The Silent Watchers: Income Tax Authorities Shaping Global Finance

The Silent Watchers: Income Tax Authorities Shaping Global Finance

Across nations and economies, tax authorities operate as the guardians of fiscal integrity—powerful, precise institutions that enforce tax compliance, detect evasion, and ensure governments collect their rightful revenue. These bodies, from the IRS in the United States to HMRC in the United Kingdom and the Bundeszentralamt in Germany, wield far more influence than many realize. They are not merely tax collectors but essential pillars of public trust, shaping how individuals and corporations contribute to societal infrastructure.

With digital transformation accelerating, these agencies are evolving rapidly, adopting advanced data analytics, artificial intelligence, and cross-border cooperation to maintain revenue fairness in an increasingly complex financial landscape.

Income tax authorities navigate a dual mission: maximizing tax compliance while fostering voluntary cooperation with taxpayers. Their role extends beyond audits and penalties—though these remain critical deterrents—into education, digital service delivery, and strategic enforcement.

For example, the U.S. Internal Revenue Service (IRS) recently launched enhanced taxpayer assistance platforms combining AI chatbots and live advisors, reducing processing times and improving access to crucial tax guidance. "Our goal is to make tax compliance simpler, not steeper," stated IRS Commissioner Davita Stevenson in a recent testimony.

"When taxpayers understand their obligations—and see the benefits of their contributions—they become partners in a shared responsibility."

One of the most transformative shifts in recent years has been the rise of data-driven enforcement. Income tax authorities now harness vast datasets from financial institutions, digital platforms, and international exchanges to identify inconsistencies and high-risk behaviors. The Common Reporting Standard (CRS), coordinated by the OECD, exemplifies this trend: over 100 jurisdictions, including France, Australia, and Japan, automatically exchange financial account information annually, significantly reducing offshore tax evasion.

In the UK, Her Majesty’s Revenue and Customs (HMRC) employs machine learning algorithms to flag anomalies in over 200 million tax returns, resulting in tens of millions in additional revenue each year. "Advanced analytics let us detect patterns invisible to traditional reviews," explained HMRC’s Director of Compliance, Mark Bush. "This isn’t just about catching cheats—it’s about ensuring every citizen pays the right amount based on their true economic engagement."

Yet enforcement remains grounded in fairness and transparency.

Tax authorities increasingly emphasize risk-based audits—targeting non-compliance without burdening compliant taxpayers. This targeted approach reduces administrative costs and preserves trust. Germany’s Federal Central Tax Office, for instance, uses predictive modeling to assess risk across millions of filers, focusing scrutiny on high-risk cases while streamlining services for the majority.

Equally important is international coordination. Initiatives like the OECD’s Base Erosion and Profit Shifting (BEPS) project bind tax authorities in a collaborative front against multinational tax avoidance, closing loopholes exploited by global corporations. "Taxation knows no borders," remarked a senior German tax official at a recent forum.

"When one country strengthens its stance, it levels the playing field worldwide."

Digital transformation defines the modern mandate. Tax authorities deploy e-filing systems, mobile apps, and real-time reporting tools to lower barriers and increase accuracy. South Korea’s National Tax Service (NTS) offers near-instant filing with automatic reconciliation, cutting processing times from weeks to minutes.

Meanwhile, Brazil’s Cartório de recibos e informações integrates blockchain for secure transaction logging, enhancing auditability and reducing fraud. These innovations do more than improve efficiency—they reshape taxpayer experience, turning what was once a stressful obligation into a seamless, transparent process.

Critics highlight concerns about privacy and overreach, especially as authorities expand surveillance capabilities.

But most agencies operate under strict legal frameworks emphasizing data protection and due process. The European Union’s GDPR, for example, mandates stringent controls over personal financial data held by tax bodies, ensuring accountability. “Transparency and public trust are non-negotiable,” stated a spokesperson from the IRS.

“We publish annual reports detailing enforcement actions, data safeguards, and taxpayer rights, giving citizens clear insight into how their information is used.”

As economies grow

Related Post

Inside the Backroom Power: The Essential Roles and Responsibilities of Income Tax Authorities

Coffin Ombre Nail Designs: The Perfect Way to Express Your Unique Style with 55 Summer-Inspired Shades

Master Southwest’s Luggage Rules: Pack Smart, Fly Lighter, and Avoid the Stress

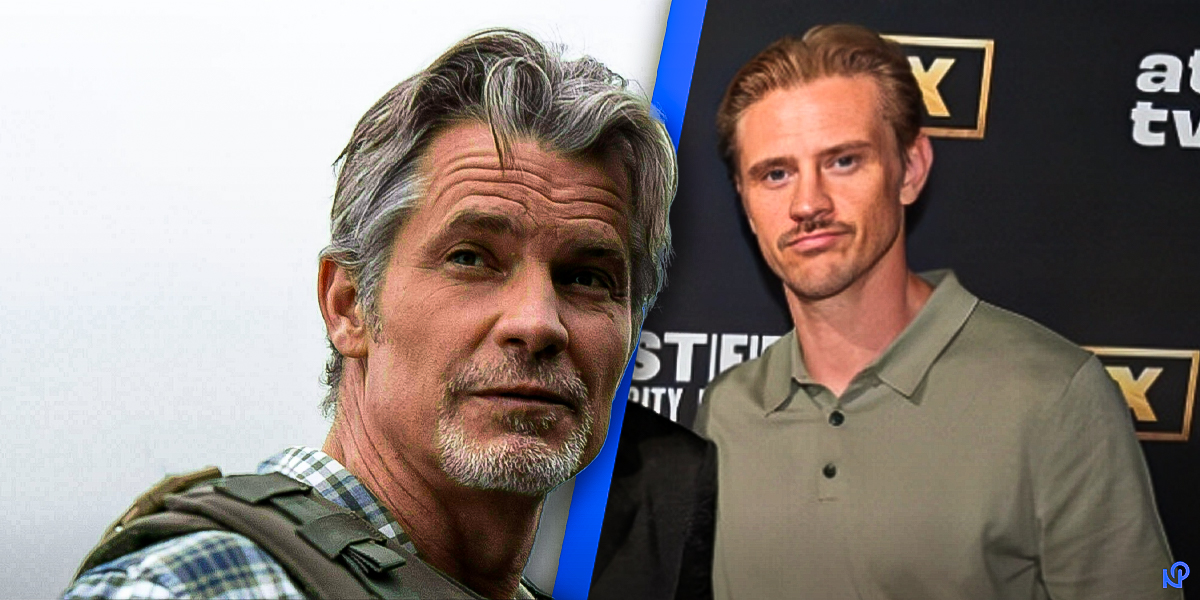

Henry Olyphant: The Resilient Pioneer Who Defined Mechanical Engineering in the U.S.