Suncoast Credit Union & Zelle: What Every User Should Know Before Sending, Receiving, or Managing Money Online

Suncoast Credit Union & Zelle: What Every User Should Know Before Sending, Receiving, or Managing Money Online

In an era defined by instant digital transactions, understanding how banks like Suncoast Credit Union integrate with emerging payment tools such as Zelle is essential for safeguarding funds and maximizing convenience. For savvy users, knowing the key details about Suncoast’s Zelle access—how it works, what it covers, and how to avoid common pitfalls—can transform everyday money management into a seamless, secure experience. This article unpacks the essentials of Suncoast Credit Union and Zelle, revealing practical insights behind the scenes.

Suncoast Credit Union, a member-centric financial institution serving communities across Florida’s west coast, has embraced Zelle as a core payment solution, reflecting a broader industry shift toward real-time transfers. Unlike traditional ACH transfers that process in 1–3 business days, Zelle enables funds to move instantly—from hours to minutes—within the same bank or directly between participating institutions. For Suncoast members, this means faster bill payments, same-day vendor settlements, and more agile financial handling of urgent expenses.

How Suncoast Credit Union Enables Zelle Transfers

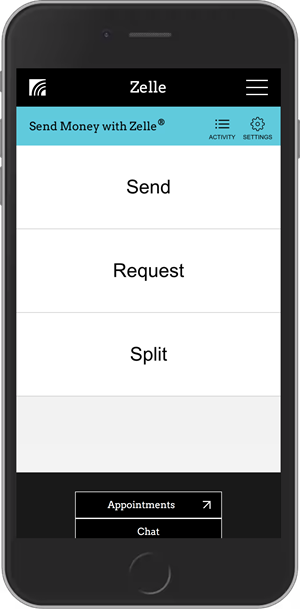

At its core, Suncoast Credit Union supports Zelle functionality through its robust digital banking platform, allowing authorized members to initiate transfers with minimal friction.Unlike cash or checks, Zelle sends and receives with a simple upload of a payee’s account details, with verified identity and secure encryption protecting each transaction.

- Eligibility and Integration: Zelle is natively available to Suncoast Credit Union members who use Suncoast’s online banking or mobile app. No separate account setup beyond standard login credentials is required.

- Transfer Limits and Fees: While Suncoast doesn’t impose additional fees for Zelle (a key advantage over third-party services), indirect safeguards and capital spikes are monitored under federal regulatory guidance, ensuring member protection.

- Real-Time Settlement with Risk Safeguards: Upon sending, funds are instantly debited from the sender’s account and credited to the recipient’s within seconds—subject to confirmations and real-time fraud detection protocols.

Unlike PayPal or Venmo, Suncoast’s Zelle experience is tightly linked to the credit union’s broader financial ecosystem, offering member-specific support and integration with internal banking tools—making it both a convenience and a security-conscious choice.

What Members Need to Know Before Using Zelle with Suncoast

Navigating Zelle safely begins with awareness of both the benefits and hidden nuances—especially around fraud prevention and transaction controls.While Zelle’s speed is unmatched, misuse or careless sharing of access data can expose funds to unauthorized transfers. Suncoast Credit Union equips users with resources and policy clarity to avoid common mistakes.

One central alert Suncoast emphasizes is never sharing Zelle login credentials or sending funds without verifying recipient details—wait five minutes for confirmation before finalizing transfers, and always double-check account numbers.

The credit union actively educates members via:

Email alerts triggering for unusually large or new recipient transactions.

In-app security prompts requiring biometric confirmation before high-stakes transmissions.

Beyond individual transactions, Suncoast’s Zelle integration strengthens financial inclusion by minimizing barriers to digital banking—benefiting members who value both efficiency and security.

Whether paying bills, splitting household expenses, or disbursing business payments, Zelle’s presence at Suncoast exemplifies how traditional credit unions adapt to modern payment expectations without compromising on risk oversight.

In practice, using Zelle with Suncoast Credit Union means faster, direct transfers backed by a member-first institution committed to transparency and protection. The credit union’s approach balances accessibility with robust controls, helping even less tech-savvy users move money safely online. For anyone using digital payments, understanding how Zelle works within Suncoast’s framework isn’t just helpful—it’s a critical step toward smarter, safer financial habits.

The convergence of Suncoast Credit Union’s member trust and Zelle’s instant payment capabilities sets a new standard in digital banking—one where speed meets security, and innovation serves everyday users with precision.

For those ready to embrace seamless, real-time money movement, understanding these dynamics is the key to confident financial control.

Related Post

Transform Your Mobile: Experience One Piece Anime Wallpapers 4K in Ultra HD on Android Devices

Orion Distribution Center: What People Are Saying—Speed, Precision, and Logistics Excellence

Worldgussr: The Next Frontier in Global Manufacturing Transparency and Supply Chain Intelligence

Clemson vs LSU: A Clash of Titan Athletes – Player Stats That Drove the Game’s Heart