ROI Calculation: A Simple Guide to Mastering Return on Investment

ROI Calculation: A Simple Guide to Mastering Return on Investment

Investing time and capital into any business or project demands clarity—especially when measuring success. At the heart of this clarity lies Return on Investment (ROI), a powerful metric that quantifies financial gain relative to cost, enabling informed decisions and strategic prioritization. Understanding how to calculate ROI isn’t reserved for finance experts; with straightforward methods and clear examples, anyone can apply it to personal or professional ventures.

This guide demystifies ROI calculation, offering a practical framework to assess performance, optimize spending, and ensure sustainable growth. Understanding Return on Investment — Beyond the Formula ROI is far more than a single mathematical expression; it’s a lens through which the efficiency of an investment is evaluated. In simple terms, ROI measures profitability by comparing net gains to total costs, expressed as a percentage.

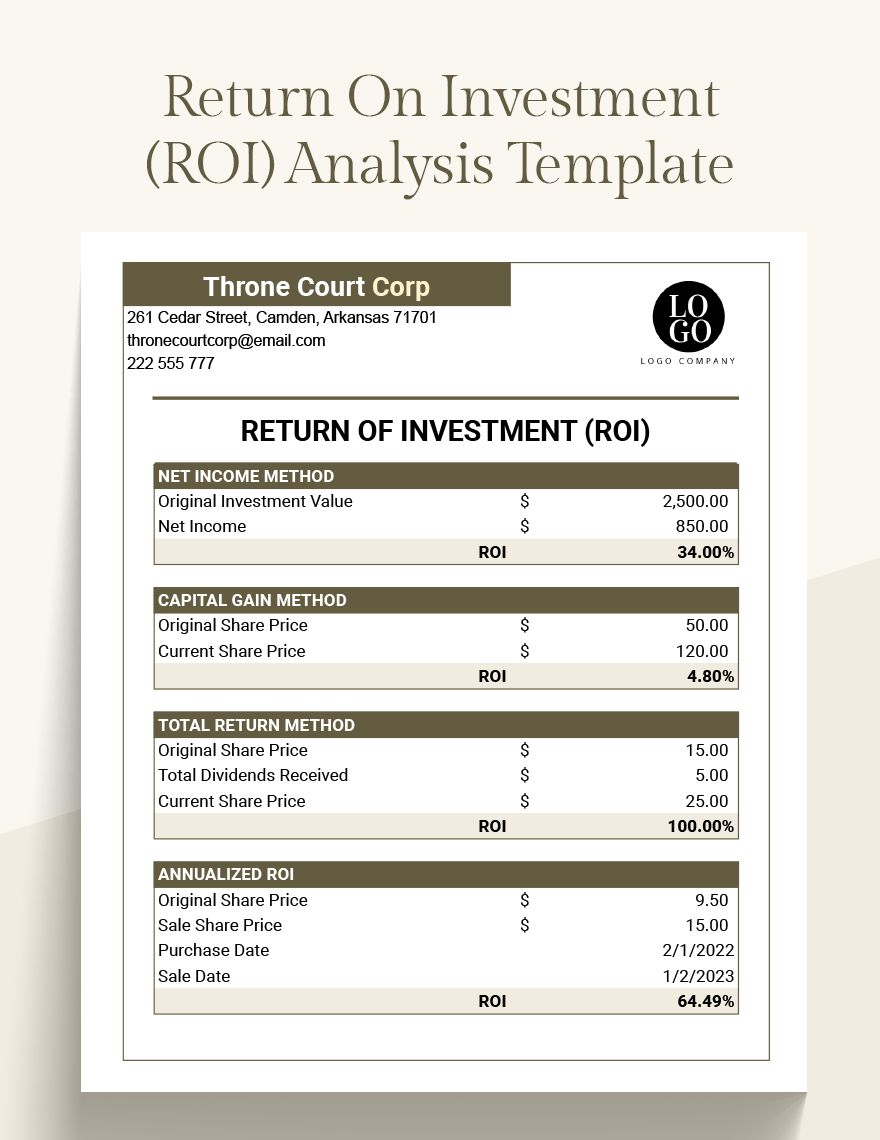

The formula remains consistent across industries, but its application varies by context. As investor and financial strategist David Budoff noted, “ROI answers one universal question: were you right to invest?” This succinct yet profound insight underscores ROI’s core purpose—transforming inherently subjective judgments into objective, data-driven assessments. The Core ROI Formula and Why It Matters The foundational ROI calculation follows a clean structure: ROI equals (Net Profit / Investment Cost) × 100.

This formula demands precision—identifying true net profit and all associated costs. Net profit is not simply revenue minus cost of goods sold; it must capture all expenses directly attributable to the investment, including labor, materials, and overhead. As financial educator Barbara Wheeler emphasizes, “Accuracy in defining investment cost separates valid ROI analysis from misleading figures.” Understanding these nuances ensures the ROI metric delivers reliable, actionable insights.

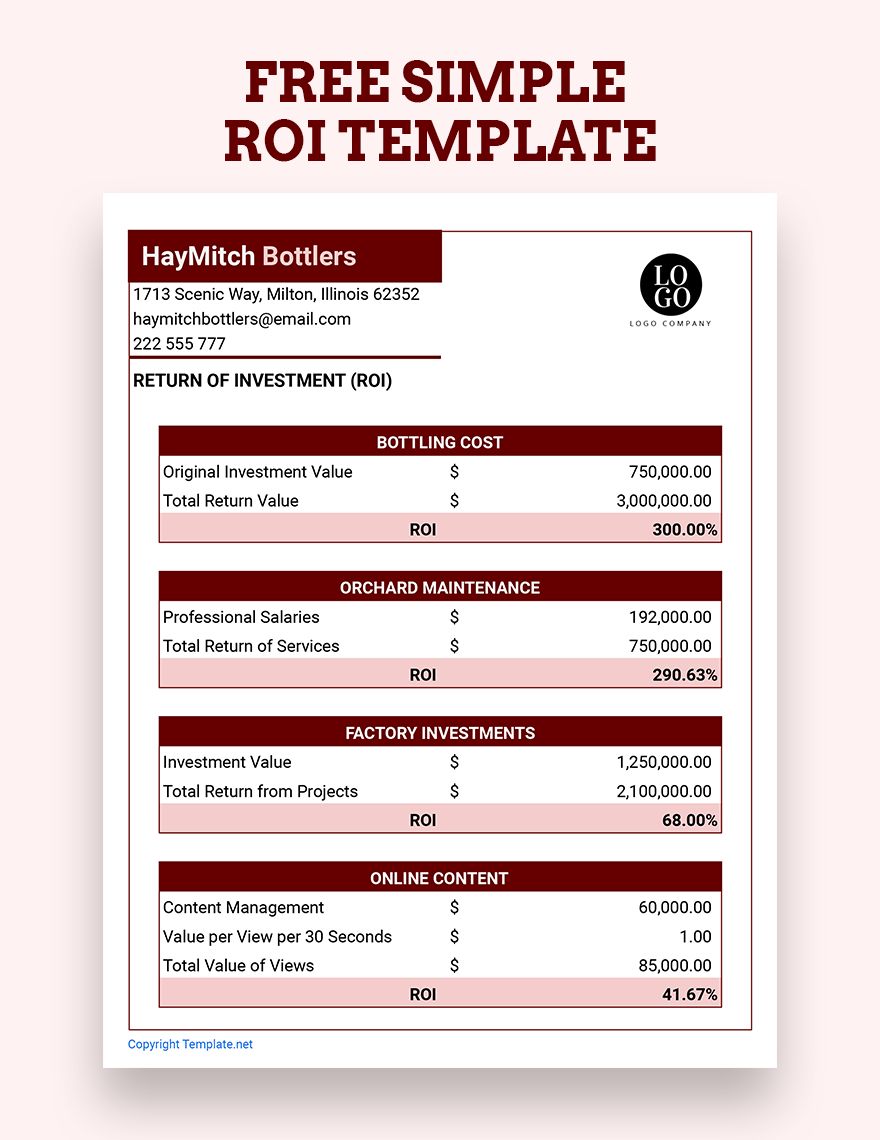

Step-by-Step: How to Calculate ROI Like a Pro To compute ROI effectively, follow this structured approach: - Define the investment period and total expenditure accurately. - Calculate gross revenue generated directly by the investment. - Subtract total costs, including direct and indirect expenses.

- Divide net profit by initial investment and multiply by 100 for percentage Return. For practical clarity, consider this real-world example: Imagine a marketing campaign costing $10,000 that produced $15,000 in incremental revenue. Total costs included $7,000 in ad spend, $2,500 in creative production, and $500 in analytics tools—totaling $10,000.

Net profit was $15,000 – $10,000 = $5,000. Applying the formula: (5,000 / 10,000) × 100 = 50% ROI. This means every dollar invested returned $0.50 in profit.

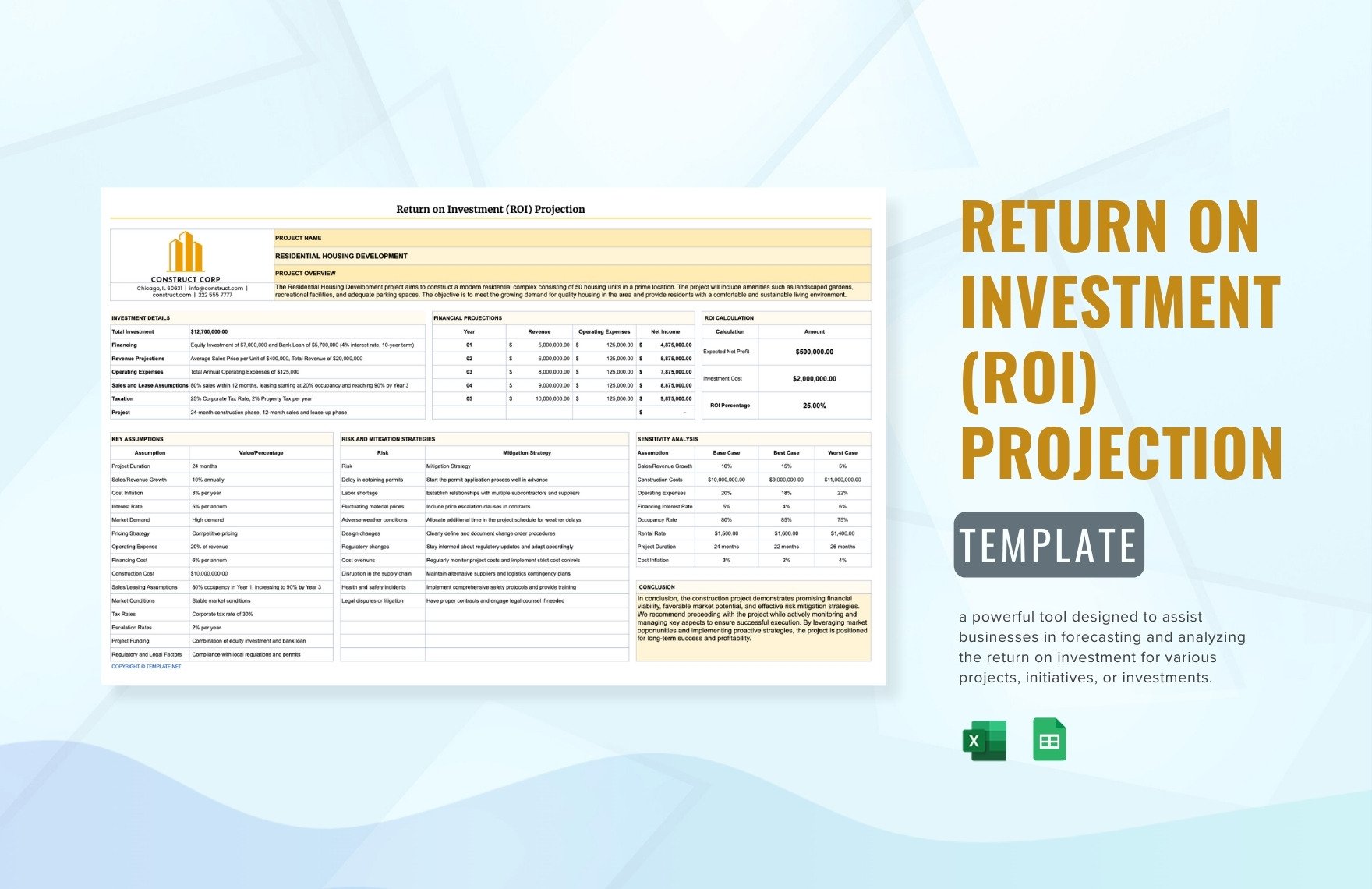

ROI variations across sectors reveal deeper strategic value. In technology, a software development project may yield ROI by tracking user adoption and long-term retention. In real estate, ROI analysis incorporates property appreciation, rental income, and maintenance costs.

Even personal investments—such as education or skill development—can use ROI principles: estimate the financial benefit of enhanced earning potential against tuition, time, and opportunity costs. The key insight is that ROI adapts to context, making it a universal tool for any return-oriented decision. Evaluating ROI: Benchmarks, Limitations, and Practical Considerations While ROI offers compelling clarity, its power lies in informed interpretation.

Industry benchmarks provide context—while a 50% ROI may signal success in retail, it could indicate underperformance in high-capital infrastructure. Time horizons matter too: short-term gains may mask long-term risks, and high-risk ventures naturally carry wider ROI variance. According to business analyst John Smith, “ROI is not a static number—it’s a dynamic indicator requiring adjustment for context, risk, and strategic goals.” Moreover, ROI should never be used in isolation.

Complementary metrics like payback period, net present value (NPV), and internal rate of return (IRR) enhance analysis, particularly for projects with extended timelines or uneven cash flows. This balanced approach prevents overreliance on a single figure and strengthens decision-making under uncertainty. Understanding both the strengths and boundaries of ROI ensures it remains a credible, strategic asset—not a misleading shortcut.

The impact of mastering ROI calculation extends beyond financial tracking; it cultivates a results-oriented mindset. By consistently measuring investments, individuals and organizations align actions with outcomes, optimize resource allocation, and foster accountability. In a competitive landscape where every dollar counts, ROI transforms vague expectations into concrete, trackable progress.

Summary: ROI is the bridge between investment and insight. From a single formula to strategic application, its power lies in clarity, consistency, and context. Whether evaluating a startup’s growth, a marketing campaign’s success, or personal development, ROI enables smarter, bolder choices.

With disciplined execution and realistic expectations, anyone can harness ROI as a cornerstone of effective investing—turning uncertainty into confidence, and investments into results.

Related Post

Breaking: Leolulu Face Reveal — The Enigmatic Identity Unmasked After Years

Who Is Lee Jung-Jae Daughter? Unveiling the Private Life of a Star’s Byline

True Crime Obsession: How Crime Watch Daily’s YouTube Phenomenon Hooks Millions

Driving With Prism Glasses: Everything You Need to Know