Wells Fargo IBAN: What You Need to Know Before Transacting Globally

Wells Fargo IBAN: What You Need to Know Before Transacting Globally

For millions navigating cross-border payments, understanding the role of the IBAN under the Wells Fargo umbrella is essential—but rarely intuitive. Whether transferring funds, opening a internacional account, or managing international expenses, the IBAN (International Bank Account Number) serves as a digital gateway to seamless financial connectivity. With Wells Fargo’s integration of IBAN standards into its global banking services, users demand clarity on how this number functions, why it matters, and what safeguards are in place.

This comprehensive guide breaks down everything from format and regional variations to security privileges and common pitfalls—empowering customers to use their Wells Fargo IBAN with confidence.

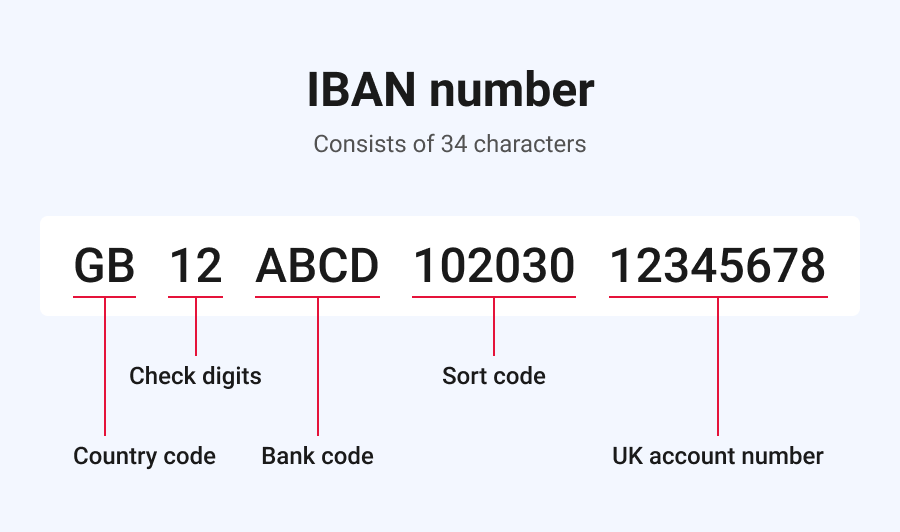

The IBAN under Wells Fargo follows the standardized international format, ensuring compatibility across European and select global banking systems. Typically, it consists of 34 characters: two letters representing the country code (e.g., "DE" for Germany, "FR" for France), two digits for the financial institution identifier, followed by six digits, and a final 25-character bank account number.

This structure—formal and precise—enables automated clearing and reduces processing errors. As Wells Fargo specifies, any IBAN bearer must conform strictly to this international schema to be accepted by its transaction networks.

Regional Variations: How IBANs Differs Across Countries Served by Wells Fargo

While the core principles of IBAN remain consistent, regional adaptations reflect national banking traditions. Wells Fargo’s IBAN functionality integrates these nuances, tailoring formats to country-specific rules.For instance, in Germany, Wells Fargo’s IBAN generally includes a check digit at the end—computed algorithmically to validate accuracy—while in France, the format incorporates a mandatory 2-digit institution code separated from the national IBAN segment.

Key Differences by Country

- Germany & Austria: GL (General Ledger) IBANs — Represented as DExx.xxxxxxxxxxx.xxx, where the first two letters denote the delegate bank. Wells Fargo treats these as domestic master IDs, enabling swift domestic and EU cross-border transfers. - France: ISO-Code + 2-Plus Key — IBANs begin with FR, followed by a 2-digit efficient branch code, then the national account number.Wells Fargo systems automatically validate these structure rules during international wire initiations.

- United States (for select operations): EDN Format — Though Wells Fargo’s primary global focus is Europe, its U.S. international arm supports EDN (Electronic Drivers’ Number) mappings alongside standard IBANs for unique logistical accounts. This dual format enhances flexibility for clients managing multi-jurisdictional funds. These regional distinctions ensure that each IBAN is optimized for seamless domestic and cross-border settlement within its banking zone—no manual adjustments required.Why Wells Fargo Emphasizes IBAN Accuracy and Security Wells Fargo integrates advanced fraud detection and compliance protocols directly into its IBAN transaction workflows. Every IBAN entry undergoes validation against real-time database checks, confirming country codes, financial institution identifiers, and account number integrity. This safeguards against misuse, identity theft, and routing failures.

According to Wells Fargo’s official documentation, “Accuracy in IBAN entry is non-negotiable—errors can delay transfers or result in funds being sent to unintended recipients.” The bank employs multi-layered validation:

- Automated syntax checks that verify character count and alphanumeric composition

- Cross-referencing with institutional master data to confirm account legitimacy

- Real-time integration with SWIFT and SEPA networks for immediate status feedback

Primary Uses of Your Wells Fargo IBAN

The IBAN held with Wells Fargo serves as a foundational element across multiple financial operations:- International Wire Transfers—Essential for sending or receiving cross-border payments, from payroll disbursements to business treasury operations.

Wells Fargo’s IBAN enables direct debiting and crediting across EU SEPA zones and selected global corridors.

- Single Euro Payments Area (SEPA) Compliance—Wells Fargo IBANs automatically comply with SEPA directives, allowing seamless euro transactions without currency conversion fees within the zone.

- Foreign Account Management—To open or manage non-U.S. bank accounts linked to Wells Fargo, the IBAN acts as a primary banking identifier, streamlining account verification and future transaction setup.

- Automated Bill Payments & Recurring Payments—IBANs facilitate set-up of recurring transfers for utilities, subscriptions, or vendor settlements, reducing manual processing and error risks.

Common Pitfalls and How Wells Fargo Prevents Errors

Despite its precision, IBAN misuse remains a frequent source of banking delays.Common mistakes include transposing digits, omitting check digits, misassigned country codes, or entering invalid bank identifiers. Wells Fargo addresses these risks through a combination of education, technology, and policy enforcement. Key preventive strategies include: - Real-time syntax validation: entered during IBAN creation blocks invalid formats before transmission.

- Region-specific guidance: customers receive tailored instructions based on the intended country, highlighting local quirks like Germany’s check digit. - Automated back-end verification: once submitted, well before funds leave the system, Wells Fargo’s fraud engines validate the IBAN against its institutional database. - Customer alerts and support—automated notifications warn of potential errors, while dedicated support teams assist with exceptions, minimizing settlement hold-ups.

Users are repeatedly advised to double-check every character, especially country codes and numbers, before initiating any cross-border transaction.

Setting Up and Managing Your Wells Fargo IBAN: A Step-by-Step Guide

Establishing a Wells Fargo IBAN is straightforward but requires attention to detail. Whether opening a multi-currency account or connecting an existing international account, Wells Fargo offers clear pathways.- Open a Wells Fargo International Account: Complete the application with full bank details, including the country code and branch-specific identifiers required to generate a valid IBAN. Wells Fargo typically supplies IBAN templates post-approval.

- Receive Your IBAN: Upon approval, your unique IBAN is delivered via secure email or via the Wells Fargo private online portal—never via unencrypted email.

- Confirm and Input with Precision: Always verify the number against official statement docs before use. Duplicate characters or missing segments risk failed transfers.

- Utilize Ready-Made Formats: Wells Fargo provides downloadable IBAN templates tailored to your home country, simplifying input into partner networks.

Wells Fargo also supports recurring updates if account codes change, ensuring long-term reliability.

The Future of IBAN Standards in Global Banking: What Wells Fargo Is Preparing For

As global finance evolves, so too does the framework underpinning IBANs. Regulatory shifts, digital identity advancements, and real-time payment ecosystems are reshaping cross-border transactions.Wells Fargo is actively investing in next-generation payment rails, ensuring its IBAN infrastructure remains compatible with emerging technologies like instant SEPA credit transfers and blockchain-based settlements. According to Wells Fargo’s internal financial technology roadmap, “We are integrating enhanced digital identity verification with IBAN processing—blending biometrics, AI anomaly detection, and secure tokenization to redefine how IBANs authenticate and authorize global transactions.” This forward-thinking approach ensures that while the core IBAN format endures, its application grows smarter, faster, and more secure.

Understanding Wells Fargo’s IBAN system reveals more than logistics—it reflects the bank’s commitment to enabling frictionless, secure international finance.

From precise formatting rules to robust fraud safeguards, every element is engineered around reliability. For anyone relying on global transfers, this knowledge transforms potential complexity into confidence—making each IBAN a key to trusted, worldwide economic participation.

/what-is-an-aba-number-and-where-can-i-find-it-315435_final-5b632380c9e77c002c9ef750.png)

Related Post

Brave New World 2020: Brave New Technology in a Brave New Series Adjusting Humanity’s Future

The Lasting Legacy of St. Louis Funeral Traditions: Insights from Post Dispatch Obituaries

Unlocking Second Chances: The Power of Free Expungement Lawyers

How Much Money Did Kai Cenat Make on His Subathon? A Deep Dive into One of Streaming’s Most Lucrative Moments