The Kelley Blue Book Value: The Authority on True Car Worth

The Kelley Blue Book Value: The Authority on True Car Worth

Every automotive transaction hinges on a simple yet powerful truth: knowing a vehicle’s fair market value is essential to buying, selling, or trading with confidence. At the forefront of this evaluation stands the Kelley Blue Book (KBB), an industry standard that provides transparent, data-driven valuations used by professionals, dealers, and consumers alike.

More than just a price guide, KBB’s methodology reflects real-world supply and demand, adjusting annually to reflect market shifts, model updates, and regional pricing trends.

Whether you’re assessing a battered commuter car or a high-performance sports model, the Kelley Blue Book value serves as a trusted benchmark—grounded in rigorous analysis and updated quarterly to ensure accuracy.

Understanding KBB value goes beyond knowing monthly ratings. It reveals how factors like mileage, condition, location, and demand shape worth. “The Kelley Blue Book doesn’t just assign values—it educates buyers and sellers on the true drivers of value,” says automotive analyst Dan Ross.

“A smartphone-sized depreciation gap over five years can mean tens of thousands in lost value or unexpected returns.”

As the automotive market evolves with electric vehicles, inflation, and supply chain disruptions, KBB’s role intensifies—offering real-time insights that reflect shifting consumer behavior and manufacturer demand.

Deciphering the Kelley Blue Book’s Valuation Engine

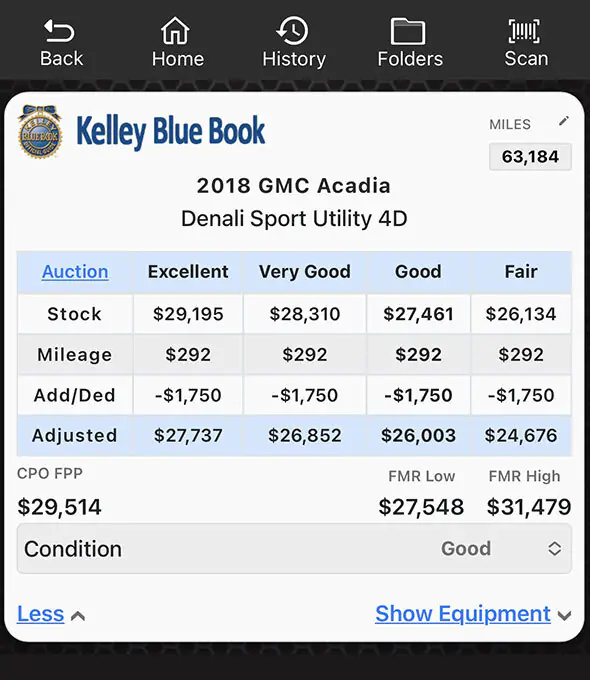

KBB’s valuation process combines decades of industry experience with modern data analytics. Unlike publicly available ratings that may lack nuance, KPP—Kelley Blue Book’s proprietary algorithm—evaluates over 30 million vehicles from dealer inventories, auction results, and certified pre-owned data to determine market-driven prices.“We don’t rely on guesswork,” explains a KBB spokesperson.

“Our value assessments reflect what buyers are actually paying in local markets, considering hidden factors like regional scarcity, trim-specific features, and brand reputation.”

- Model-Based Pricing: Each vehicle type—from sedan to SUV, electric to hybrid—is assessed within its precise category, avoiding broad generalizations.

- Condition Adjustments: Condition ratings range from “New Like New” to “Poor,” with tangible impacts: a 2023 study found a 200,000-mile weathered sedan depreciates 35% more than its pristine counterpart.

- Geographic Variability: Prices fluctuate by location; a luxury SUV might sell 15–20% higher in high-income urban areas but struggle to move in rural markets.

- Market Trends: Shifts in demand—such as rising interest in SUVs or EVs—directly influence valuation, ensuring KBB stays aligned with evolving buyer preferences.

KBB values are referenced across the automotive ecosystem—not only by private buyers but by dealerships, insurers, lenders, and trade organizations. When evaluating a used vehicle’s worth, lenders use KBB to determine loan eligibility and resale value, while insurers reference it for accurate coverage assessments.

For example, a 2024 KBB report highlighted that electric vehicles with battery degradation above 10% command约15–20% lower values in secondary markets, underscoring how technological features directly impact financial worth.

Why Kelley Blue Book Value Outlasts Competitors

What sets KBB apart is its commitment to objectivity and consistency.While online calculators may oversimplify value into broad percentile rankings, KBB’s detailed breakdowns empower users to understand exactly what drives a price—mileage, accident history, optional packages, and regional demand.

“One strong selling point of KBB is its standardization,” notes automotive researcher Laura Kim. “You compare apples to apples, not guesswork.

That level of clarity builds trust.”

Moreover, annual updates ensure values reflect current realities. Inflation, semiconductor shortages, and green vehicle incentives continuously reshape the market—KBB tracks these shifts with quarterly recalibrations rather than yearly snapshots.

For used car dealers, KBB serves as both a diagnostic tool and a strategic asset.

“Knowing KBB values helps us price inventory correctly,” says Mike Chen, industry consultant and former KBB executive. “Without it, dealers risk underpricing premium vehicles or overpaying on d規ctive ones. With it, we align with buyer expectations and accelerate resale.”

Similarly, consumers armed with KBB data negotiate with confidence.

A family planning to sell their 2020 Honda Accord can reference KBB’s “애 remaining value projections—avoiding emotional bargaining and locking in fair return.”

Real-World Impact: How KBB Shapes Market Decisions

Consider the case of a 2018 BMW X5 with 75,000 miles. Using KBB’s 2024 baseline, a “Good Condition” valuation sits around $72,000. However, a specialized review revealing low enrollment in battery range and interior wear might lower the adjusted value by 8–10%—to roughly $68,000.This nuanced breakdown prevents buyers from overpaying and sellers from setting unrealistic listings.

In electric vehicle markets, KBB’s emerging emphasis on battery health and charging compatibility sets a new standard for transparency. “EVs depreciate on more than mileage—their ability to retain battery capacity is now central,” says Ross.

“KBB reflects that by quantifying degradation and factoring in upgradability trends.”

For fleet operators and rental companies, accurate valuation directly affects fleet cost management. Purchasing used electric delivery vans at KBB-aligned values ensures proportional depreciation over lease terms, minimizing unexpected financial hitches. Similarly, insurance providers rely on KBB data to price comprehensive coverage, linking coverage rates to demonstrated resale lifespans.

The Evolving Role of Kelley Blue Book in a Changing Market

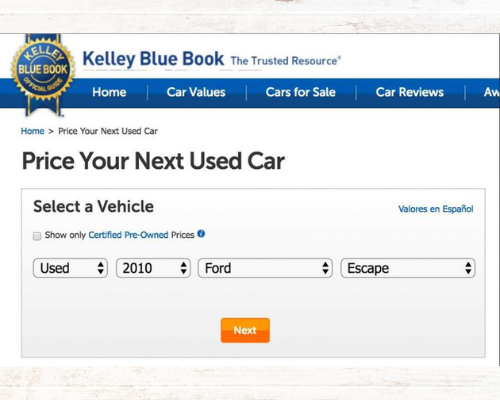

As the automotive landscape transforms—electric mobility, autonomous features, and shifting consumer priorities—the relevance of objective valuation tools grows.Mobile apps and real-time valuation tools have democratized access to KBB data, allowing anyone to check true market value on the go.

“We’ve moved beyond static catalogs to dynamic digital platforms,” notes KBB’s digital strategy lead. “Buyers and sellers now receive instant valuation updates based on updated vehicle data, ensuring street-legal fairness in every transaction.”

With rising uncertainty in new vehicle pricing—fluctuating steel costs, tariffs, and supply bottlenecks—KBB’s real-time, data-backed insights remain indispensable for financial planning and risk mitigation.

Moreover, KBB’s integration with emerging market trends, such as performance upgrades, aftermarket modifications, and certified pre-owned quality, broadens its applicability. “Tesla owners no longer face arbitrary bets on resale,” argues Kim. “With KBB’s inclusion of battery age, driving cycles, and software status, EV traders have a reliable framework rooted in market reality.”

How Buyers and Sellers Can Maximize KBB Value

For consumers, leveraging KBB value starts with thorough preparation: document all miles, note maintenance history, and verify condition with photos.Use KBB’s “Incentage” tool to compare offer apps like CarGurus and Autotrader against its fair market value. This dual-check method reduces information asymmetry and levels the playing field.

“Proactive documentation doesn’t just strengthen your negotiation,” says consumer advisor Elena Torres.

“It gives you leverage when getting a fair deal in a fast-moving market.”

For sellers, pricing a vehicle conservatively—just under KBB’s estimated fair value—attracts quick interest. Overpricing leads to prolonged listing without action; underpricing leaves money on the table. “It’s a balance,” adds Chen.

“Use KBB not to dictate price but to anchor realistic expectations.”

Used car fixers and prepper shops benefit too. “Documenting each service date, mileage spacing, and replacement parts justifies outreach,” says David Moore, founder of a renovation service. “KBB-grounded valuations make your pitch credible to interested buyers.”

Workshops on vehicle diagnostics and styling further enhance appeal, creating a package backed by objective data.

The Future of Auto Valuation: Kelley Blue Book’s Enduring Leadership

Looking ahead, Kelley Blue Book’s influence shows no signs of waning. As electric and connected vehicles redefine ownership, the book’s rigorous, market-responsive framework evolves in lockstep.“The core principle remains: value is dynamic, but truth is timeless,” closes Ross.

“KBB gives users not just numbers, but direction—empowering smarter decisions in a volatile market.”

Whether you’re buying your first used car, centralizing a fleet, or appraising a collector’s rare convertible, Kube Blue Book value stands as the gold standard—unwavering, actionable, and essential. In an industry driven by obsolescence and uncertainty, objective valuation isn’t just helpful—it’s indispensable.

Related Post

What Is Kbb Understanding Kelley Blue Book Values? Decoding Car Value Verification

Unveiling The Secrets Of Gio Helou: Insights For Success

Star News Mugshots Reveal What’s Behind Brunswick County’s Most Memorable Criminal Faces

Synthetic Biologics Stocks Soaring: A Deep Dive into Price Trends, Analytical Drivers, and Future Predictions