Unlock Your Drive: How Santander Auto Loan Login Shapes Modern Car Financing

Unlock Your Drive: How Santander Auto Loan Login Shapes Modern Car Financing

Accessing your Santander Auto Loan Loan through the dedicated login platform isn’t just a transaction—it’s a streamlined gateway to financial flexibility for vehicle ownership. Designed with convenience and security in mind, the Santander Auto Loan Login interface empowers borrowers to manage loan applications, track repayments, and adjust terms with unprecedented ease. In an era where digital banking defines financial expectations, Santander’s platform delivers clarity and control, transforming vehicle financing from a cumbersome process into a seamless experience.

At the heart of the Santander Auto Loan Login service lies a user-first design tailored to meet the demands of today’s mobile-first consumers. Users begin by securely entering their credentials—typically a corporate ID tied to Santander’s financial ecosystem or individual Bank Santander account details—to initiate or manage a loan. “Our goal was to reduce friction at every step,” says Maria Lopez, Senior Product Manager at Santander Auto Finance.

“With intuitive navigation and real-time data, customers no longer juggle paperwork or wait for manual verification.” The login page features quick access to application status, repayment schedules, and eligibility alerts, enabling proactive financial oversight.

Right from login, borrowers enjoy a customized dashboard displaying key loan metrics: outstanding balance, due dates, payment history, and upcoming reminders. This transparency supports responsible borrowing while enhancing financial literacy.

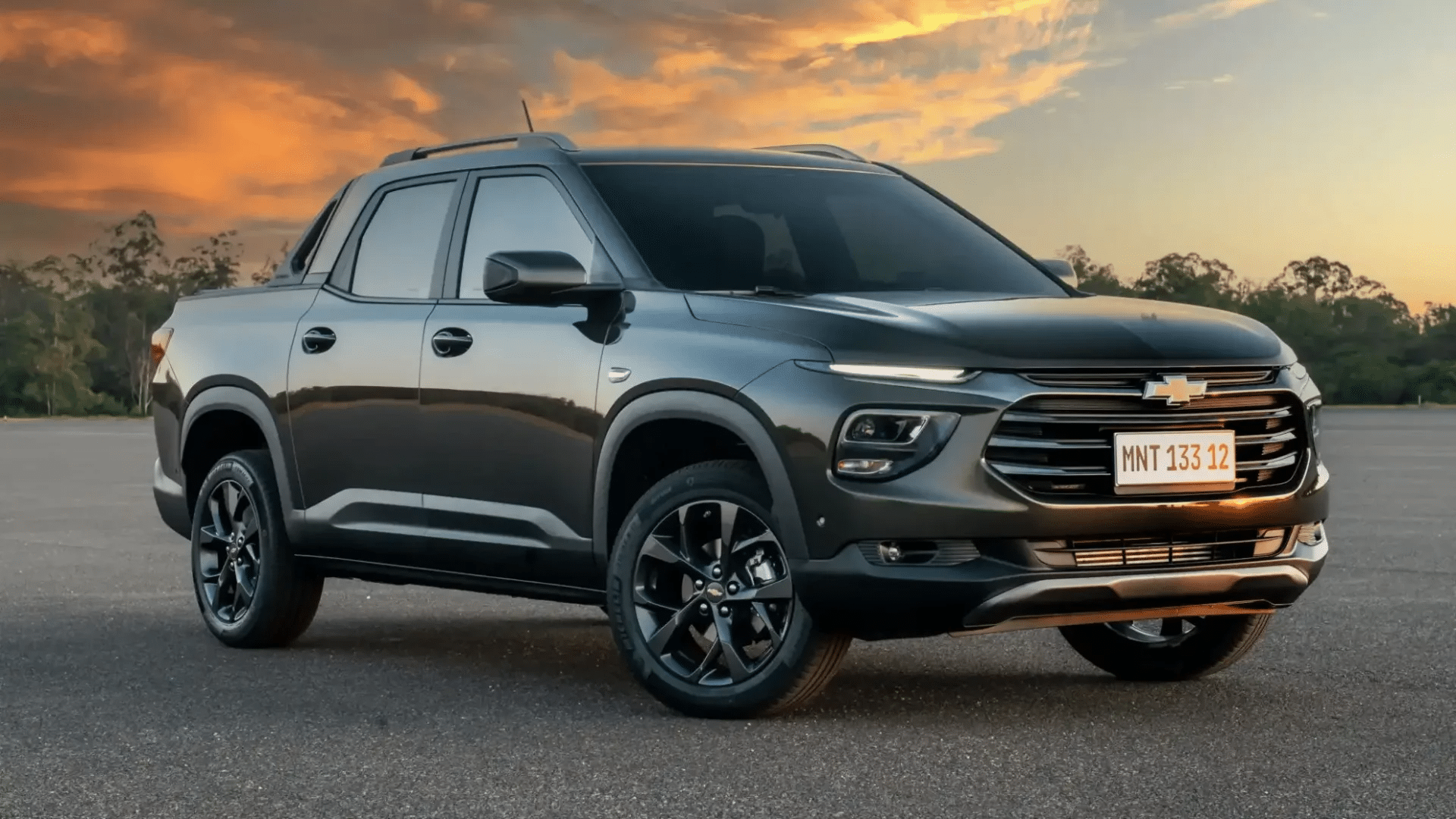

Unlike traditional bank portals, Santander’s interface integrates vehicle-specific customization—after approval, users can update loan terms such as repayment period or interest rate when planning additional financing, like extending coverage or refinancing mid-term. “The flexibility built into the platform reflects Santander’s commitment to evolving with customer needs,” notes Lopez. “Many auto loan clients later transition to full account management, using the loan portal as a cornerstone of their broader banking experience.”

Security remains non-negotiable.

The login system employs end-to-end encryption and multi-factor authentication to safeguard sensitive financial data. Biometric login options—fingerprint or facial recognition—are available on mobile devices, adding layers of protection without compromising convenience. “Trust is built through consistency,” emphasizes the security team.

“Every login session is monitored, and anomalies trigger immediate alerts, ensuring users stay in control at all times.” Regular audits and compliance with global data protection standards further reinforce the platform’s reliability.

Accessing Santander Auto Loan Login via mobile or desktop offers multi-device synchronization. Updates cascade instantly across phones, tablets, and computers, so a payment reminder logged on one device appears instantly on another.

This continuity is vital for busy professionals balancing work, family, and financial responsibilities. Integration with calendar apps provides proactive notifications—missing a payment or approaching a due date—helping users maintain consistent repayment schedules with minimal effort.

One of the most impactful features is the real-time eligibility assessment tool.

When users want to finance a new vehicle, they can instantly simulate various loan scenarios: term lengths, interest rates, and down payments—all within the login interface. “This immediate feedback reduces decision fatigue,” explains Lopez. “Borrowers see the precise impact of choices before committing, fostering confidence and smarter financial behavior.” Small changes in monthly payments drastically affect total interest costs—a dynamic explored visibly in the dashboard, demystifying the long-term implications of loan terms.

Beyond convenience, Santander Auto Loan Login supports a holistic financial journey. Post-loan, users gain access to personalized summaries, credit score updates, and optional financial planning resources—tools designed to help build long-term wealth. The interface serves as a financial hub, evolving from a transactional login to a comprehensive management platform.

Santander’s strategy reflects a growing industry trend: financial institutions are no longer just lenders but long-term partners in personal and automotive finance.

For borrowers, the Santander Auto Loan Login experience redefines ownership. It turns a single loan into a strategic asset—one that’s transparent, secure, and adaptable.

As digital transformation accelerates, platforms like Santander’s set a benchmark for how banking technology can empower individuals, simplify complex decisions, and foster lasting financial stability. For anyone considering vehicle finance, engaging with Santander’s login ecosystem isn’t just practical—it’s a forward-thinking choice that puts users in the driver’s seat.

Related Post

Santander Auto Loan Login: Streamline Access, Fix Issues Fast with Expert Troubleshooting

Is EarthLink Internet Worth It? EarthLink Reviews Reveal What Users Actually Experience

Dominate EFootball 2024: Long Ball Counter Formation Guide

<h1><strong>Mastery of Sandtris: The Algorithm Transforming Digital Storytelling</strong>