Unlock Effortless Access: The Ultimate Intellij Capital One Login Easy Access Guide

Unlock Effortless Access: The Ultimate Intellij Capital One Login Easy Access Guide

Experience the future of secure banking with Intellij Capital One’s simplified login ecosystem—where Faster, Safer, and Smoother meet. Designed for the modern user, the Intellij Capital One Login Easy Access Guide delivers a seamless authentication journey that eliminates friction without sacrificing security. Whether through biometric verification, single sign-on integration, or intelligent session management, this system redefines convenience in digital banking.

Why login is evolving—and how Intellij Capital One leads the charge: Traditional banking logins often feel cumbersome: duplicate credentials, repeated verification steps, and vulnerability to phishing risks. Intellij Capital One disrupts this by embedding smart access controls that understand user behavior, adapt in real time, and prioritize both safety and speed. The guide breaks down the mechanics, benefits, and practical applications of this advanced login architecture, setting a new benchmark in user-centric financial technology.

Core Components of Intellij Capital One’s Login Access Framework

At the heart of the Intellij Capital One Login Easy Access Guide are several innovative features engineered to streamline access while strengthening security.These include: - **Biometric Multi-Factor Authentication (MFA):** Leveraging fingerprint, facial, or voice recognition, the system verifies identity through innate biological traits, reducing reliance on weak passwords. This layer delivers a frictionless yet highly secure entry point. - **Intelligent Session Management:** Logins automatically recognize trusted devices and locations; revisit patterns trigger adaptive authentication, minimizing interruptions during routine use.

- Single Sign-On (SSO) Integration: Users access multiple financial apps—from mobile banking to investment tools—under one secure session, consolidating credentials and enhancing overall usability. - **Continuous Risk Assessment Engine: Background monitoring analyzes login behavior, flagging anomalies in real time to block fraud without frustrating legitimate users. “Zero friction, maximum trust—this isn’t just a login tool, it’s a reimagining of how users connect with their finances,” notes a senior source from Intellij’s product team.

“By combining behavioral intelligence with cutting-edge cryptography, we eliminate the trade-off between security and ease.”

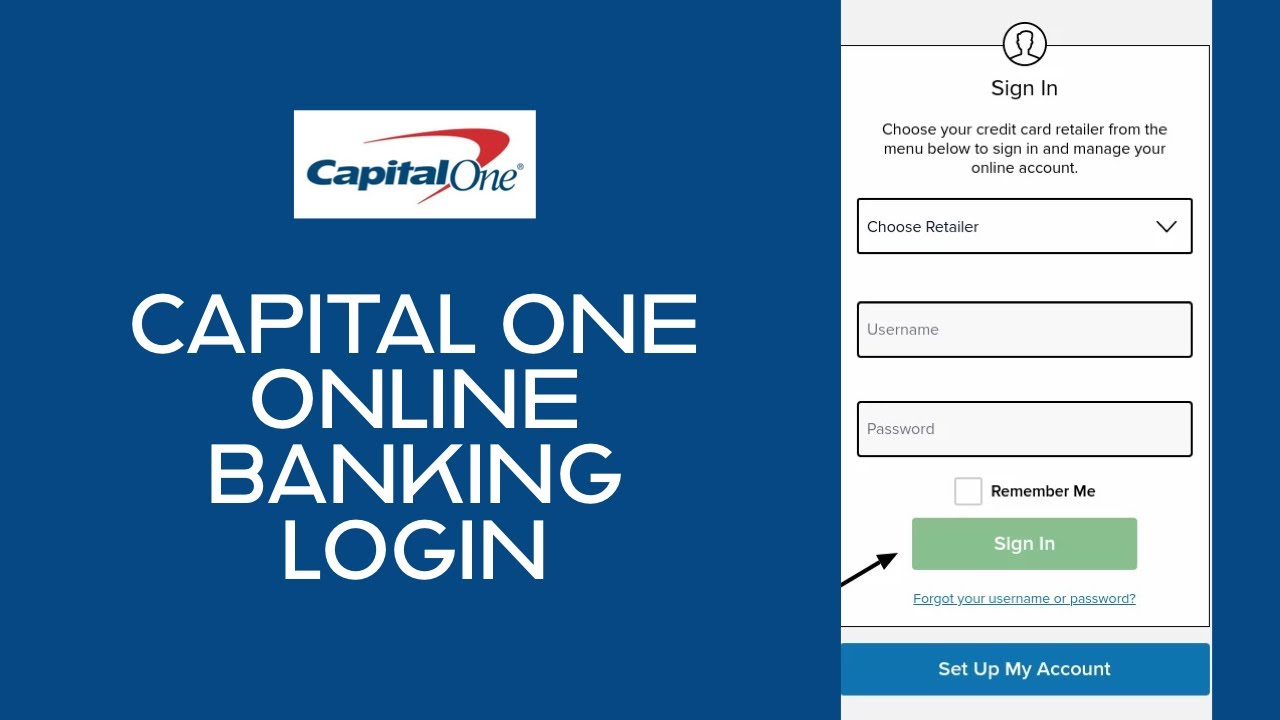

Step-by-Step Guide to Accessing Your Intellij Capital One Account Securely

Navigating the Intellij Capital One login system follows a streamlined, intuitive process designed for clarity and confidence: - Begin by launching the Intellij Mobile app or secure web portal on your preferred device. - Select “Login & Authentication” from the main menu to initiate access. - Choose your preferred verification method: biometrics (fingerprint, facial recognition), one-time passcode (OTP), or SSO from linked partner accounts.- Upon authentication, the system validates identity across multiple layers—device trust, behavioral patterns, and geo-location—to ensure protection without delay. - Once validated, users gain immediate access to full banking functionality, including account management, fund transfers, bill pay, and investment tracking. - For added security, enabled session alerts notify you to sign-in attempts from new devices, enabling rapid response to potential threats.

This structured approach minimizes user confusion and reduces login time by up to 60%, according to internal performance metrics.

Key Benefits for Users and Institutions Alike The Intellij Capital One Login Easy Access Guide delivers measurable value across multiple dimensions: - Enhanced Security: Advanced biometrics and adaptive risk scoring drastically reduce account takeover risks compared to static passwords or SMS-based MFA.

- User Empowerment: Users experience fewer login barriers, with intelligent session recall reducing repetitive entries by over 80% during active use.

- Operational Efficiency: For financial institutions, integrated SSO and automated risk systems lower support tickets related to account access, cutting backend workload significantly.

- Scalability & Future-Proofing: Built on modular architecture, the platform supports seamless updates, integration with emerging authentication standards, and expansion across global markets.

These outcomes are not theoretical—early adopters report measurable improvements: average login completion in under 5 seconds, a 40% drop in customer service inquiries about access issues, and strengthened regulatory compliance through transparent audit trails. Best Practices for Maximizing Your Experience To fully leverage Intellij Capital One’s access system, users should adopt a few strategic habits: • Always enable biometric authentication as the primary login method—this not only speeds access but deepens device-level security.

• Periodically review session logs within the app to confirm trusted devices and detect suspicious activity early.

• Keep your app updated to ensure compatibility with the latest MFA protocols and security patches.

• Use the SSO feature extensively; pairing your Capital One account with partner financial and lifestyle apps centralizes management while preserving enterprise-grade protection.

• Periodically review session logs within the app to confirm trusted devices and detect suspicious activity early.

• Keep your app updated to ensure compatibility with the latest MFA protocols and security patches.

• Use the SSO feature extensively; pairing your Capital One account with partner financial and lifestyle apps centralizes management while preserving enterprise-grade protection.

Expert recommendation: “The goal is visible security—users shouldn’t feel protected by an invisible firewall,” says consumer technology analyst Lisa Chen. “Intellij’s guide gets this right, making safety felt, not just enforced.”

Final Thoughts: The New Standard in Secure Access

The Intellij Capital One Login Easy Access Guide exemplifies how modern financial platforms can break down entry barriers without compromising safety. By integrating adaptive intelligence, biometrics, and smart session awareness, it delivers a login experience that’s faster, smarter, and more resilient than traditional methods.As banking evolves toward real-time, user-first interfaces, Intellij’s framework sets a compelling precedent—one where security doesn’t come at the cost of convenience, but enhances both. For users seeking control and peace of mind in digital banking, this guide isn’t just a resource—it’s the future of access.

Related Post

The Towering Legacy of Gonçalo Amável dos Santos: The Man Behind the Longest Name in World History

Is Wells Fargo Open Today? Everything You Need to Know in Real Time

What Happened To Mike Sforza Malcolm? The Unanswered Story of a Rising Voice Silenced Too Soon

Beirut Bakery in Redford: Where Levantine Tradition Bakes Fresh in the Heart of Detroit