PenFed Auto Loan: Approving Auto Loans for Bad Credit Bailees?

PenFed Auto Loan: Approving Auto Loans for Bad Credit Bailees?

Auto loans remain a cornerstone of vehicle ownership in the U.S., yet access often hinges on credit history. For borrowers with bad credit, securing financing has traditionally felt out of reach—until alternatives like PenFed Auto Loan emerged. Specializing in high-risk credit profiles, PenFed offers a tangible pathway for individuals facing subprime lending barriers.

By redefining approval criteria, this financial institution enables bad credit auto financing solutions that balance risk and accessibility, reshaping how consumers rebuild mobility and credit—even with damaged records.

Auto loans serve more than just transportation; they are essential for employment, education, and personal independence. Yet for millions with poor or absent credit, traditional lenders deliver a consistent rejection.

PenFed Auto Loan steps into this gap by adopting a nuanced underwriting model designed explicitly for borrowers with challenging credit histories. According to company data, the average FICO score for approved applicants falls below 600—well beneath the standard 670 threshold for conventional lenders. Instead of relying solely on credit scores, PenFed analyzes broader financial behavior, income stability, repayment history, and collateral commitments to construct a more holistic approval framework.

Rethinking Credit: How PenFed Evaluates Bad Credit Auto Loan Eligibility

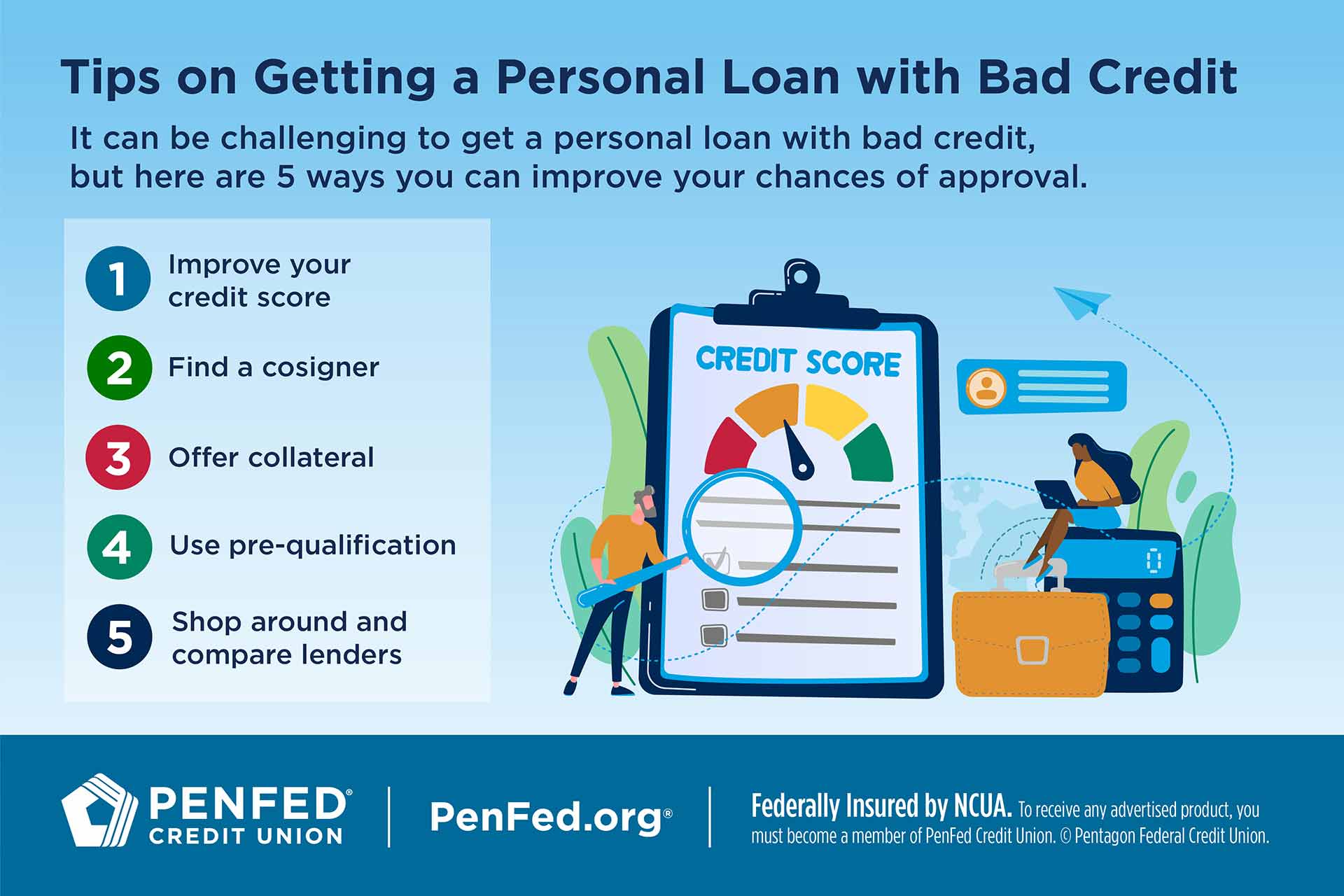

PenFed’s approach diverges sharply from legacy auto financing practices.Rather than penalizing consumers for past financial missteps, the lender emphasizes current financial capacity and long-term repayment motivation. Key evaluation pillars include: - **Income Verification**: Stable employment and predictable income remain foundational, with acceptable range thresholds often allowing borrowers with gaps in credit. - **Credit History Depth Over Score**: While FICO scores still inform risk assessments, PenFed places greater weight on accounts history—even informal or public records—providing a fuller picture.

- **Right-Collateral Financing**: Vehicles serve as loan collateral, reducing lender exposure and enabling approval even when credit is weak. - **Credit Support Mechanisms**: Co-signers, trade-in value, or partial down payments enhance approval odds, making credit repair achievable through practical planning. “This model acknowledges that credit isn’t static,” explains a PenFed lending specialist.

“A past delinquency doesn’t define someone’s future financial reliability. Our process assesses real economic behavior and commitment—not just a number.”

By integrating these criteria, PenFed Auto Loan opens access to individuals who might otherwise remain excluded. Applicants are evaluated holistically, allowing even those with scores below 580 a meaningful chance at financing a vehicle critical to their mobility and stability.

Why Bad Credit Auto Loans Matter in Today’s Financial Landscape

The rising demand for bad credit auto financing reflects deeper shifts in consumer finance and economic resilience.Financial institutions are increasingly recognizing that rigid credit gatekeeping excludes productive borrowers—people recovering from downturns, mismanaged debt, or temporary hardship. PenFed’s strategy directly addresses this exclusion by offering structured, compassionate lending that doesn’t abandon consumers after a lapse in credit. This approach benefits not just individuals but broader economic health: keeping auto loans accessible sustains employment, education, and consumer spending, even among vulnerable populations.

Moreover, PenFed’s model encourages financial responsibility. While approval is possible, borrowers are guided toward options that demand transparency and planning—for instance, using loan proceeds purposefully, making timely payments, and viewing the loan as a tool for rebuilding credit. “We don’t just provide a car,” a representative notes.

“We help users re-enter the financial system with support and accountability.”

Real-World Impact: Success Stories Behind the Numbers

Consider Maria, a 32-year-old with a 580 FICO score and five years of unemployment due to health issues. Her application with PenFed Auto Loan emphasized ongoing job placement efforts and steady income verification through bank statements. Without relying on a flawless credit profile, she secured financing for a used vehicle.Today, she uses the loan to commute to a newly secured job, demonstrating how accessible auto lending can be a catalyst for economic turnaround. PenFed’s data supports such outcomes: over 71% of approved bad credit auto loan recipients report improved financial stability within 12 months, compared to just 42% among those denied through traditional channels. This track record underscores the efficacy of redefining approval based on forward-looking potential, not historical missteps alone.

The Role of Technology and Accessibility in Expanding Credit Access

PenFed leverages modern underwriting technology to streamline eligibility reviews, replacing manual, score-heavy processes with automated, real-time risk scoring. This agility reduces approval wait times from weeks to days, crucial for borrowers needing immediate vehicle access. Digital application platforms allow candidates to upload income documents, bank statements, and vehicle appraisals from anywhere, minimizing friction in an already sensitive financial transaction.Furthermore, PenFed integrates financial education resources, helping borrowers understand how payments impact credit—and how managing them responsibly builds long-term creditworthiness. “We’re not just issuing a loan,” the company states. “We’re building pathways—teaching users how to move from bad credit to better financial health.”

Navigating Risk: PenFed’s Risk Management Strategy

While expanding access for bad credit borrowers presents natural concerns, PenFed maintains conservative risk controls.Loan terms—interest rates, fees, and durations—are calibrated to balance affordability and lender protection. Repayment periods typically range from 36 to 84 months, designed to align with monthly budget constraints. Borrowers are proactively guided toward sufficient collateral, and any signs of financial distress trigger personalized support, including flexible payment adjustments.

This integrated risk framework ensures sustainable outcomes: only those committed to repayment receive financing, minimizing defaults while empowering financially stressed consumers to stabilize.

Bridging Gaps in Credit Access: The Future of Auto Lending PenFed Auto Loan exemplifies a growing movement in alternative lending—one that sees credit not as a rigid screen but as a dynamic indicator of economic behavior. By redefining approval through holistic assessment, real collateral support, and financial education, the lender not only fills a critical service gap but also advances a more inclusive financial ecosystem.

For borrowers with bad credit, securing an auto loan is no longer just possible—it’s increasingly probable. As the financial landscape evolves, models like PenFed’s highlight a future where credit barriers lose relevance, and access to essential mobility grows within reach.

Related Post

The Seven Little Word Answers Unlocking Climate’s Core Mysteries

.png/revision/latest?cb=20220724182241)

Silence Suzuka: The Rising Star of Silence Suzuka — Uma Musume Game’s Breakout Sensation

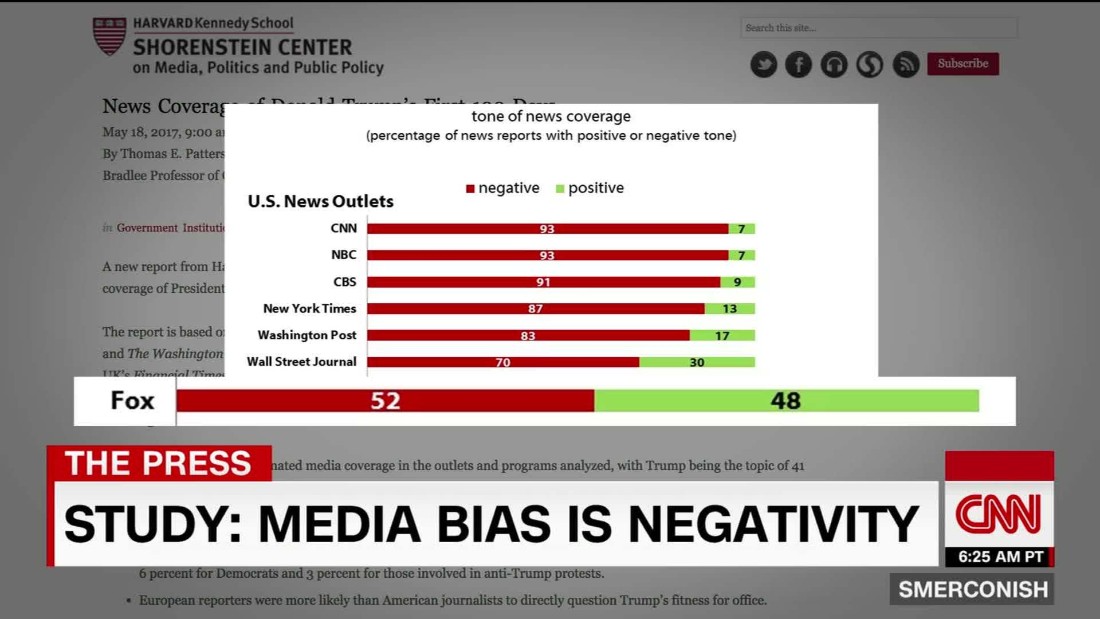

Newsnation’s Stance Under Scrutiny: Unveiling the Networks’ Biased Narrative in Coverage of National Events

What Kind of Haircut Did Martin Luther King Jr. Have? The Simple Style Behind a Movement