SpaceX Funding: How Does Elon Musk Finance His Dream of Interplanetary Humanity?

SpaceX Funding: How Does Elon Musk Finance His Dream of Interplanetary Humanity?

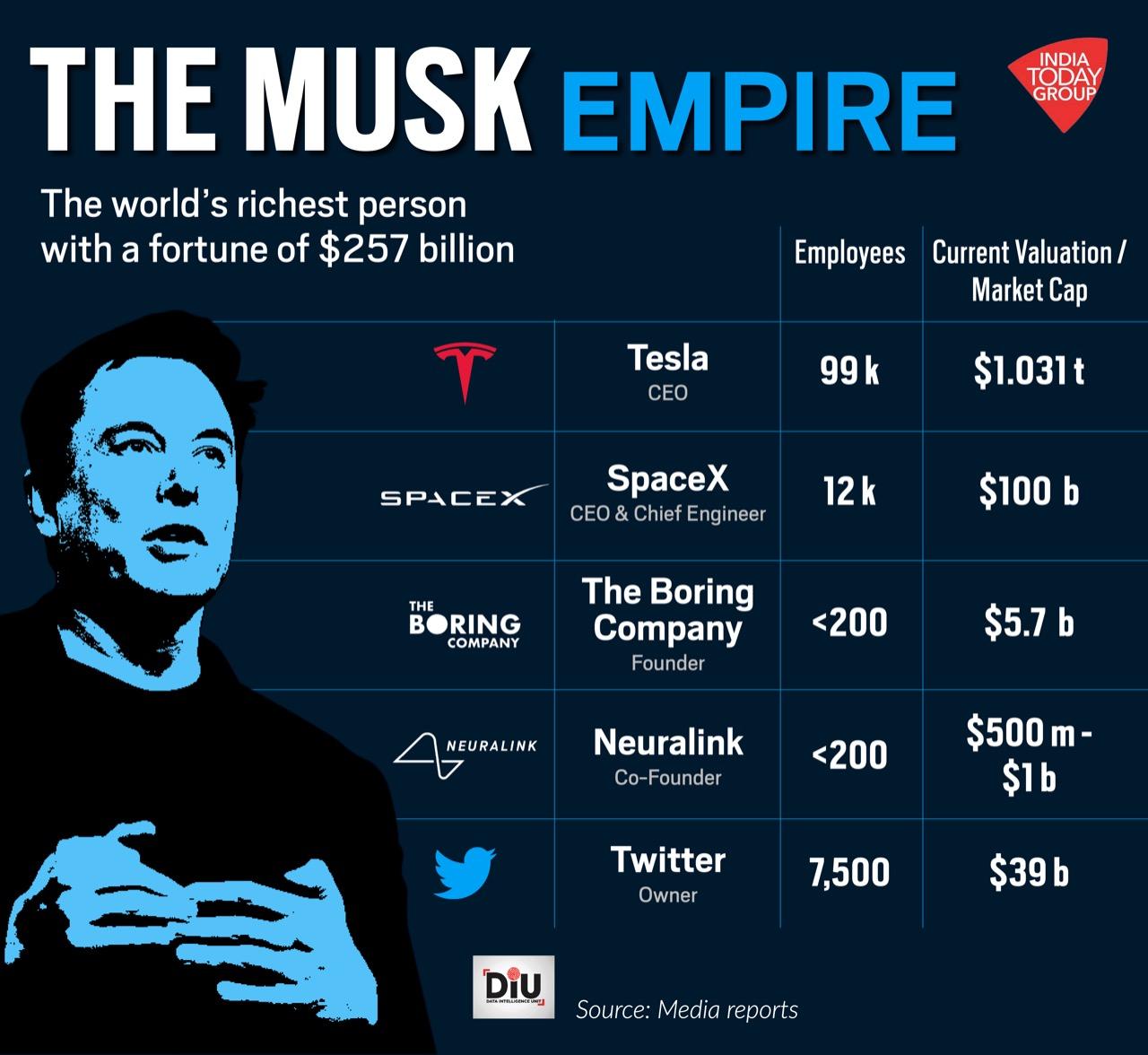

SpaceX, the private aerospace company founded by Elon Musk in 2002, stands at the forefront of humanity’s ambition to colonize Mars and revolutionize space travel—an endeavor backed by a multi-layered, unconventional funding strategy that defies traditional aerospace economics. With generational visions extending far beyond near-term profitability, Musk has financed SpaceX through a combination of personal wealth, strategic investments, innovative revenue streams, and calculated risk-taking—all meticulously aligned with a long-term mission to make life multiplanetary. At the core of SpaceX’s financial engine is Musk’s initial personal capital.

When he founded the company with $100 million from the sale of PayPal, he injected personal funds that reached approximately $250 million in early stages, a substantial but limited starting point for an ambitious rocket company. As Musk often reflects, “If something is important enough, you do it even if the odds are not in your favor.” This mindset shaped the company’s early years, where losses were accepted as necessary costs for rapid innovation and orbital test milestones. Beyond personal capital, Musk leverages strategic government partnerships, most notably NASA contracts that provided critical early momentum.

The Commercial Orbital Transportation Services (COTS) program, launched in 2006, awarded SpaceX hundreds of millions in non-repayable, milestone-based funding—estimated at over $1.6 billion cumulatively. These public-private partnerships reduced development risk while validating SpaceX’s technical approach, enabling reinvestment into next-generation systems like the Starship. “A lot of people underestimate the importance of government contracts early on—not as charity, but as strategic scaffolding,” Musk noted during a 2021 interview.

“They gave us runway to iterate fast, fail, and come back stronger.” Bootstrapping through commercial contracts further diversifies the revenue base. SpaceX’s Falcon 9 rocket transformed satellite launches with reusability—a game-changing technology that drastically reduced costs. By securing over 200 launches, including high-value military and commercial payloads, SpaceX generated tens of billions in revenue.

Annual revenue surpassed $5 billion by 2023, fueling ambitious R&D for Starship and Mars colonization plans. Equally vital is SpaceX’s aggressive reinvestment model. Musk directs nearly all profits back into development, embodying a high-risk, high-reward philosophy.

“We’re not building cars to make quarterly profits—we’re writing the future,” he stated. This relentless reinvestment accelerated the Starship program despite technical setbacks and delayed launches, maintaining momentum toward orbital and interplanetary flight. Diversified income streams expand the company’s financial foundation.

Beyond launch services, SpaceX develops Starlink, a global satellite internet constellation. With over 6,000 satellites already in orbit serving more than 5 million users across 60+ countries, Starlink now contributes tens of billions in annual revenue—funds that subsidize long-term space exploration goals. As Musk succinctly puts it, “Satellite internet pays the bills so we can reach for Mars.” Equity dynamics also reveal Musk’s financing acumen.

Though his estimated net worth often leads headlines, SpaceX’s ownership structure shields Musk from full personal market exposure. The company’s private status avoids public scrutiny and allows long-term strategic patience, crucial for breakthroughs like full reusability in orbital-class rockets. Internal funding via retained earnings and fresh equity rounds—partially driven by Musk’s willingness to take on debt—sustain growth without sacrificing control.

Investor confidence, largely self-inflicted through milestones, underpins SpaceX’s capital access. While traditional aerospace firms rely on steady investor pipelines, Musk has cultivated a loyal coalition of private backers, institutional investors, and strategic partners convinced of the company’s vision. The Falcon Heavy’s record-breaking launches and Starship prototypes have reinforced market belief in SpaceX’s trajectory, supporting valuation growth despite minimal public disclosures.

Musk’s approach is not merely about jury-riding government checkbook aid but about building self-sustaining momentum. He combines personal conviction with market-driven innovation, where commercial success fuels mission-driven R&D, and every launch—successful or not—advances the core objective. As SpaceX pushes boundaries with Starship’s orbital test flights, Mars habitat prototypes, and lunar lander contracts, its financial model remains a blueprint for deep-space entrepreneurship.

Ultimately, Elon Musk finances his interplanetary dreams not through conventional means, but through a bold fusion of personal capital, public-private collaboration, commercial dominance, and relentless reinvestment. By aligning financial strategy with a vision that transcends Earth, SpaceX exemplifies how audacious ambition, when backed by smart funding architecture, can propel humanity beyond the planet—and toward the stars.

From personal funds to government partnerships, commercial contracts to satellite internet, SpaceX’s funding ecosystem is as dynamic and relentless as the mission itself.

With Musk’s unwavering focus on Mars and beyond, the company’s financial architecture remains a masterclass in funding humanity’s next frontier.

![Elon Musk Finance [Video] | Elon musk, Finance, How to get rich](https://i.pinimg.com/736x/26/f4/77/26f47775dae33b16d6ee2b3226f500cc.jpg)

Related Post

December 12: Cosmic Alignment Reveals What The Stars Have In Store for You

Hisashi Ouchi: The Untold Story of a Tragic Nuclear Accident and the Limits of Human Endurance

What Pinkerton Does Today: Modern Private Investigations in Action

The Shocking Final Act of Derek Shepherd: The Final Breath in Grey’s Anatomy