Unveiling the Heavy Cost of Owning Ch ponds in NYC: The Real Impact of Nyc Finance Property Tax

Unveiling the Heavy Cost of Owning Ch ponds in NYC: The Real Impact of Nyc Finance Property Tax

In the bustling heart of New York City, where skyline towers stretch toward the sky and real estate values soar, property taxes represent one of the most decisive financial burdens for homeowners and investors alike. Nyc Finance Property Tax—encompassing the city’s unique assessment, taxation, and revenue-allocation systems—plays a pivotal role in shaping affordability, investment returns, and urban policy. Far more than a simple annual bill, the city’s tax structure influences housing markets, drives public investment, and determines how resources flow back into the communities that sustain one of the world’s largest metropolitan economies.

Understanding its mechanisms, variations, and implications is essential for anyone navigating the complexities of property ownership in the Big Apple.

At the core of Nyc Finance Property Tax lies a sophisticated assessment process designed to value real estate based on current market conditions, though not always in perfect alignment with purchase price. The New York City Department of Finance oversees property valuation through periodic reassessments, typically every six years, using a mix of automated models and manual inspections.

“Property taxes here reflect true market value, adjusted for location advantage, property type, and improvements,” explains Amanda Torres, a tax policy analyst with NYC Affordable Housing Coalition. “This ensures fairness, but also means even recent renovations can trigger assessment spikes.” For instance, a $2 million Manhattan condo bought a decade ago could face a dramatically higher tax bill after five years if neighborhood property values rise sharply—sometimes by 20% or more between cycles.

Once assessed, properties in New York City are subject to two layers of taxation: the citywide municipal tax and local assessments that fund critical services like schools, transit, and public safety.

The current standard city tax rate stands at approximately 0.97%, though it varies slightly across boroughs and property classifications. Beyond the base rate, homeowners face additional assessments tied to special taxes—such as Local Law 84 monitoring compliance or School Streets initiatives—adding complexity. “Taxpayers shouldn’t underestimate the cumulative effect,” warns Torres.

“A $500,000 home may pay $7,000 in base tax, plus hundreds more from special levies—sometimes pushing total obligations beyond 1.5% of value annually.”

To illustrate, consider two comparable multi-family buildings in Brooklyn: one assessed at $8 million with 15 units, the other at $12 million with 30 units. If both markets strengthen equally, the larger property generates not only higher raw tax due but also benefits disproportionately from citywide reinvestment—yet bears a heavier absolute burden in absolute terms. Tax burdens are calculated using a precise formula: (Assessed Value × Tax Rate) divided by Fair Market Value.

“This system ensures proportionality, but it also means investors must model tax risk as part of returns,” notes real estate economist Dr. Marcus Chen. “In high-growth markets, rapid appreciation boosts value but also taxes, amplifying both upside and downside.”

Property tax incentives play a crucial role in balancing equity and development.

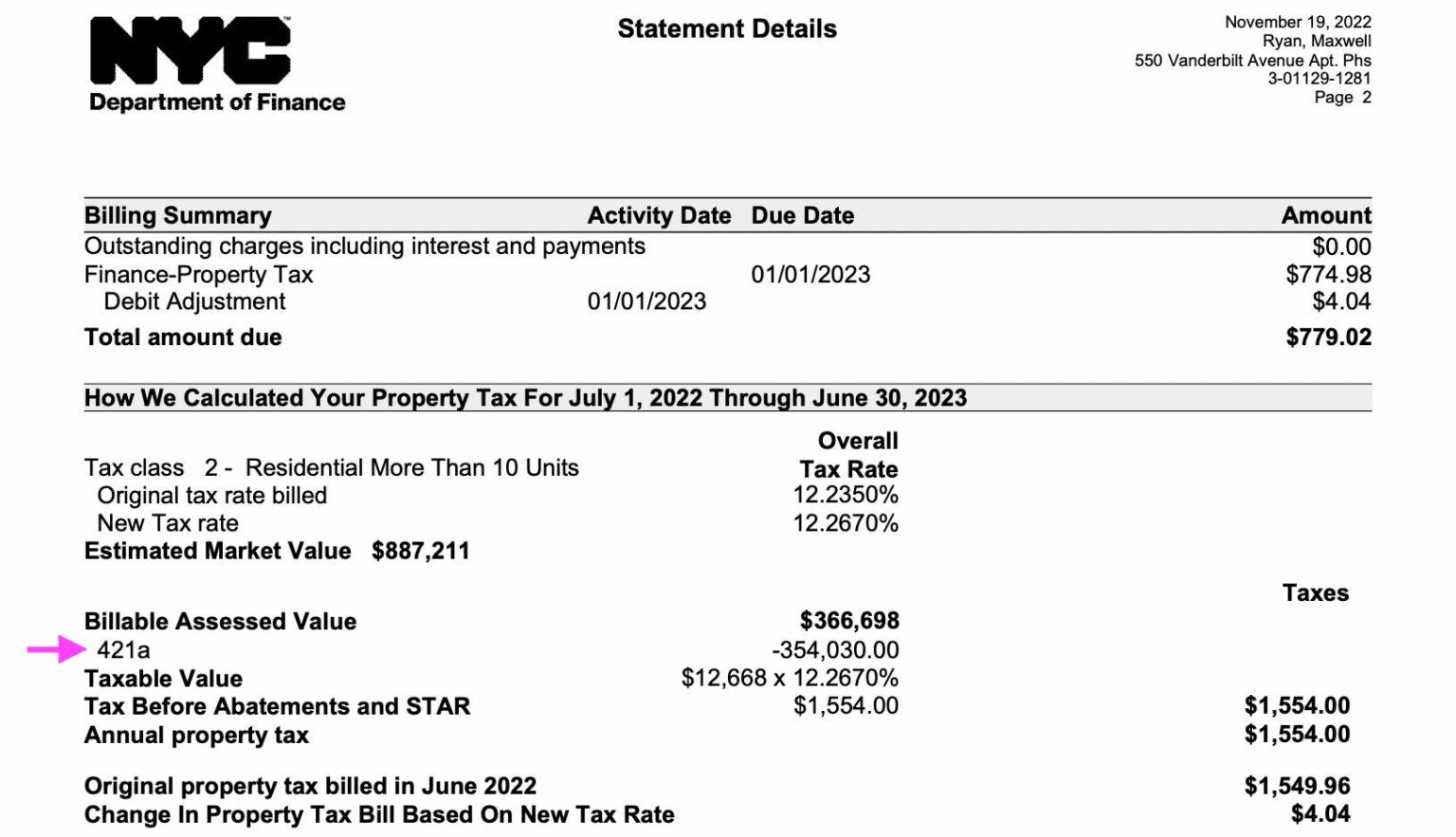

The city offers targeted abatements, such as the 421-a tax exemption (though phased out in recent years), historic landmark relief, and small business owner exemptions to ease pressure on vulnerable owners. For homeowners, the Universal Property Tax Relief program provides critical relief—capping taxes at 80% of assessed value for below-market-rate dwellings or offering full abatement for seniors and disabled residents. “These programs prevent displacement, especially in gentrifying zones,” says Torres.

“But eligibility is narrow; many eligible homeowners remain unaware.”

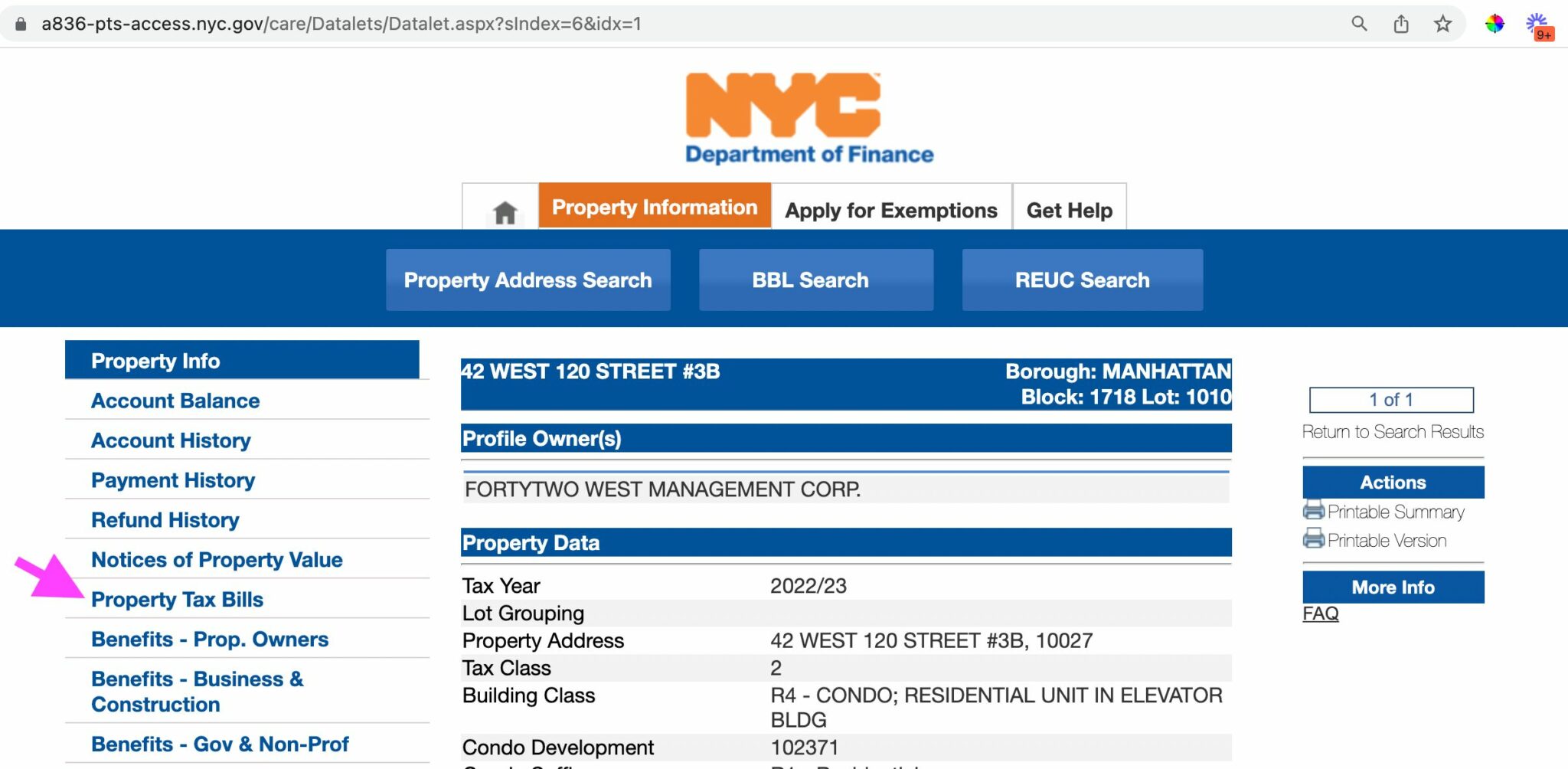

Transparency remains a contested issue. The Department of Finance maintains an online portal with detailed property records, but the process can feel opaque to non-experts. “Taxpayers often want more granular breakdowns—itemized cost drivers, market comparables, tax credit eligibility screening,” says Chen.

In response, the city has expanded digital tax analysis tools, including AI-driven estimators that simulate tax impacts based on neighborhood trends, purchase history, and building conditions—resources increasingly vital in a rapidly shifting market.

Impact on housing supply and affordability is stark. High and unpredictable tax liabilities deter long-term ownership, particularly for owner-occupied units, accelerating shifts toward short-term rentals and institutional ownership.

In Queens and the Bronx, rising taxes have coincided with shrinking owner-occupied stock—a trend visible in census data showing stagnating homeownership rates amid surging rental demand. “Property tax shapes who stays and who leaves,” observes urban planner Elena Ruiz. “Without thoughtful policy, affordability erodes from the ground up.”

Investors, too, must navigate this terrain with precision.

Institutional buyers analyze tax exposure as deeply as cap rates and occupancy. A 0.3% tax hike in a consistently renting building can erode net operating income by thousands annually—altering break-even models and ROI projections. “Tax efficiency is no longer optional,” says David Malik, co-founder of NYC Property Fund.

“Smart investors layer tax forecasts into every deal, hedging against reassessment volatility and jurisdictional shifts.”

Public scrutiny intensifies during reassessment cycles, when entire neighborhoods face sudden valuation jumps. In 2022, the Financial District saw a 12% average tax increase after a comprehensive rebuild, sparking community protests and policy reviews. These episodes underscore the human side: property tax is not merely a financial line item but a direct stake in neighborhood identity and financial stability.

“People don’t pay tax because they trust the system—they revolt when they feel it’s arbitrary or unjust,” Ruiz explains. “Clear communication, fair appeals processes, and responsive oversight are imperative.”

Looking forward, digital transformation promises greater fairness and efficiency. NYC has piloted blockchain-enabled assessment trails and real-time tax impact calculators, empowering homeowners and investors with instant insights.

Meanwhile, legislative efforts aim to stabilize rates, enhance transparency, and expand credit access—particularly for elderly and low-incomepayers facing escalating burdens. “The goal is a tax system that funds essential services while protecting vulnerable owners,” notes Torres. “It’s ambitious, but necessary.”

In the intricate ecosystem of New York City’s real estate, the finance property tax functions as both a revenue engine and a social lever—one that balances disincentive and equity, growth and preservation, profit and community.

Understanding its full scope isn’t just financial prudence—it’s civic awareness. As the city evolves, so too must stewardship of its tax framework: fair, flexible, and fiercely aligned with the diverse lives that shape Manhattan, Brooklyn, Queens, the Bronx, and beyond.

Navigating these dynamics requires more than intuition—it demands clarity, foresight, and data-driven clarity.

For every dollar paid, a city’s future is decided. The true cost of NYC property ownership is written not just in numbers, but in lives, investments, and dreams shaped by tax policy.

Related Post

Remeisha Shade: A Rising Star Defined by Age, Height, and Uncompromising Presence

Delving Into The Life And Career Of Sarah Russi: A Rising Star Redefining Her Generation

The National Identification Number: A Cornerstone of Modern Identity in the Digital Age

Jamaica Hospital Medical Center: Queens’ Trusted Healthcare Hub Bringing Care Closer to Home