<strong>Unlocking Growth: Mastering Equity-Based Financing in Today’s Dynamic Markets</strong>

Unlocking Growth: Mastering Equity-Based Financing in Today’s Dynamic Markets

>Equity-based financing stands at the heart of innovation, enabling startups, scaling enterprises, and even established firms to fuel growth without the burden of debt. Unlike loans or debt financing, equity financing pits ownership — partial control and financial risk — in exchange for capital infusions, creating a strategic alignment between investors and business leaders. With rising investor appetite and evolving structures like venture capital, private equity, and employee stock ownership plans, understanding the nuances of equity financing is no longer optional—it’s essential for sustainable expansion and long-term resilience.

The Core Mechanics of Equity-Based Financing

Equity financing involves raising capital by selling shares of ownership in a business. When entrepreneurs issue equity, they trade a portion of their company for funds used to grow operations, develop products, expand markets, or acquire talent. This form of financing is especially pivotal in high-growth sectors such as technology, biotech, and renewable energy, where large upfront investments are necessary but debt repayment would strain fragile cash flows.At its foundation, equity finance operates on a clear principle: investors become partial owners, sharing in both risks and rewards. The capital raised allows companies to reinvest dynamically, scale teams, and compete aggressively in crowded markets. “Equity financing isn’t just a funding mechanism—it’s a strategic partnership,” notes Dr.

Elena Martinez, venture capital analyst at Ecliptic Strategies. “Investors bring more than capital; their expertise, networks, and oversight often prove instrumental in guiding a company’s trajectory.” There are several key forms of equity financing, each tailored to distinct stages and needs: - Venture Capital (VC) Financing: Early-stage funding from specialized firms targeting high-growth potential startups, typically exchanged for 10–30% ownership. - Angel Investment: Individual high-net-worth investors who inject early capital, often mentoring alongside funding.

- Private Equity (PE): Later-stage, larger investments, usually by institutional buyers seeking control for operational transformation. - Employee Stock Ownership Plans (ESOPs): A structure allowing employees to receive equity, aligning workforce incentives with company performance. Understanding these models clarifies not only how capital enters but also the broader strategic implications—ownership dilution, governance influence, and exit expectations.

Stages of Growth and Equity Needs

Equity financing needs evolve as companies progress through growth phases. Early-stage companies—frequently in product-market fit exploration—often rely on angel or seed rounds, where as little as $500,000 can define a minimum viable product and go-to-market strategy. As businesses validate demand and scale operations, Series A through C rounds fuel customer acquisition, talent expansion, and infrastructure development.Take, for example, a SaaS startup aiming to expand regional presence. A typical Series B round might raise $20–40 million in exchange for 15–25% equity, enabling hiring, technology enhancements, and international scaling. Each round represents a careful balance: raising enough to grow, but maintaining meaningful founder control and investor confidence.

Investors assess not only financials but also team capability, market traction, and long-term viability. This high bar ensures only promising ventures secure equity funding, taking on the inherent ownership trade-off.

Valuation: The Currency That Balances Risk and Reward

A central challenge in equity financing is fair valuation—determining the enterprise’s worth without undervaluing founders or overcommitting equity.Premature or overly aggressive valuations risk unsustainable dilution, while underpricing misses opportunity. Accurate valuation hinges on a blend of quantitative metrics and qualitative insight. Key factors influencing equity valuations include: - Revenue growth trajectory and projections - Customer acquisition cost (CAC) and lifetime value (LTV) - Market size and competitive positioning - Proprietary technology or competitive advantages - Management team strength and execution track record Private investors often use multiple discount methods, comparing peers, adjusting for growth phases, and stress-testing assumptions.

“Valuation is both an art and a science,” says Marcus Lin, CEO of Greenfield Capital. “It reflects not only what the numbers say but what the market believes—and whether that belief aligns with future potential.” Equity rounds typically structure participation through priced shares, with different classes—common, preferred—each carrying distinct rights. Preferred equity, common in venture rounds, provides liquidation preferences and dividends, reducing risk for investors while preserving founder control.

Founders must carefully navigate these structures to retain strategic autonomy.

Equity Financing vs. Debt: Strategic Trade-Offs

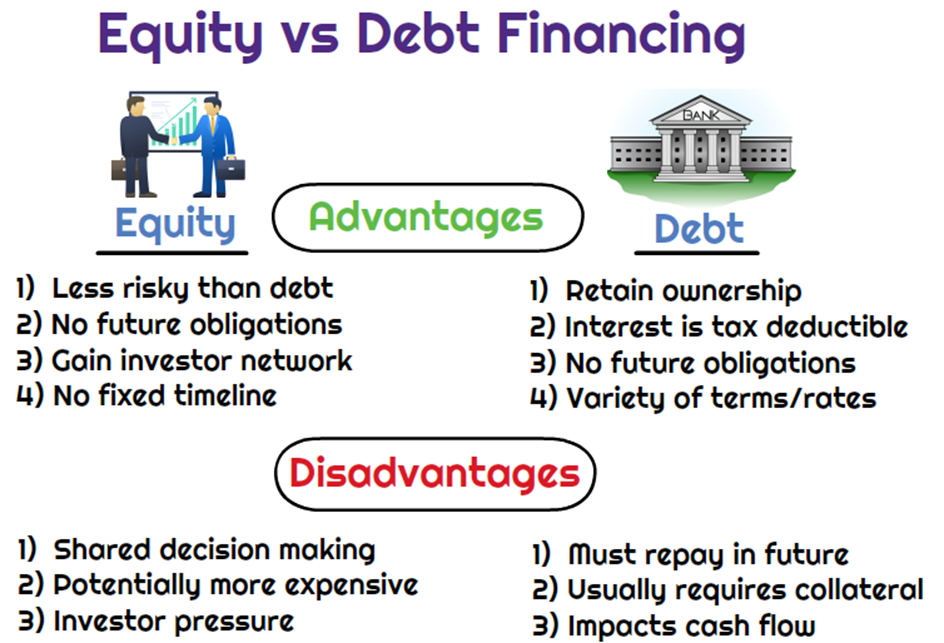

Equity financing contrasts fundamentally with debt financing in terms of risk, flexibility, and long-term impact.Debt requires repayment with interest, regardless of cash flow, posing severe strain on cash flow during downturns. Equity, conversely, defers repayment obligations—capital is available now for growth, with investors sharing downside risk. Yet this flexibility comes at a cost: loss of ownership and decision-making influence.

Founders trading capital gain strategic latitude but surrender partial control and future earnings. “Every equity round shifts the balance between growth and governance,” explains Dr. Martinez.

“Companies must weigh how much control they’re willing to share against how much capital they need.” This trade-off becomes especially critical in dilution-sensitive ventures. Founders must assess not just immediate financial needs, but the long-term impact of investor partnerships, board composition, and future fundraising capacity.

Equity Financing in Practice: Real-World Applications

Consider a biotech startup developing a novel cancer treatment.Early research funding of $10 million via venture capital grants the company critical runway to advance clinical trials. With no immediate profitability, debt

Related Post

Knowing the Right Time in Texas: How Usa Tx Time Now Powers Precision Across the Lone Star State

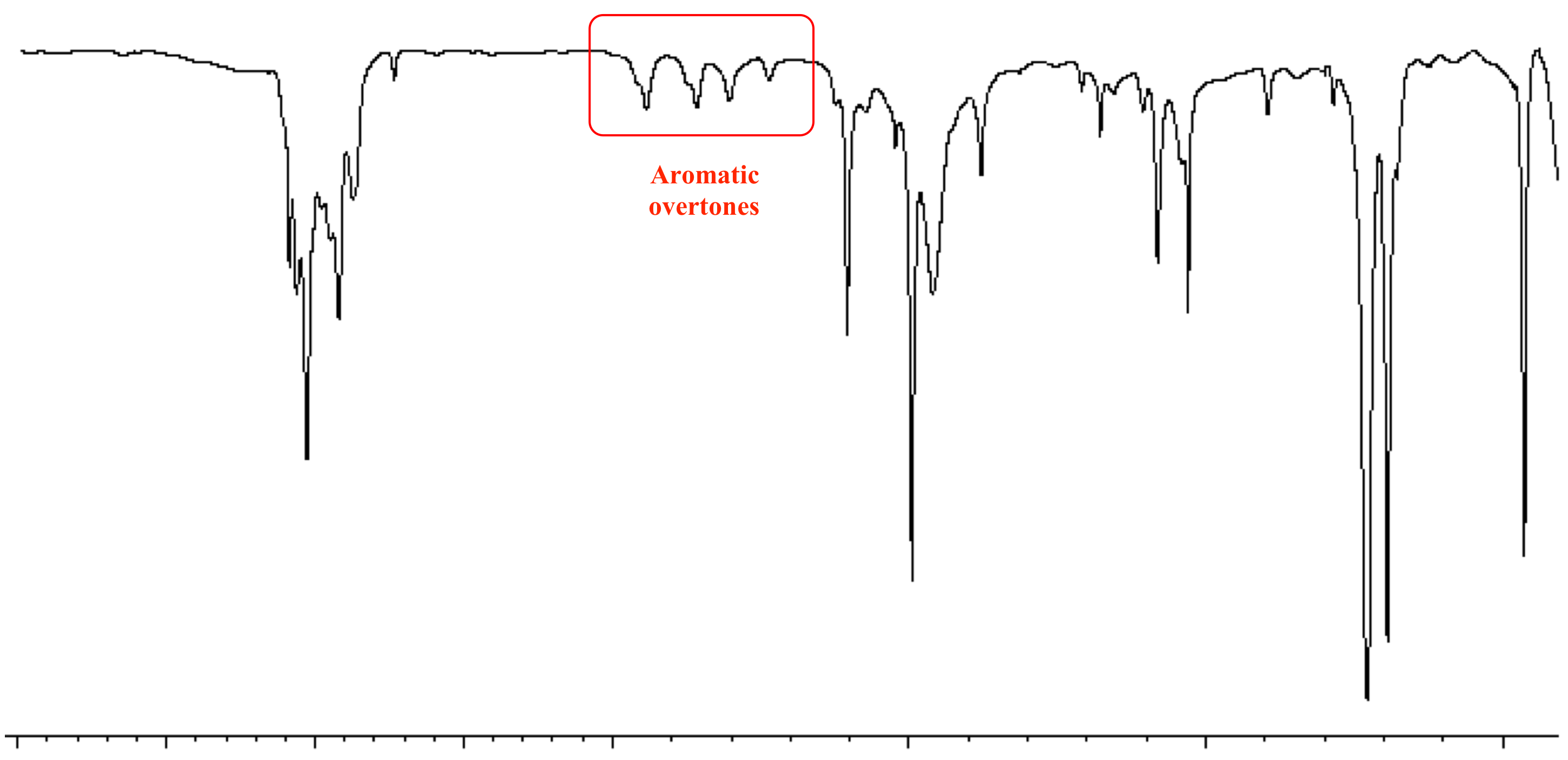

Revealing Aromatic Secrets: How Ir Spectroscopy Deciphers the Irrous Allure of the Aromatic Ring

A Well-Lived Life Remembered: Albany Times Union Obituaries Capture Enduring Journeys

How How Are They Doing? The Growing Global Shift in Work, Health, and Daily Life