State Farm & Your Hot Tub: Are You Covered? The Coverage You Need Before You Splash

State Farm & Your Hot Tub: Are You Covered? The Coverage You Need Before You Splash

When you invest in a hot tub, the pursuit of relaxation and wellness spikes—but so do critical questions about insurance coverage. Can your State Farm policy protect you if a DIY upgrade malfunctions? Do claims get paid fast if a pump fails or a lining tears?

For every hot tub owner, the answer hinges on a sharp understanding of what State Farm covers, what’s excluded, and how proactive protection prevents financial strain. With hot tubs involving complex plumbing, electrical systems, and ongoing maintenance, knowing your insurance landscape isn’t just smart—it’s essential. punta iuseppe hot tubs demand precision and care, yet many assume standard home policies fully support them.

That’s a pitfall. State Farm, one of the largest U.S. insurers, offers flexible coverage—but gaps exist, and nuances matter.

This article decodes the essentials: recognizing written coverage, understanding umbrella protections, navigating deductibles, and recognizing when proactive communication with your agent makes all the difference. State Farm and your hot tub aren’t just compatible—with the right knowledge, you can swim with confidence.

The State Farm Hot Tub Coverage Framework: Written Policies Count

State Farm’s position on hot tubs leans on clear written policy language.The insurer does not automatically include hot tubs in every standard homeowners or renters insurance policy; coverage depends on explicit endorsement. “A hot tub is typically covered only when specifically endorsed,” explains a State Farm representative. This endorsement is a formal rider added to your policy that expands standard liability and property protection.

_covering hot tubs as part of property ownership isn’t automatic._ Without the endorsement, State Farm treats the hot tub as a separate, excluded risk—meaning leaks, electrical failures, or pump breakdowns may not be covered. For context, standard homeowners policies usually cover structural components like roofs and walls but often exclude “mechanical systems” unless explicitly added. The hot tub, being both a major investment and complex appliance, falls squarely into this gray area.

Essentially, if your plan doesn’t list hot tubs, the insurer’s default sidesteps liability claims. Owners must confirm endorsement status—often found buried in policy documents—or seek a tailored rider ranked alongside fire and theft protections.

Key Coverage Elements: Liability, Equipment, and Liability Limits

State Farm’s hot tub coverage, when properly endorsed, addresses core risks with defined limits. The policy typically offers: - **Liability coverage** shielding owners from third-party injury claims—critical if someone slips while using the tub.- **Equipment coverage** for mechanical failure, including pumps, heaters, and filtration systems, helping offset repair or replacement costs. - **Deductible frameworks**, commonly higher for specialty equipment like hot tubs, often in the $500–$1,500 range depending on plan tier. State Farm generally caps hot tub equipment coverage between $25,000 and $100,000, depending on coverage level.

Above that, riders extend limits, but owners must weigh cost against real need—frequent hiccups almost guarantee expensive repairs. “We’ve seen instances where unreported leak damage overwhelmed standard deductibles,” notes a local agent. Insureds should verify exact scope: what’s covered, what’s not, and whether additional coverage for runoff or drainage is included.

An uncovered breakdown can cost $3,000 to $7,000, and liability claims, if uninsured, may run into tens of thousands. State Farm’s structured endorsement seeks to eliminate these gaps—but only with clarity.

Umbrella Policies: Extending Protection Beyond Standard Limits

For hot tub owners seeking broader safety, a State Farm umbrella policy adds a critical safety net. This additional layer extends primary policy limits, often doubling or tripling protections for liability and equipment.“An umbrella isn’t a substitute, but a powerful enhancer,” states a State Farm spokesperson. For families with hot tubs, umbrella coverage—typically $1 million or more per occurrence—ensures protection against catastrophic events, such as a multi-occupant injury or major equipment failure outside daily limits. Combining a properly written hot tub endorsement with an umbrella broadens confidence.

Should a revamped tub cause injury to multiple guests or trigger a massive pump failure, coverage extends beyond the base policy. “Without these layers, even careful owners risk exposure to escalating costs,” observes a claims specialist.

Omitting umbrella coverage after endorsing a hot tub essentially leaves a financial soft spot—gaps that can compound with each unexpected hot tub malfunction.

Claims Process & Documentation: What to Expect When It Go Wrong

Time is of the essence when a hot tub fails.State Farm insists on swift, detailed reporting—calling the agent immediately, documenting damage with photos and repair estimates, and preserving all maintenance records. “Delayed claims significantly reduce payout potential,” a claims executor warns. Key steps include: - Immediate notification of your State Farm agent or claims supervisor.

- Keeping repair receipts, contact logs, and fast service tags. - Retaining original policy endorsement or rider for verification. - Fixing issues within coverage limits to maintain claim legitimacy.

State Farm specifies reporting requirements clearly: a delayed response and incomplete records may result in claim denial. Proactive documentation not only accelerates payouts but fortifies trust when you need support.

Hot tub emergencies don’t wait.

Responding in hours—not days—protects both your investment and your

Related Post

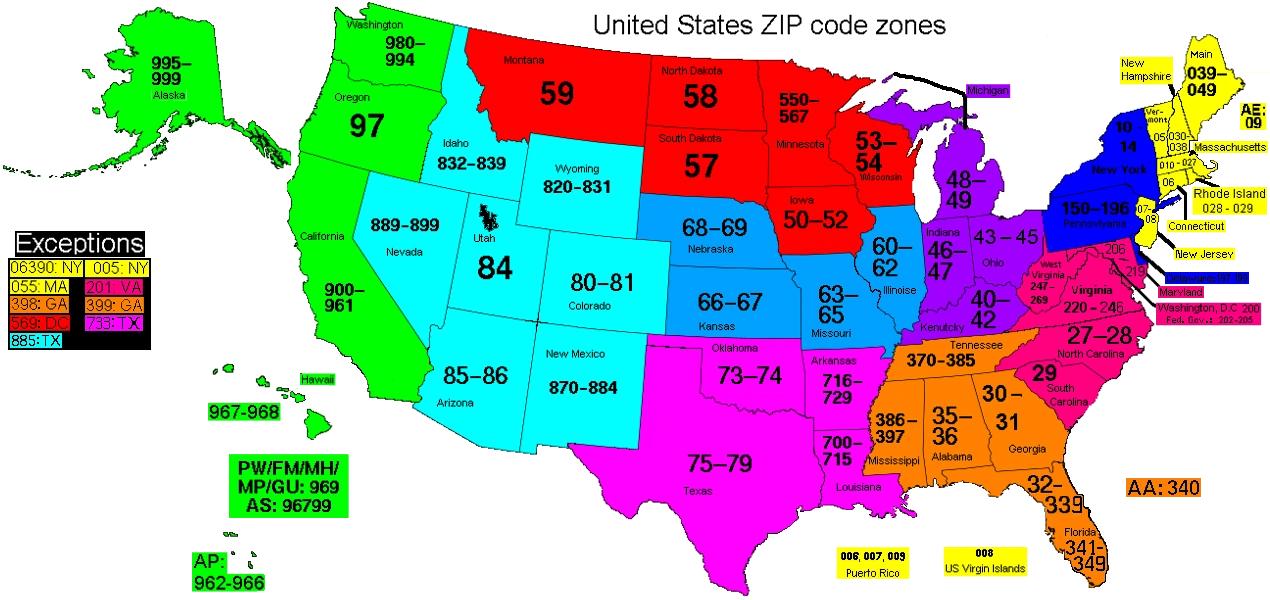

Marion, Ohio Zip Code Zones: Decoding ZIP Mail Delivery Across Marion’s Neighborhoods

Kathy Craine’s Salary Revealed: Unveiling the Strategic Pay Structure Behind Top Talent in Digital Marketing

From Stage to Family: The Multifaceted Life of Alexandra Kay Husband

From Behind the Scenes to Billion-Dollar Real Estate: The Rising Net Worth of Brandy’s Net