Revolutionize Your Finances: How the Capital One Mobile App Redefines Banking on the Go

Revolutionize Your Finances: How the Capital One Mobile App Redefines Banking on the Go

The Capital One Mobile App stands as a powerful force in modern finance, transforming how users manage their money, track spending, and access financial tools—all from a smartphone. More than a digital wallet, it is a comprehensive financial companion that combines intuitive design with robust functionality. Whether controlling budgets, monitoring accounts in real time, or applying for credit instantly, the app empowers users to take full ownership of their financial journey, making smart money moves easier than ever before.

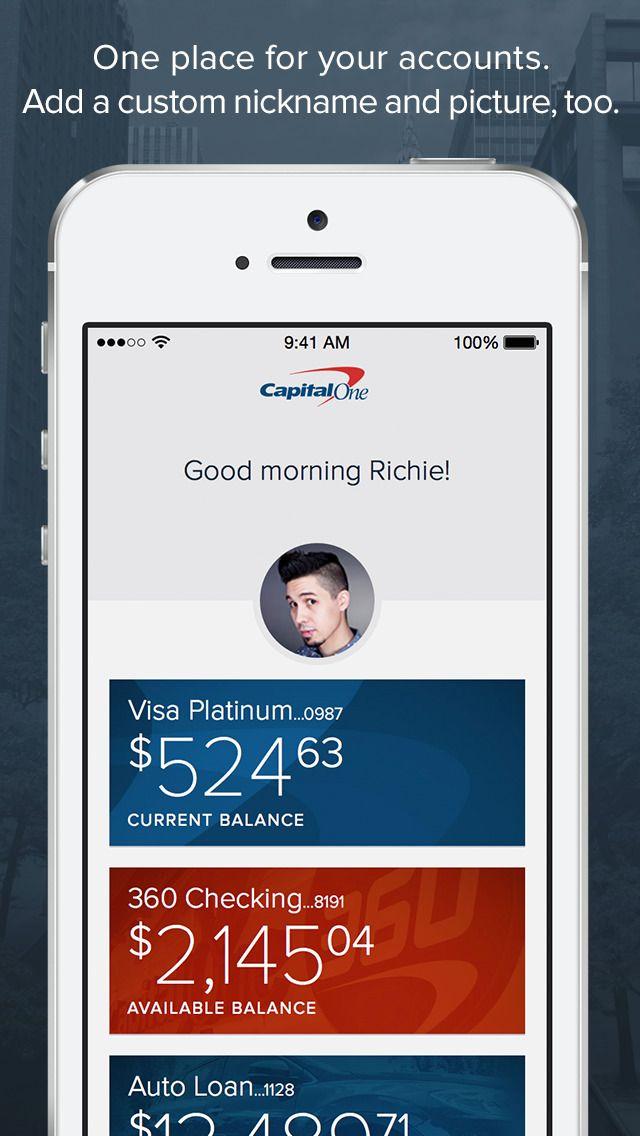

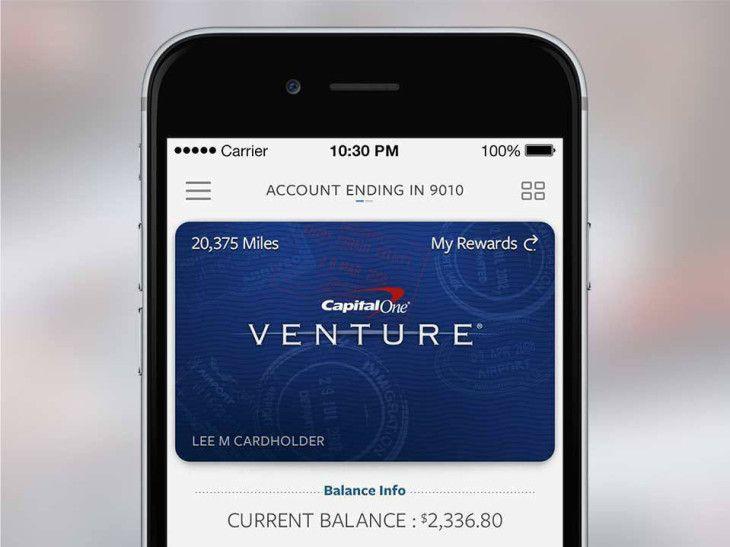

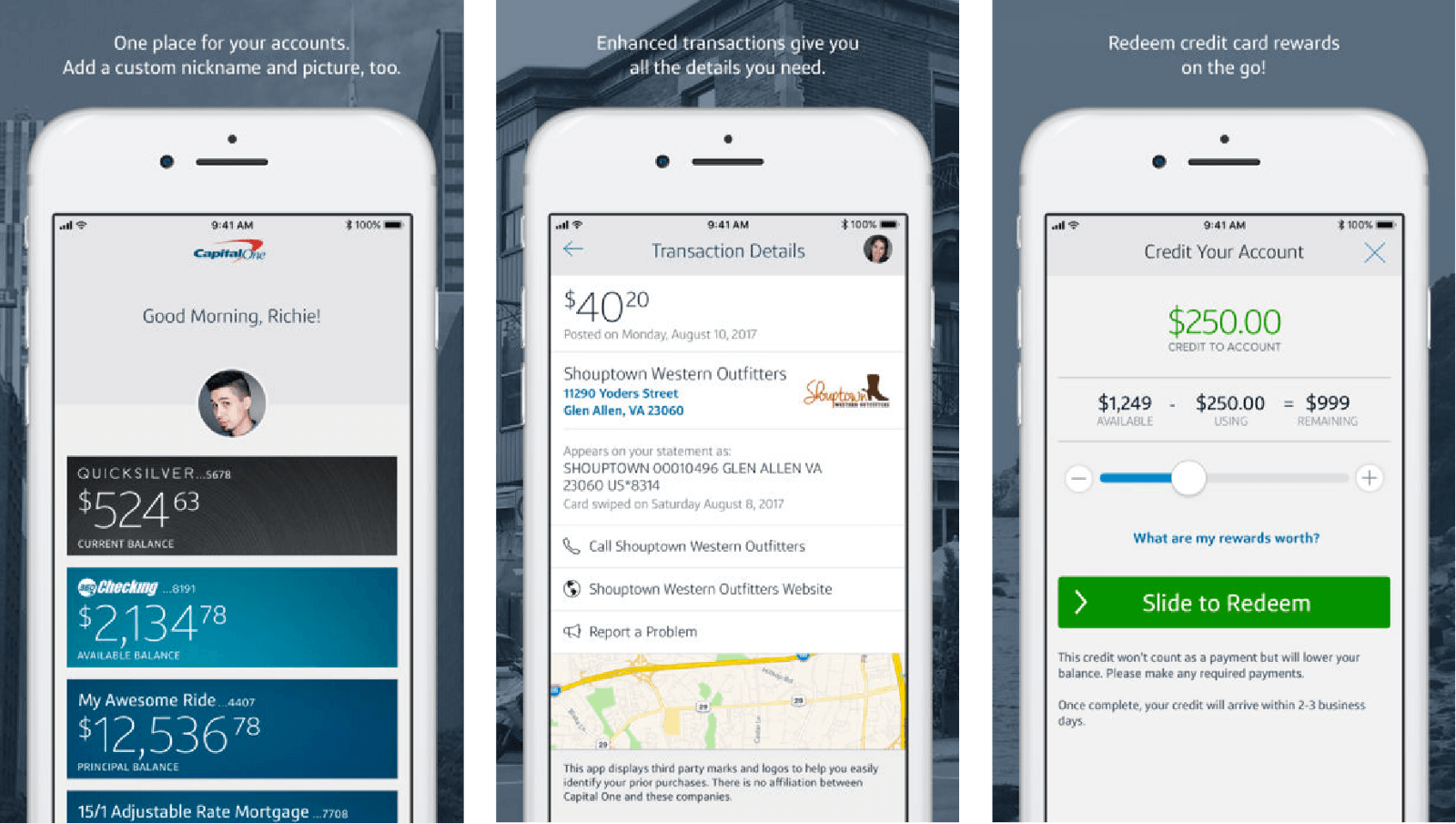

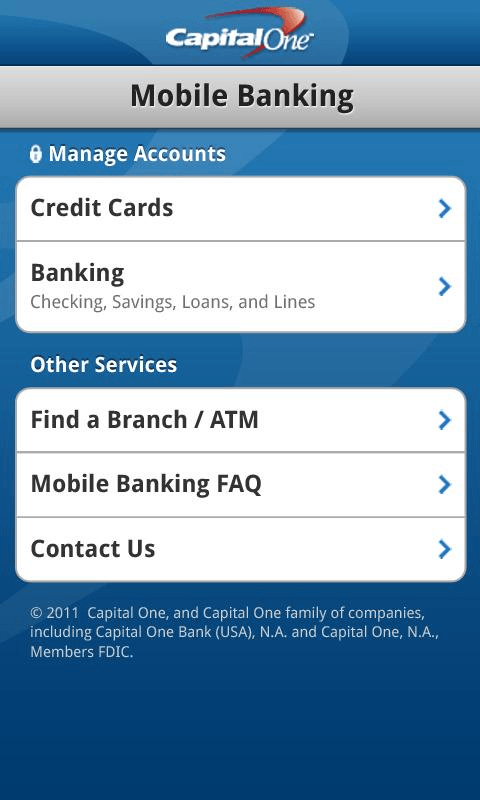

At the heart of the Capital One Mobile App is a seamless user experience engineered for frequent mobile banking. With a clean interface and accessible navigation, the app enables users to check account balances and transaction histories in seconds, eliminating the need to visit a branch or dig through email summaries. Every screen is thoughtfully designed to prioritize clarity, ensuring even first-time users can master the tools quickly.

As one Capital One customer recently shared, “The app feels like having a personal banker at my fingertips—always available when I need it.”

Powerful Budgeting and Spending Control

Managing personal finances begins with visibility—and the Capital One app delivers exceptional budgeting tools. Users can create custom spending categories, set realistic monthly limits, and receive automated alerts when approaching or exceeding budget caps. These proactive nudges help cultivate discipline without constant manual oversight.Real-time access to transaction history alongside visual spending dashboards provides a clear picture of financial inflows and outflows, allowing for quick course corrections. Data insights reveal trends over time, empowering users to identify wasteful spending and adjust habits before they spiral. The app’s integrated budgeting framework goes beyond simple categorization.

It uses machine learning to analyze spending patterns and suggest personalized savings goals. For example, if a user regularly overspends on dining out, the app may recommend reallocating that amount to a monthly savings bucket, with automated transfers to reinforce the new habit. As financial analyst Jane Patel notes, “Capital One’s budgeting features are among the most user-centric in digital banking, turning financial planning into a dynamic, guided process rather than a tedious chore.”

Instant Offline Access and Unmatched Security

One of the app’s most underrated strengths is its offline functionality, ensuring users stay in control regardless of connectivity.Transaction history, account balances, and even recent payments remain accessible without an internet connection—an essential feature for travelers or those in low-connectivity zones. This offline capability preserves continuity, so users never lose touch with their financial picture. Security is nonnegotiable.

The Capital One Mobile App employs industry-leading encryption, biometric authentication (Touch ID and Face ID), and multi-factor verification to protect sensitive data. Regular security audits and real-time fraud monitoring further shield accounts, with instant transaction alerts enabling rapid response to suspicious activity. “Users reason carefully before enabling features, but the built-in security simply stops threats before they begin,” observes cybersecurity expert Mark Liu.

Streamlined Financial Services Through One Tap

Beyond fundamental banking, the app serves as a gateway to a full suite of financial products—all accessible with minimal friction. Applying for a credit card, securing a personal loan, or opening a new account requires no office visits. The application process leverages digital identity verification and instant underwriting, often delivering approval decisions within minutes.This speed transforms what was once a weeks-long process into a seamless, paperless experience. Spending and applying for a Capital One loan is just a few taps away, with all required documents pre-loaded and state-of-the-art image recognition making the process remarkably efficient. For small business owners and freelancers, the app supports self-employed banking—tracking income, managing expenses, and reconciling cash flow with precision.

As one professional finance user puts it, “I used to dread financial admin. Now, the app puts me in charge with clicks, not calls or paperwork.”

The integrated “Chase Clear” account integration allows real-time lookups of non-Capital One accounts, consolidating all funds into one place. For early-insurance spenders, the app includes savings snapshots for auto-generated insurance premium deductions, automatically setting aside money with a few taps. Customer support is readily available through in-app chat, live phone assistance, and a comprehensive knowledge base—ensuring help is never far when needed.

From troubleshooting login issues to explaining complex financial products, the support ecosystem is designed to be both responsive and knowledgeable.

The Future of Mobile Banking: Intelligent, Accessible, and Empowering

The Capital One Mobile App exemplifies the evolution of personal finance tools—blending simplicity with sophistication to meet users wherever they are. By unifying budgeting, security, real-time insights, and instant services, it transforms passive money management into an active, empowering process.As younger generations increasingly expect digital-first solutions, Capital One continues to lead by delivering not just functionality, but trust and convenience. For anyone seeking a smarter, more connected banking relationship, the Capital One app is more than a tool—it’s a financial partner built for the mobile generation. With continuous innovation and a focus on user needs, it doesn’t just meet expectations—it redefines them.

In a world where financial agility defines success, the Capital One Mobile App stands as a benchmark in mobile banking excellence—complex enough for power users, intuitive enough for beginners, and relentless in protecting what matters most: your money.

Related Post

Download Capital One Mobile App Easy: Skip the Steps, Secure Your Financial Tools in Seconds

Get The Capital One Mobile App for Android: A Quick Guide to Instant Financial Empowerment

Ultimate Guide to CR Deck Checker: Everything You Need to Know Before Safety Tests

Cedric The Entertainer: From Stage Kings to Financial Resilience—A Behind-the-Scenes Look at His Career and Wealth