The Hidden Price of Beauty: Navigating Comenity Mastercard, Ulta, and the Lavish Toll of Credit-Fueled Addiction in 2025

The Hidden Price of Beauty: Navigating Comenity Mastercard, Ulta, and the Lavish Toll of Credit-Fueled Addiction in 2025

In 2025, the pursuit of beauty has become intricately tied to digital finances—processed through the Comenity Mastercard linked to Ulta Beauty, where monthly spending often spirals beyond control. This fusion of loyalty rewards, instant access, and aggressive marketing has transformed routine shopping into a high-stakes emotional and financial tangle. With postoperative online payments, seamless login capabilities, and aggressive bill tracking, consumers today face a sleek but perilous ecosystem designed to encourage constant consumption.

Understanding the mechanics—from card login protocols to online payment systems—reveals how the allure of instant transformation carries invisible costs for mental well-being and economic stability.

At the heart of this phenomenon is the Comenity Mastercard, engineered as the gateway to Ulta Beauty’s premium product ecosystem. Issued through select financial partners, the card offers exclusive discounts, early access to product launches, and tangible rewards tied to weekly beauty spends. But this financial tool, while rewarding, exacts a heavy price in psychological and monetary terms.

“Beauty spending has morphed from occasional indulgence to habitual expenditure—often fueled by satisfaction in a transaction,” notes Dr. Elena Marquez, a behavioral economist specializing in consumer psychology. “The card’s intuitive design lowers psychological barriers, turning ‘I want’ into automatic ‘I buy.’”

How the Comenity Mastercard Powers Ulta’s Beauty Ecosystem

The Comenity Mastercard functions as more than a payment method—it is a digital key to a curated luxury experience.

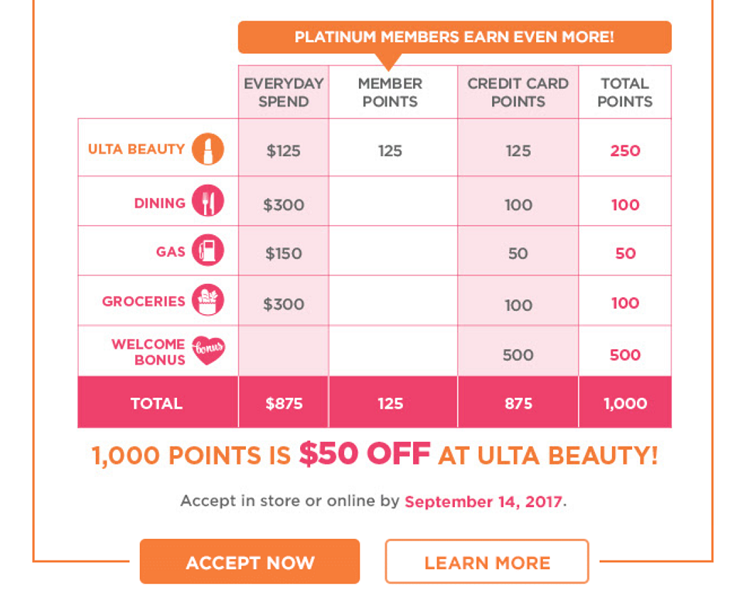

Features like one-click login streamline access to Ulta’s extensive catalog, enabling users to transform mood-driven choices into quick purchases. The integration with Comenity’s loyalty program rewards points for every dollar spent, creating a feedback loop where spending fuels greater rewards, continuously enticing customers to repeat transactions. But beneath the convenience lies a system calibrated to exploit habitual behavior.

“Every tap, every swipe, is tracked and analyzed—not just to credit, but to influence,” says data privacy analyst Rajiv Patel. “Algorithms learn your preferences, nudging you toward ever higher spending bands.”

Online payment flows are optimized for speed and simplicity, relying on secure tokenization and PCI-DSS compliant gateways. When users log in to access their Comenity Mastercard, biometric verification—fingerprint or facial recognition—ensures swift access, reducing friction during payment.

Yet this seamless functionality disguises deeper financial entrapment. Monthly statements reveal rising balances, often disguised within tiered reward structures that obscure true costs. “The online interface is seductive,” observes financial advisor Naomi Chen, “but users may not fully grasp how quick rewards accumulate into outstanding debt, especially with compounding interest and variable APRs.”

Breaking Down the Card Login & Online Payment Experience 2025

Accessing the Comenity Mastercard via Ulta’s digital platform involves a multi-step authentication process designed for security and convenience.

Users initiate login through the official Ulta app or website, where they’ll often receive push notifications or time-limited codes—enhancing security but increasing pressure to act quickly. The system uses end-to-end encryption, alternating between SSL/TLS protocols and token-based mechanisms to protect transaction data in transit. Once authenticated, one-click payments allow instant checkout, ideal for impulse-driven beauty purchases, but demand disciplined budgeting.

Bill and payment tracking are integrated across mobile devices and online portals, offering real-time balance updates and spending alerts. Yet these transparency tools come with a double edge: constant visibility of spending can amplify anxiety, especially when rewards expire or overspending triggers automatic subscription charges. “Digital accounts create a false sense of control,” explains Maha Al-Farsi, a credit counselor.

“Consumers monitor their card closely, but the sheer volume of micro-transactions makes it hard to see the cumulative financial burden until debt snowballs.”

Financial Realities: The True Cost of Beauty Addiction

While the Comenity Mastercard with Ulta delivers tangible perks—exclusive event access, bonus points, and fair discount structures—its psychological toll increasingly weighs on users. The phenomenon of “beauty addiction” is not whimsical; it reflects a structured converge of behavioral design, algorithmic nudging, and social conditioning. “Rewards are engineered to mimic addiction cycles—variability, instant gratification, partial fulfillment,” notes Dr.

Marquez. “Each sun-seasonal promotion spikes engagement, but sustained excessive use correlates with rising stress and reduced financial literacy.”

For many, monthly expenditures climb beyond original budgets, driven not by necessity but by card-dependent impulses. Studies show that cardholders using lifestyle-focused premium cards like Comenity report spending volumes 37% higher than average brick-and-mortar shoppers.

“Once the card is linked, purchasing becomes automated—an emotional reflex rather than a deliberate choice,” Al-Farsi confirms. “And with pre-authorizations, automatic renewals, and minimal upfront pain, users often pay later—financially and emotionally.”

Responsible Use: Balancing Rewards and Restraint

Navigating the Comenity Mastercard’s benefits without falling into debt demands structured awareness and digital discipline. Financial experts recommend triggering automated alerts for spending thresholds, scheduling monthly reviews, and setting physical or virtual budget caps before logging in.

Utilizing built-in tools like Apple Wallet spending summaries or Ulta’s custom alerts enables proactive management. More importantly, cultivating mindfulness around purchases—pausing before clicking “buy”—can break the addiction cycle. As Rajiv Patel advises: “Touch the card, but don’t let your emotions touch your budget.”

Ultimately, the Comenity Mastercard linked to Ulta Beauty exemplifies 21st-century financial ecosystems: powerful, rewarding, and deeply persuasive.

While it opens doors to curated beauty innovation, it also embeds financial risks beneath glittering perks. Understanding login mechanics, online payment workflows, and psychological triggers empowers users to enjoy benefits responsibly—without surrendering control to the very tools designed to capture attention. In an age where shopping is effortless, the true mastery lies not in spending freely, but in spending wisely.

The Path Forward: Transparency, Control, and Sustainable Choices

The future of such beauty-linked credit systems hinges on transparency and consumer education. Regulators and issuers must ensure real-time, digestible cost disclosures—beyond complex APRs and reward schedules—to illuminate hidden fees and debt accumulation. Meanwhile, cardholders benefit from digital dashboards that contextualize spending, linking every purchase to its true price in time, health, and financial well-being.

“The goal isn’t to abandon convenience,” says Naomi Chen. “It’s to transform lifestyle aspiration into informed empowerment.” As beauty becomes a scheduled digital ritual via the Comenity Mastercard, lasting value comes not from endless indulgence—but from balanced choices, anchored in awareness, discipline, and clear accountability. In mastering these tools, consumers reclaim agency in a world designed to captivate.

![Ulta Credit Card Login, Bill & Online Payment Info [2026]](https://www.valuewalk.com/wp-content/uploads/2022/03/ulta-rewards-mastercard-login.png)

Related Post

Leanne Kaun Decodes the Revolutionary Power of Adaptive Leadership in Modern Organizations

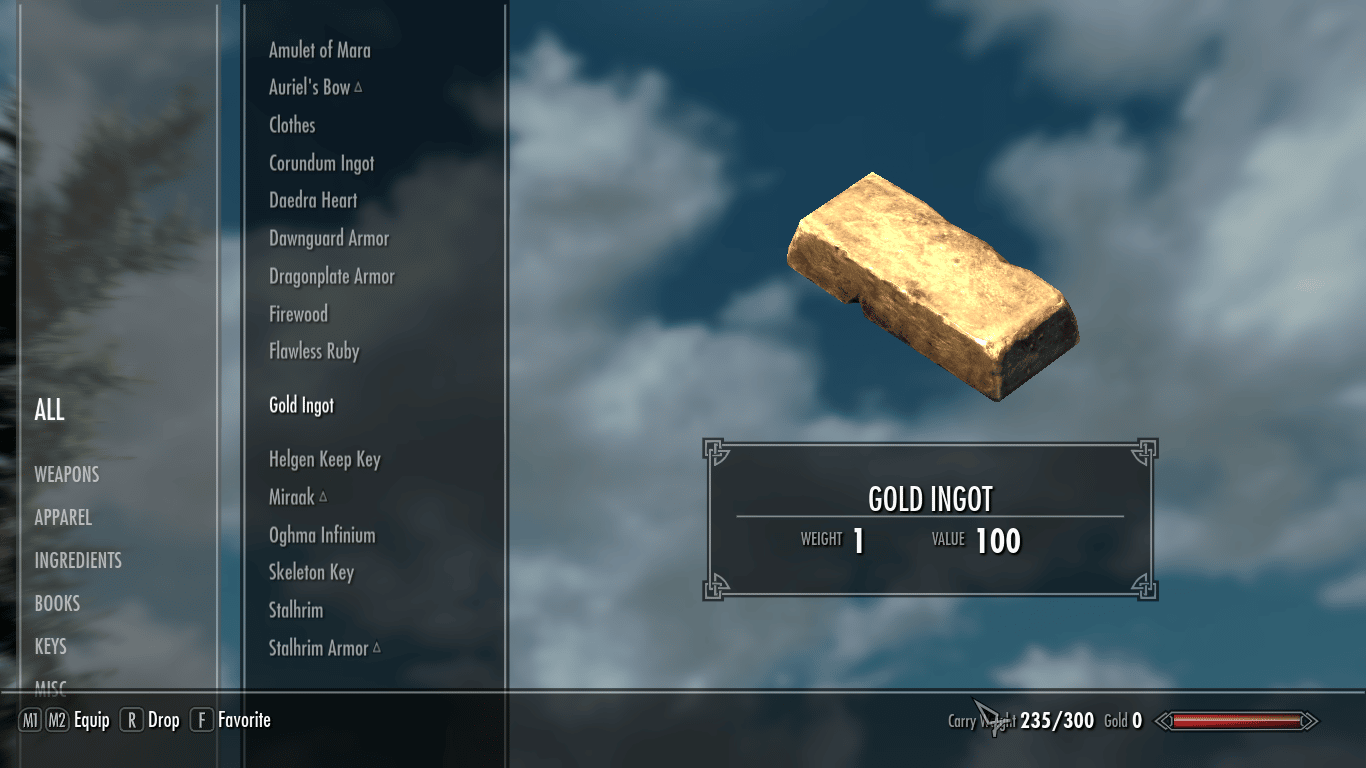

Unlock Skyrim’s Golden Secret: The Skyrim Gold Ingot ID You Need to Know

Camille Nighthorse Gordon: A Legacy Forged in Courage, Leadership, and Service