Powering Smart Decisions: The Geometric Average Formula in Data Analysis

Powering Smart Decisions: The Geometric Average Formula in Data Analysis

When it comes to making sense of fluctuating data—whether in finance, averaging investment returns or project performance—the geometric average emerges as an indispensable tool. Unlike the arithmetic mean, which treats all values equally, the geometric average accounts for compounded growth, offering a more accurate reflection of exponential trends. Central to this power is a simple yet profound formula: if growth rates are expressed as multipliers, their geometric mean provides a fair measure of long-term performance.

This article unpacks the mechanics, applications, and precision of the geometric average formula across disciplines, illustrating how it shapes sound decision-making in uncertain environments.

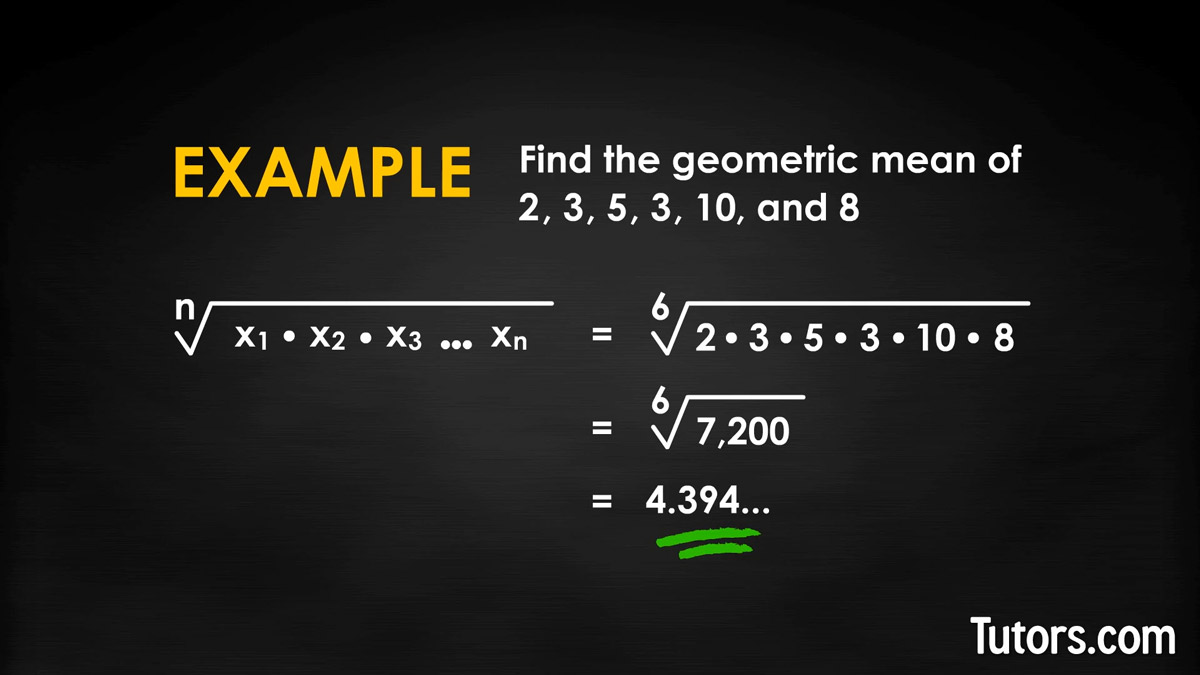

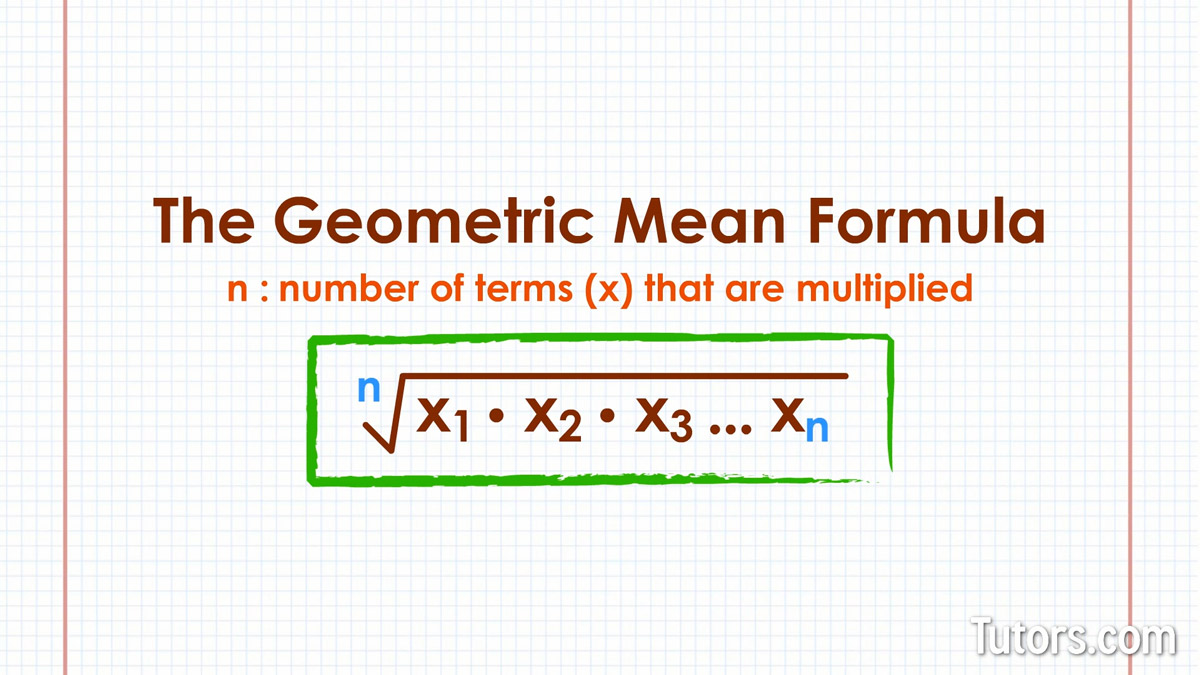

The geometric average is not merely a mathematical representation—it’s a cornerstone of quantitative analysis. Defined mathematically, it is the nth root of the product of n positive values. For a set of values \( x_1, x_2, \ldots, x_n \), the formula is: \[ G = \left( \prod_{i=1}^{n} x_i \right)^{1/n} \] where the product runs across all data points and the nth root ensures proportional balance.

This calculation inherently dampens the influence of extreme outliers, making it especially valuable in financial forecasting, risk assessment, and long-term performance evaluation. Where arithmetic averages inflate averages through progressive scaling, geometric averages respect the multiplicative nature of growth, decay, or compound returns.

The Core Mechanics: Why Geometric Average Matters

At its core, the geometric average reflects how values compound over time. Consider annual investment returns: a 10% gain followed by a 10% loss isn’t neutral—returns are multiplicative, not additive.

A 10% return multiplies value by 1.10, while a 10% drop multiplies by 0.90. The geometric average accurately captures this fluctuation by analyzing the product of gains and losses, revealing the true median growth rate beneath the surface.

Formally, given a sequence of positive numbers \( x_1, x_2, \ldots, x_n \), the geometric mean is: \[ G = \sqrt[n]{x_1 \cdot x_2 \cdot \ldots \cdot x_n} \] This formulation preserves the logarithmic relationship between values: taking logarithms converts multiplication into addition, enabling statistical handling of skewed data. Exponentiation then restores the original scale, ensuring meaningful, interpretable results.

The formula’s elegance lies in its simplicity and adaptability—from quarterly earnings to exponential decay in radioactive materials.

Applications: From Finance to Science

The geometric average finds profound utility across disciplines, most notably in finance, economics, and scientific measurement. In portfolio management, it is the gold standard for calculating average annual returns. Unlike arithmetic averages—such as averaging 2%, 8%, -10%, and 10% returns (which yields an arithmetic mean of 0% but zero real value)—the geometric average returns approximately 3.25%, reflecting the lost purchasing power of volatility.

Investors and analysts rely on this metric to evaluate real risk-adjusted performance over time.

Beyond finance, the geometric average guides data averaging in environments with exponential dynamics. Climate scientists use it to compute long-term temperature anomalies, recognizing that small, consistent shifts compound into measurable trends. Epidemiologists assess disease progression rates using geometric means to reflect multiplicative infection spread, avoiding misleading arithmetic summaries.

Innovations in technology and healthcare similarly depend on geometric averaging to interpret growth curves, battery life cycles, and drug response trajectories.

Real-world application demands precision. For example, a company ranking quarterly revenues must apply geometric averaging rather than arithmetic to capture compounding patterns. When projecting revenue over multiple periods, assuming arithmetic average growth leads to overestimation, potentially distorting planning and investment.

The geometric average, by

Related Post

APAQILLA SHAARIA VILLAGE: Your Dream Home Awaits in Fulfilling Possibility

Top Cheap Strikers FM23: Score Big On A Budget

Atl Security Wait Times: The Hidden Delay Undermining Public Safety

Watch-Serieshd: Revolutionizing How We Experience Global Television on Demand