Top Binary Options Trading Bots: The Ultimate Guide to Automating High-Stakes Trading

Top Binary Options Trading Bots: The Ultimate Guide to Automating High-Stakes Trading

In an era where algorithmic precision meets the volatile world of global markets, traders are increasingly turning to binary options trading bots to reclaim control, speed, and consistency. These specialized software tools automate decision-making across binary finance, leveraging pre-programmed strategies to execute trades in milliseconds—something human traders simply cannot match. As competition intensifies and market windows shrink, top binary options trading bots are emerging as critical instruments for professionals and retail traders alike, offering a blend of speed, scalability, and data-driven insights that redefine modern trading discipline.

What Are Binary Options Trading Bots—and Why They Matter Binary options trading bots are automated software platforms designed to analyze real-time price movements, assess market trends, and execute trades based on predefined criteria. Unlike manual trading, which relies heavily on human judgment, these bots operate 24/7, identifying profitable patterns through technical indicators, price momentum, and volatility signals. They bridge the gap between emotional decision-making and cold, analytical precision, turning complex market data into actionable trades with minimal human input.

For busy professionals juggling multiple deals, or retail traders seeking to scale strategies, the ability to automate is no longer optional—it’s a competitive necessity.

How Top Binary Options Trading Bots Improve Strategy Execution

Top-tier bots don’t just mimic human trades—they optimize them. Many leverage advanced algorithms rooted in machine learning and high-frequency data processing to enhance timing, reduce slippage, and improve risk-reward ratios.These tools dissect market micro-movements in real time, adjusting entry and exit points dynamically based on live data feeds. Key advantages include:

- Speed & Precision: Bots execute trades in fractions of a second, capitalizing on fleeting opportunities that disappear long before human reflexes can react.

- Reduced Emotional Bias: Automation eliminates fear, greed, and impulsive decisions, ensuring adherence to strict, pre-defined rules.

- Scalability: A single bot can monitor multiple markets across global exchanges simultaneously, expanding trading efficiency without increasing workload.

- Historical Validation: Leading platforms test strategies against vast historical datasets, refining algorithms to maximize win rates and minimize drawdowns.

Take, for instance, AutoBot Pro, widely cited as a market leader for its adaptive neural network architecture. This bot doesn’t just follow static rules—it learns from past market behavior, adjusting accordingly in response to shifts in volatility or liquidity.

As one verified user noted, “Using AutoBot Pro changed my trading rhythm—trades now feel calculated, not guessed.”

Core Features That Define Market-Leading Binary Trading Bots

Not all trading bots are created equal. The most effective systems share a suite of advanced capabilities engineered for real-world performance:- Multi-Market Support: Top bots operate across major exchanges such as Binance, IG, and TradingT Bever, enabling seamless diversification across currencies, commodities, and indices.

- Custom Strategy Builder: Users can design tailored trading rules—from time-based triggers to indicator overlays—giving precise control over when and how trades are opened.

- Risk Management Engine: Automatic position sizing, stop-loss enforcement, and real-time drawdown alerts protect capital without constant oversight.

- Real-Time Analytics Dashboard: Comprehensive performance tracking visualizes win rates, trade frequency, and cumulative ROI, empowering data-driven optimization.

- Webhook & API Integration: Bots connect seamlessly with brokers, slicing milliseconds off latency and enabling instant order execution.

Take TradeMaster Bot—a standout platform praised for its intuitive interface and robust automation. With one-click deployment and AI-powered pattern recognition, it caters to both beginners and advanced traders seeking reliability and adaptability.

“TradeMaster transformed my approach,” says long-time user Elena Morozova, “No more endless backtesting; now every trade feels intentional.”

The Landscape of Top-rated Binary Options Trading Bots

While thousands of bots populate the market, only a select few have earned consistent acclaim for performance, transparency, and user support. Industry analysts highlight several key players consistently ranking among the best:1. TradeMaster Bot — Renowned for adaptive learning, cross-market capabilities, and a drug-friendly UI, it excels at learning from market dynamics and refining strategies on the fly.

Users report improved consistency and scalability, especially across volatile assets like crypto pairs.

2. AutoBot Pro — Backed by proprietary machine learning models, this bot combines strict risk controls with high-frequency signal generation. Users emphasize its precision and reliability in live trading conditions.

3.

MarketPulse Bot — Favored for its deep technical analysis engine and real-time news integration, translating market sentiment into actionable trade signals with minimal manual input.

4. BinaryFlow — A newer contender gaining traction with a focus on low-latency execution and seamless multi-exchange support, appealing to fast-paced scalpers and arbitrage specialists.

Each of these bots offers distinct strengths, but their shared value lies in merging computational strength with user-centric design—eliminating barriers to professional-grade trading without sacrificing control.

Proven Strategies: Beyond Automation—Smart Use of Binary Bots

Effective binary options trading bots are not silver bullets; their success hinges on thoughtful strategy integration. Top users pair automation with disciplined planning: - Defining clear risk tolerance and win/loss targets before deployment.- Combining bot signals with fundamental market awareness, especially when trading less liquid instruments. - Regularly reviewing performance dashboards to refine parameters and respond to evolving market regimes. - Starting with small capital allocations to test bot behavior before scaling exposure.

“Automation removes the guesswork, but strategy builds the edge,” explains trading consultant Rajiv Patel. “The best bots amplify smart decisions—don’t automate blindly.”

Consider SwingSprout, a bot optimized for intermediate-term trends. By integrating MACD and RSI indicators with volume analysis, it identifies carve-out opportunities over hours or days, allowing traders to balance scalping with longer-term positioning.

This hybrid approach exemplifies how top bots elevate—not replace—strategic thinking.

Risk Assessment: Navigating Volatility with Confidence

Despite their precision, binary options trading bots operate in inherently uncertain markets. Price swings, liquidity crunches, and sudden news events can trigger swift losses. The most advanced platforms mitigate these threats with fail-safes such as pre-trade risk checks, automatic pauses during extreme volatility, and comprehensive audit logs.However, users must accept that no bot can eliminate risk—only manage it. Transparent communication from bot developers, rigorous backtesting, and continuous monitoring remain essential. As industry standards warn, “Automation enhances control, but informed awareness remains your first line of defense.”

Leading providers like QuickPro Bot publish detailed risk disclosures and offer educational resources to empower traders with context—turning technical tools into trusted companions rather than opaque black boxes.

In essence, binary options trading bots are not about replacing traders, but transforming how they operate—converting instinct into system, chaos into clarity, and reaction into strategy.

When chosen with clarity and deployed with discipline, top bots become more than tools: they are accelerators of growth, reliability, and sustainable profitability in one of finance’s most demanding arenas.

Related Post

RSVP Like a Pro Easy Guide to Responding to Invitations with Confidence

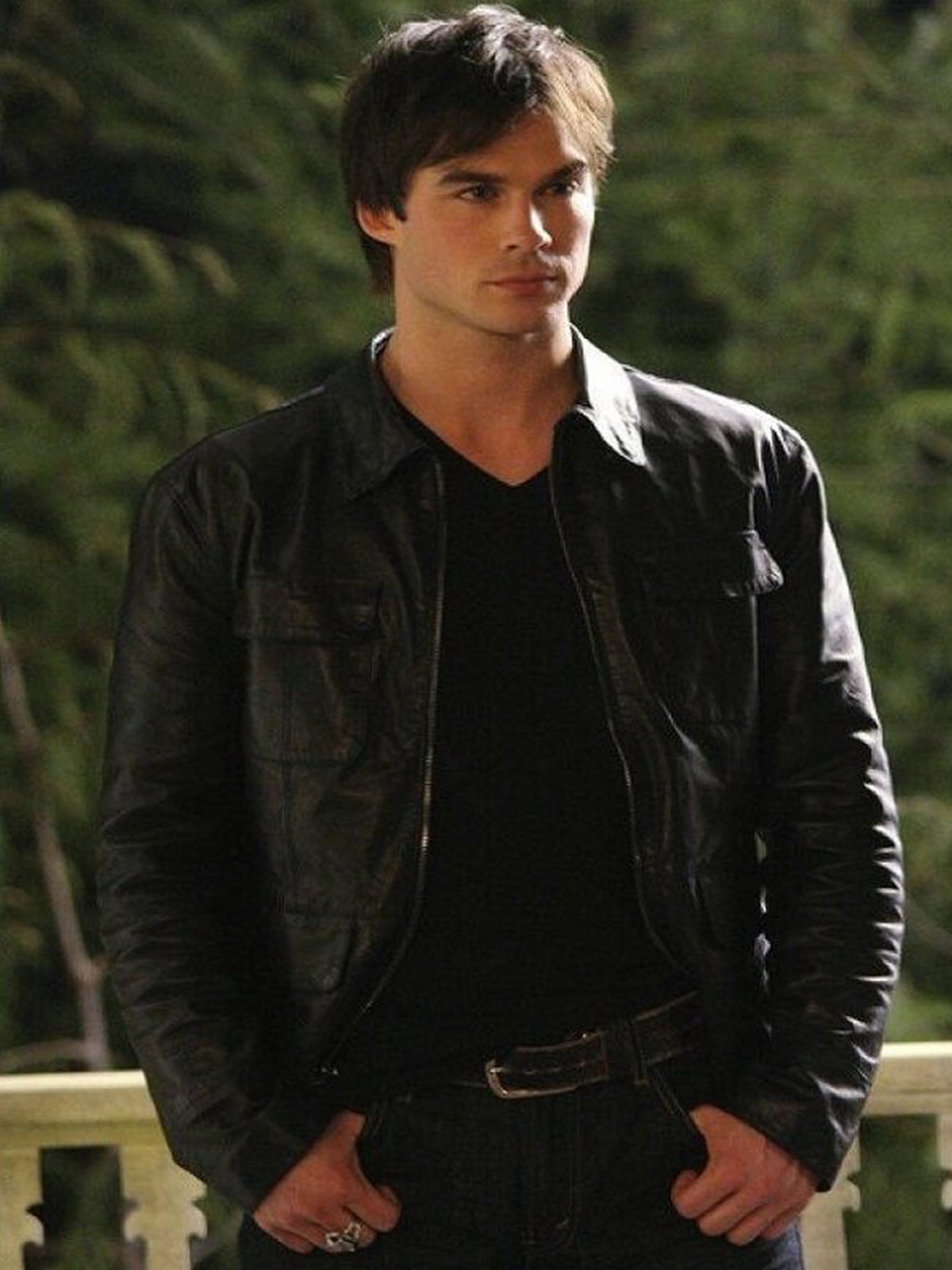

Damon Salvatore: The Archetypal Vampire Guardian in The Vampire Diaries

Map of Red and Blue: Decoding America’s Political Divide in Color

The Unfinished Symphony: The Story Behind Linkin Park’s “Numb” Encore with Jay Z