Unlock Hidden Wealth: How the Present Value Calculator Powers Smart Financial Decisions

Unlock Hidden Wealth: How the Present Value Calculator Powers Smart Financial Decisions

Every investment decision hinges on one fundamental question: how much is money worth today, given its potential future returns? The Present Value Calculator silences uncertainty by translating future cash flows into today’s dollars—transforming speculation into clarity. Whether evaluating a business acquisition, comparing investment alternatives, or assessing loan terms, this essential tool quantifies the time value of money with precision.

By discounting prospective earnings to their current worth, the calculator enables individuals and institutions alike to make data-driven choices that align with long-term financial goals.

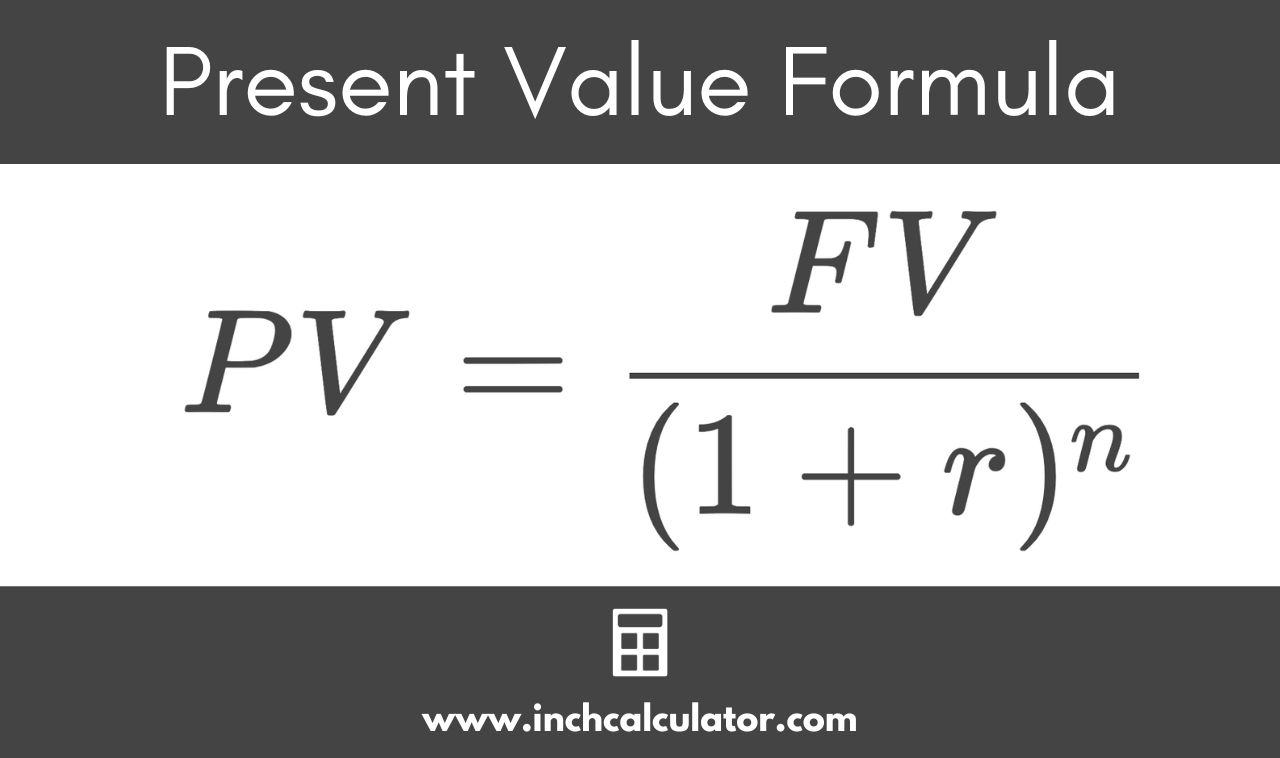

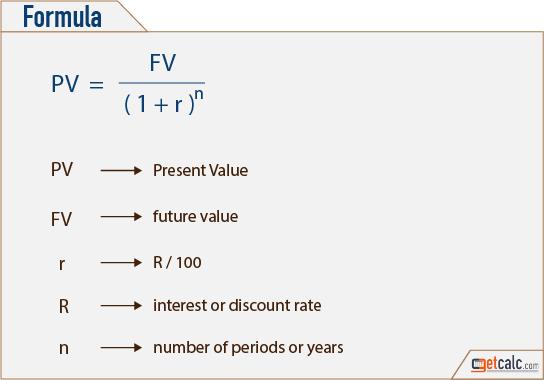

At its core, the Present Value (PV) represents the current worth of a future sum of money, adjusted for time and risk. The formula—PV = FV / (1 + r)^n—might appear mathematical, but its practical impact is profoundly human.

Consider a potential investment promising $100,000 in ten years. Without discounting, that amount seems equal to today’s dollar, but due to inflation, opportunity cost, and market risk, its real value declines. The Present Value Calculator reveals the true displacement: how many today’s dollars would equal $100,000 collected a decade hence, assuming a specific discount rate.

This shift from variable potential to fixed present value empowers investors to compare disparate opportunities on a single financial plane.

Mastering the Mechanics: How the Present Value Calculator Works

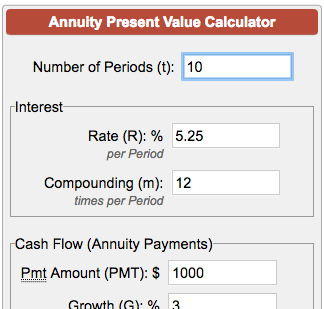

The Present Value Calculator operates on a deceptively simple principle: it erodes future cash flows by applying a discount rate that reflects the expected return of risk-free alternatives—typically bond yields—or the investor’s required rate of return. This rate accounts not only for time but also for the risk inherent in the cash flow stream. The result is a tangible figure representing today’s purchasing power, free from inflationary distortion and opportunity loss.When inputting data into a reliable Present Value Calculator, users define four core inputs: - Future Value (FV): the target lump sum to be received. - Discount Rate (r): an estimate of the minimum return needed for acceptable risk, often derived from government bond yields or projected internal rates of return. - Number of Periods (n): the time horizon from today to when the payment arrives, typically in years.

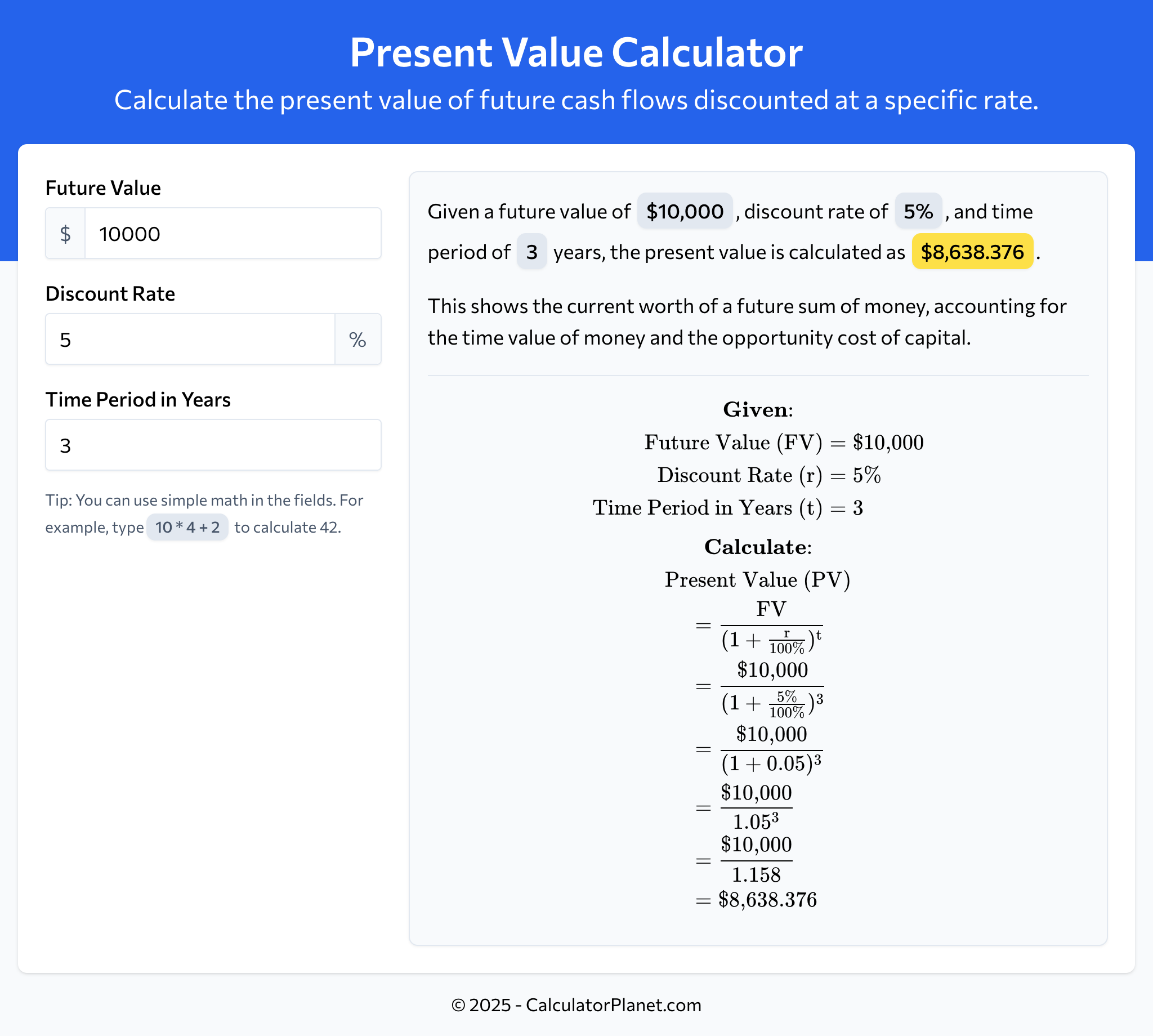

- Payment Frequency (optional): frequency (annual, quarterly, monthly) depending on whether cash flows occur in discrete intervals. With these inputs, the calculator applies exponential discounting—applying compound interest backward in time. For single payments, the formula simplifies to PV = FV / (1 + r)^n, but compounding frequency introduces nuances: monthly payments require adjustments using effective annual rates to preserve accuracy.

Example: Suppose you’re evaluating a bond offering €150,000 in 7 years and expect a 4.2% annual return. Using a monthly compounding calculator, the present value today is calculated as: PV = 150,000 / (1 + 0.042/12)^(7×12) ≈ €137,920. This means €137,920 invested now at 4.2% would grow to €150,000 in seven years—illustrating how the tool converts future promise into present ground reality.

The Calculator’s power lies not just in computation, but in transparency. Unlike opaque financial models, it lays bare the time value mechanics, fostering trust and eliminating guesswork. Investors gain clarity on whether a deal’s present value exceeds projected returns—leading to more disciplined capital allocation.

Applications Beyond Theory: Real-World Use Cases

Business planners deploy Present Value Calculators to assess project viability, comparing initial outlays against discounted future revenues.A tech startup projecting $500,000 annual income for five years might discount at 8%, revealing whether net present value justifies seed funding. Similarly, real estate investors use the tool to compare rental cash flows across properties, adjusting location risk and inflation expectations into present power. When financing debt, lenders and borrowers evaluate loan repayments by comparing present costs to future obligations.

A 30-year mortgage with fixed payments combines seamlessly with PV logic: each monthly payment’s present value equals the loan principle; total PV of payments equals the borrowed sum, ensuring balance. Personal finance applications extend even further. Homebuyers compare loan offers—some front-loaded payments, others spread evenly—using PV to quantify long-term cost differences.

Retirees estimate how much savings today can generate steady income, discounting life-span cash streams against market benchmarks. The Calculator turns abstract terms like “net present value” into explicit, actionable insights.

The Future of Value: Why Present Value Remains Indispensable As financial markets evolve with faster data flows and complex instruments, the Present Value Calculator endures as a cornerstone of rational decision-making.

It demystifies time, risk, and return, ensuring investors don’t chase illusions but anchor choices in measurable reality. Whether evaluating a small mutual fund or a multibillion-dollar infrastructure bond, the tool distills complexity into clarity. In an era of instant information, the Present Value Calculator remains a trusted partner—cutting through noise to reveal the economic truth beneath promises.

It isn’t merely a calculator; it’s a lens through which future value becomes visible, empowering smarter, more confident financial choices. For anyone seeking to grow wealth with precision and purpose, mastering this tool is not optional—it’s essential.

Related Post

Unveiling the Life of Jennifer Canaga: A Journey Woven with Passion, Resilience, and Inspiration

Indepth Look At Jackyline Knipfing Life Career And Impact

Lidl Zimt Deutschland: The Uncompromised Standard of Premium Quality Cinnamon

Social Media’s Lifeline When Home Internet Fails: The Rise of Solusi WiFi Viberlink Tidak Ada Internet