Wells Fargo Pickup: The Fast, Secure Way to Manage Your Accounts on Time

Wells Fargo Pickup: The Fast, Secure Way to Manage Your Accounts on Time

Tired of juggling bank visits, missed deadlines, and delayed bill payments? Wells Fargo Pickup offers a streamlined digital solution for account management that lets customers access, update, and monitor their financial activities seamlessly—without stepping into a branch. In a world where convenience and security are paramount, this pickup system transforms how users interact with their Wells Fargo relationship, blending speed with safety in daily banking.

Whether recharging a prepaid card, paying bills, or checking account balances, Wells Fargo Pickup delivers practical access tailored to busy lifestyles.

At its core, Wells Fargo Pickup is a self-service online platform designed to empower customers with control over their finances through a user-friendly digital interface. Available via Wells Fargo’s website and mobile app, it allows quick transactions and real-time account updates that keep users ahead of their financial obligations.

Unlike traditional checkups or cash-only visits, Pickup enables secure, anytime access—ideal for professionals, students, and parents juggling multiple responsibilities. The system prioritizes both speed and safety, ensuring every user interaction remains fast yet rigorously protected.

How Wells Fargo Pickup Streamlines Account Management

The fundamentals of Wells Fargo Pickup rest on three key pillars: convenience, security, and efficiency. Through a centralized digital hub, customers perform a wide array of tasks without physical presence.Key functions include: - **Balance Checks and Transaction History:** Access full account details instantly, reviewing every deposit, withdrawal, and payment with just a few clicks. - **Bill Payments and Auto-Pay Setup:** Initiate timely payments directly from the portal, automating recurring expenses to avoid late fees and service interruptions. - **Card Management:** Recharge prepaid cards, report losses, and request replacements seamlessly—no line delays, no branch trips.

- **Fund Transfers:** Move money between checking, savings, or other linked accounts swiftly, supporting paycheck deposits and peer-to-peer payments. - **Account Alerts and Notifications:** Receive instant alerts for low balances, suspicious activity, or payment due dates—staying proactive in financial oversight. Each function is engineered for clarity, with intuitive navigation ensuring users spend less time learning the system and more time managing their money effectively.

By integrating these capabilities, Wells Fargo Pickup transforms passive banking into an active, controlled experience. Users avoid the stress of appointment-heavy banking and maintain real-time visibility over their financial health—critical for essential tasks like bill payments or emergency fund adjustments.

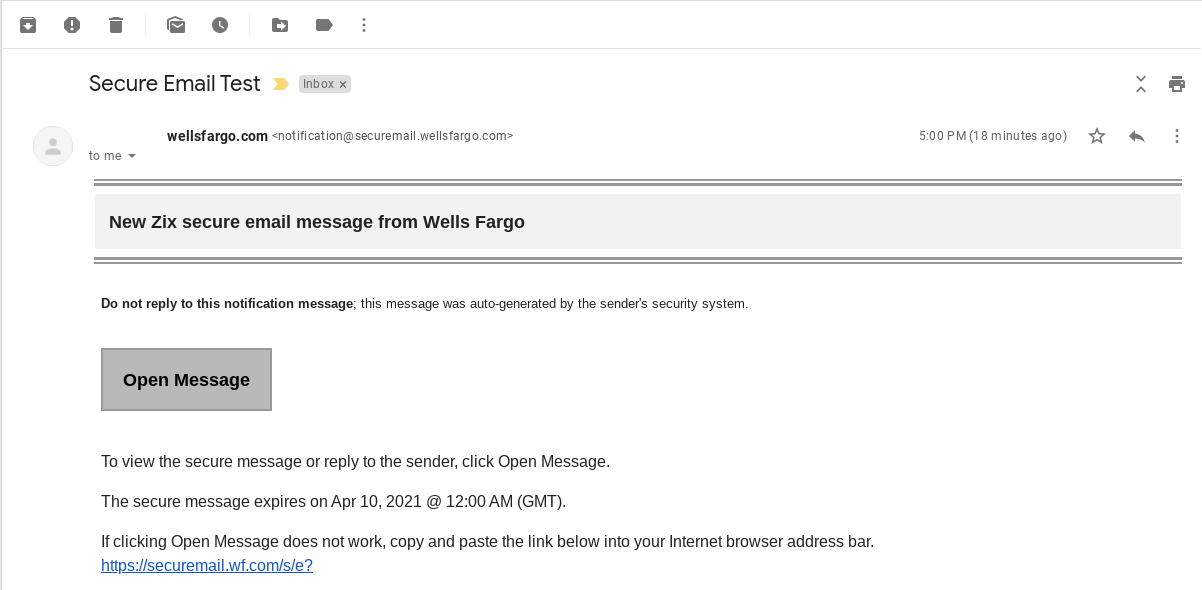

Security That Meets Modern Banking Standards

With digital access comes a non-negotiable focus: robust security. Wells Fargo Pickup employs industry-leading safeguards to protect sensitive data and transaction integrity.Every session is encrypted using end-to-end protocols, and two-factor authentication (2FA) is mandatory for account access—ensuring only authorized users proceed with sensitive actions. Biometric login options, like fingerprint or facial recognition via the mobile app, add extra layers of protection. Furthermore, Wells Fargo continuously monitors for fraudulent activity, issuing real-time alerts and enabling immediate account lockdown if suspicious behavior is detected.

This multi-tiered defense saves users from the anxiety of identity theft and financial fraud, reinforcing trust in the digital banking experience.

User Experience Designed for Real-World Demands

Wells Fargo Pickup succeeds not only through security but through a deeply user-centric design. The interface reflects the busy realities of modern life: quick loading times, mobile responsiveness, and minimal steps to complete essential tasks. For example, recharging a prepaid card—once a time-consuming process requiring in-person verification—now takes under 60 seconds from initiation to confirmation.Similarly, setting up automatic bill payments becomes a matter of a few taps, reducing the risk of missed due dates by design. The platform also accommodates recurring needs: users can schedule weekly utility payments or monthly savings transfers with recurring options, simplifying long-term financial planning. Accessibility extends beyond speed.

The system supports multilingual navigation where available, ensuring inclusivity across diverse customer bases. Clear error messages and contextual help guides prevent confusion, empowering users of all tech familiarity levels. Whether checking a balance late at night or updating payment details before a payroll cycle, Wells Fargo Pickup meets users exactly where they are—and when they need to act.

Integration with Broader Wells Fargo Services

One of Wells Fargo Pickup’s quiet strengths lies in its seamless connectivity to other banking services. The platform integrates with Wells Fargo checking and savings accounts, credit cards, and loan management tools,

Related Post

Idaho’s Time Zone: A Pacific Time Puzzle Shaping Lives Across the Treasure State

Dia Map: Transforming Spatial Awareness Through Dynamic Visual Storytelling

Peanut Butter & Jelly Sandwich: Decoding the Universal Meal with Pseudocode Simplicity

Behind the Innovation: Ado Den Haag Transforming Digital Experiences with Uncompromising Vision