Wells Fargo Temporary Card: Your Quick Guide to Secure, Fast, and Flexible Access

Wells Fargo Temporary Card: Your Quick Guide to Secure, Fast, and Flexible Access

For millions navigating financial transitions—whether due to a bank move, deployment, medical leave, or identity verification—Wells Fargo’s temporary credit card solution offers a streamlined path to uninterrupted service. Designed with speed, security, and functionality in mind, the Wells Fargo temporary card empowers users to pay bills, make emergency purchases, and access cash with minimal friction. This guide unpacks everything a user needs to know—from activation and benefits to usage limits and long-term planning.

Why Choose a Wells Fargo Temporary Card Over Alternatives?

Unlike prepaid cards or third-party digital alternatives, the Wells Fargo temporary card integrates seamlessly with your existing banking identity. "The card maintains a direct link to your Wells Fargo account, so transactions flow through verified channels—reducing fraud risk while enhancing reliability," explains financial services analyst Marcus Tran. Unlike generic temporary cards, Wells Fargo’s offering is backed by a trusted institution with deep consumer protections.Key advantages include: - Instant digital activation, often within minutes - Visa brand acceptance at millions of global merchants - Integration with pre-existing Wells Fargo credit history for smoother approval - Identity verification built into the issuance process - Clear transaction reporting directly synced to your primary account Users report faster customer support integration, with dedicated channels for temporary card inquiries—critical during high-demand scenarios such as travel disruptions or medical emergencies.

Activation & Key Features: Speed Meets Simplicity

Securing a Wells Fargo temporary card is among the most straightforward digital experiences in modern banking. Typically completed via the Wells Fargo mobile app or online portal, activation takes minutes—no need to mail physical cards or wait for couriers.Users enter basic personal ID, contact details, and optional emergency contact, after which the card is instantly delivered to their registered address. Upon arrival, the card activates automatically. Cardholders immediately gain access to: - A mobile app enabling real-time spending tracking and card freezing - Add-on protections such as fraud alerts, expense categorization, and transaction notifications - Telephone access to a dedicated temporary card helpline for urgent issues - The ability to expand usage to co-customers—temporary cards often allow controlling trusted family members or colleagues “This is not just a temporary tool—it’s a comprehensive financial bridge,” says Jane Nadler, a Wells Fargo customer experience manager.

“We’ve engineered the process so that no technical hurdles interrupt your access to essential payments.”

Where Can You Use It? Merchant Networks and Spending Flexibility

Wells Fargo’s temporary card operates on the Visa network—one of the world’s most widely accepted payment systems. With over 50 million merchant locations globally, including major retailers, groceries, and travel suppliers, the card ensures broad usability.Examples of everyday use: - Paying at gas stations, restaurants, and online merchants - Covering short-term travel expenses abroad when pre-arranged credit is unavailable - Making utility payments or medical co-payments without gaps in coverage - Establishing initial credit history through on-time payments reported to bureaus Notably, Wells Fargo temporarily suspends certain merchant categories—such as high-risk online games or unregulated vendors—reducing exposure to fraud. These safeguards maintain trust while empowering users to spend efficiently. Usage Limits: Balance Awareness and Flexibility To protect both the cardholder and partner networks, Wells Fargo imposes strict daily and weekly spending limits, typically starting at $500 and accommodate higher thresholds based on account status and activation duration.

Common restrictions include: - Daily retail limit: $500 (adjustable via customer service) - Weekly travel ceiling: Up to $2,500 when approved for emergencies - No cash advance availability during activation period - Reports indicate typical users stay within limits, reinforcing the card’s design for controlled, purpose-driven use Patients, travelers, and individuals managing short-term financial needs will find these boundaries supportive rather than restrictive.

Security Features: Protection Built-in by Design

Security remains paramount in the Wells Fargo temporary card system. Each card includes: - EMV chip technology with dynamic authentication codes - Instant freeze capability via mobile app—temporary shutdowns take seconds - Real-time transaction alerts with geo-fenced notifications - PCI-compliant data handling ensuring secure processing Moreover, accounts linked to the card inherit Wells Fargo’s fraud monitoring infrastructure, including AI-driven anomaly detection.“Users report overwhelming peace of mind,” adds security specialist Dr. Elena Ruiz. “Unlike unofficial temporary cards that vanish without trace, Wells Fargo’s system maintains full audit trails and instant support.” This proactive stance extends to incident response: users experiencing unauthorized activity can initiate freezing within minutes, preventing financial escalation during vulnerable periods.

Planning Beyond the Temporary: Pathways to Permanent Solutions

While designed for short-term use, the Wells Fargo temporary card serves as a springboard to long-term stability. Whether recovering from identity disruption, rebuilding credit after financial setbacks, or preparing for permanent banking transitions, users gain critical time to organize documentation, reevaluate credit health, and connect with permanent services. Strategies for transition include: - Using transaction history to report accurate info to new banks - Leveraging temporary card insights to negotiate better terms with permanent lenders - Setting up autopay for recurring bills through Wells Fargo’s unified digital ecosystem The card’s seamless integration with existing financial profiles minimizes disruption—ideal for those transitioning after relocation, job changes, or personal crises.A Trusted Partner in Financial Transitions

Wells Fargo’s temporary card exemplifies how modern banks can combine innovation with reliability. By merging instant access, robust security, and clear circulation pathways, it addresses urgent financial needs without compromising safety

Related Post

The Unstoppable Visual Force: Jodi Arias’ Powerful Imagery Shapes the True Crime Narrative

How New Believer Discipleship Video Curriculum Transforms Faith Growth with Interactive Learning

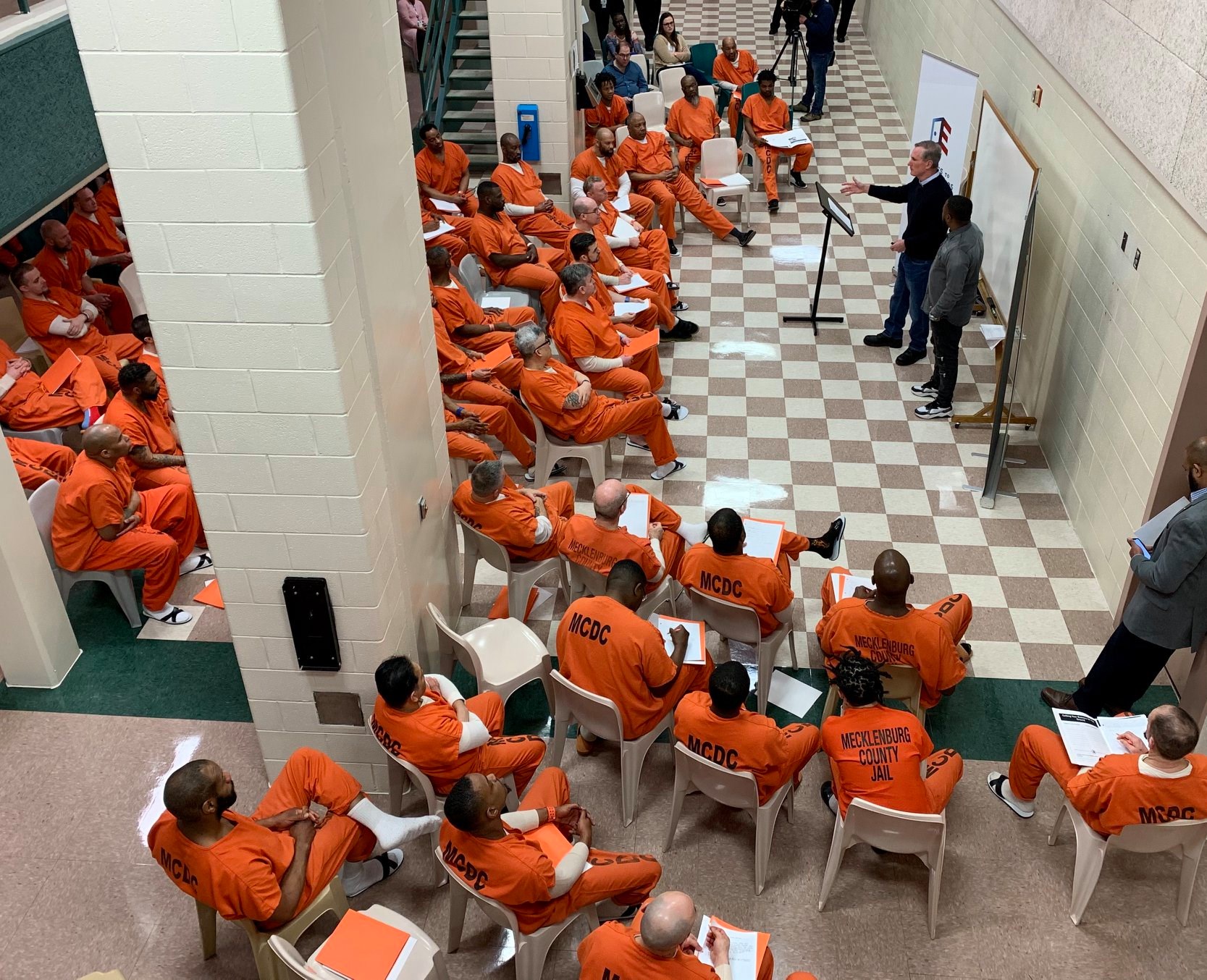

Citizen 13660: The Underground Force Redefining Digital Surveillance

Why Are Anchors Leaving Boston 25 News? A Slowdown in Cable Journalism