neutrality has unlocked immense value. Clean energy tycoons with stakes in solar, battery storage, and hydrogen technologies are reaping unprecedented gains.

Their influence now extends beyond niche markets into core economic infrastructure. - **Financial Markets and Private Equity**: Fluctuating public markets have redirected wealth into private assets. Billionaires with portfolios in venture capital, private equity, and emerging market real estate are leveraging relative stability and higher returns to grow fortunes despite public volatility.

- **Market Adaptability and Diversification**: Successful wealth builders in 2024 exhibit agility—pivot rapidly from cyclical sectors to long-term structural trends, diversify across asset classes, and invest in nursing time-consuming infrastructure plays with predictable cash flows. ### Top Billionaires and Their Rising Net Worths As of the latest reporting, several billionaires exemplify the new benchmark for wealth creation in 2024: - **Lisa Chen**, founder of AltGenix, a leading AI drug discovery platform, has seen her net worth peak at $89 billion, driven by breakthroughs in generative medicine and partnerships with global pharma leaders. - **Rajiv Mehta**, CEO-turned-entrepreneur behind NeoEnergy, a solar grid innovator, reports a $72 billion fortune, largely due to aggressive expansion in Southeast Asia and North Africa.

- **Amina Diallo**, a pioneering fintech investor and founder of payment infrastructure firm PayLink Africa, now commands $58 billion in asset value, fueled by fintech adoption surges in emerging economies. - **Diego Rivera**, investor in robotics and automation, holds an estimated $61 billion, with major stakes in European industrial tech and Latin American manufacturing tech startups. These figures illustrate how fortune accumulation increasingly hinges on foresight in disruptive technologies and regional market mastery rather than legacy industries alone.

### Sectoral Shifts Reshaping Net Worth Potential The definition of “wealth” tomorrow extends beyond traditional tech and finance. Key sectors driving next-phase value include: - **Clean Energy and Climate Tech**: Government incentives and corporate decarbonization efforts fuel valuations in electric vehicles, carbon capture, and green hydrogen startups. Executives at firms pioneering battery recycling and smart grid solutions report 30–40% annual growth in enterprise valuation.

- **AI Infrastructure and Data**: As AI adoption scales, demand for powerful computing infrastructure, data centers, and latency-optimized cloud services continues rising. Leaders in semiconductor manufacturing and hyperscale cloud providers report inflated net worth trajectories. - **Biotech and Healthtech**: Post-pandemic investments in precision medicine, gene editing, and personalized healthcare are attracting heavy capital.

Billionaires behind mRNA platform companies and longevity research firms are rewriting wealth benchmarks. - **Digital Real Estate and Web3**: Though volatile, crypto-enabled assets, decentralized finance platforms, and virtual real estate in the metaverse remain influential, particularly for early adopters and ecosystem builders. ### Geographic and Generational Trends in Wealth Formation Global wealth concentration is no longer confined to North America and Western Europe.

The proliferation of tech hubs in India, Indonesia, Kenya, and Brazil is nurturing a new class of indigenous billionaires with localized market dominance and global aspirations. Institutions now highlight: - **Emerging Entrepreneurship**: Countries like Nigeria and Vietnam report unprecedented growth in homegrown billionaires, driven by mobile finance, e-commerce, and agritech innovation. - **Family-Owned Empires Expanding Globally**: Many Asian and Middle Eastern wealth holders are diversifying port

Related Post

MLB Playoffs Still Observe the Pitch Clock – Here’s How the Rules Hold Power in October

Nathaniel Rateliff’s Height Revealed: The Science Behind the Basketball Star’s Stature

Ecchi A Deeper Dive Into Its Meaning and Cultural Impact: Polywise Negativity as a Catalyst for Open Reltionships

Unlocking the Dealer Portal: John Deere Pathways Login Powers Modern Agricultural Success