What Is Macroeconomics? A Simple Explanation of How Nations Grow and Stabilize

What Is Macroeconomics? A Simple Explanation of How Nations Grow and Stabilize

Macroeconomics is the backbone of economic understanding, revealing how entire economies function, evolve, and respond to change. Unlike microeconomics, which analyzes individual markets and firms, macroeconomics studies aggregate phenomena—national income, unemployment, inflation, and the overall flow of money across countries. It answers fundamental questions about prosperity, stability, and shared economic fate, making it essential for policymakers, investors, and everyday citizens seeking to understand global and national financial trends.

The Core Purpose: Economics Beyond the Individual

At its heart, macroeconomics examines the “big picture” of economic activity.

While microeconomics zeroes in on consumer choices and producer decisions, macroeconomics shifts focus to the economy as a unified system. It tracks key metrics such as Gross Domestic Product (GDP)—the total value of goods and services produced—unemployment rates, inflation levels, and government fiscal and monetary policies. “Economics is not just about markets; it’s about how society allocates its most precious resource: resources, labor, and capital,” notes economist Anil Kashyap.

Understanding this broader lens allows for effective analysis of booms, recessions, and everything in between.

Key Indicators That Shape Policy and Perception

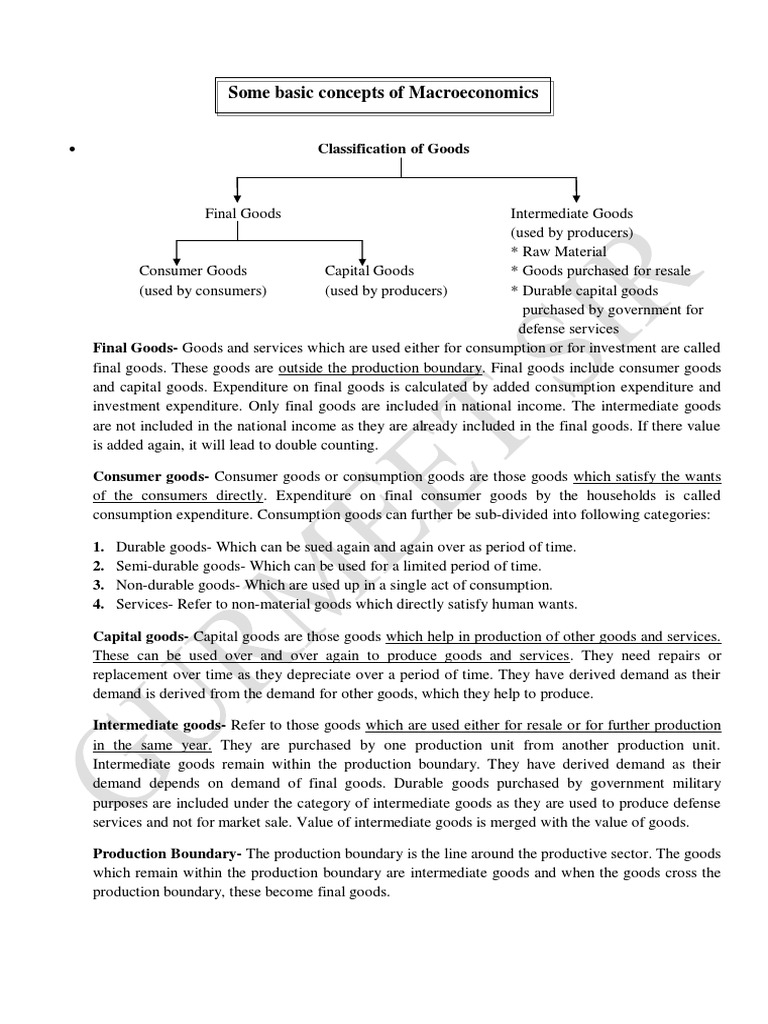

Several crucial indicators form the foundation of macroeconomic analysis: - **GDP** measures economic output and growth, serving as a barometer for national prosperity. - **Inflation** reflects the pace at which prices rise, eroding purchasing power and distorting spending behaviors. - **Unemployment** reveals labor market health and societal well-being, influencing both social stability and economic performance.

- **Interest rates and money supply**, controlled by central banks, directly affect borrowing, investment, and inflation. Each metric influences policy decisions. For example, persistent high inflation may drive central banks to raise interest rates, slowing growth but stabilizing prices.

Conversely, soaring unemployment prompts fiscal stimulus—such as infrastructure spending or tax cuts—to jumpstart demand and job creation.

The Role of Government and Central Banks

Government intervention and monetary policy are central to macroeconomic management. Fiscal policy—spending and taxation—shapes short-term demand, while monetary policy—administered by central banks—regulates money supply and interest rates to maintain price stability and sustainable growth.

The interplay between these tools defines how a nation responds to crises. During the 2008 financial crisis, governments injected trillions via stimulus packages, while monetary authorities slashed rates and launched quantitative easing. “Effective macroeconomic stewardship balances immediate relief with long-term sustainability,” says economist Laura Veldman.

Such coordinated action has helped economies recover from severe downturns, though timing and scale remain challenging.

Global Interconnectedness and Macroeconomic Challenges

The modern globalized economy means no country operates in isolation. Trade flows, capital movements, and synchronized policy actions binding nations affect domestic outcomes. A recession in China can reduce demand for U.S.

exports, dragging down growth. Currency fluctuations influence foreign investment and export competitiveness. Climate events like extreme weather disrupt supply chains and alter agricultural output worldwide.

“Macroeconomic analysis today demands a global perspective,” observes Sarah Chen, senior economist at the International Monetary Fund. Understanding these links is vital for stability in an interdependent world.

Real-World Implications: From Recessions to Inflation Surges

Macroeconomics provides the framework to interpret major economic shifts. The Great Recession of 2008, triggered by a housing market collapse, highlighted vulnerabilities in financial systems and the critical role of liquidity.

Governments and central banks responded with unprecedented fiscal and monetary interventions, halting collapse but sparking debates over inflation risks. Recent years have seen fresh macroeconomic stressors: post-pandemic supply chain bottlenecks, surging energy prices, and the dual pressures of inflation and stagnant growth—phenomena economists label stagflationary risks. Analyzing these patterns helps forecast outcomes and guide recovery strategies.

The Tools of the Trade: Fiscal and Monetary Policy in Action

Two principal levers shape macroeconomic stability: fiscal policy and monetary policy.

Fiscal policy involves government decisions on spending and taxation—recession-fighting measures might include infrastructure investments, social transfers, or tax reductions to boost consumer spending. Monetary policy, managed by central banks, uses interest rate adjustments and open-market operations to control inflation and employment. When inflation spikes, central banks may raise rates to cool demand, while expansionary policies—lower rates and increased money supply—encourage borrowing and investment during slumps.

“These tools are powerful but require precise timing; missteps can deepen crises,” warns financial analyst James Marks. Their effectiveness relies on communication and credibility to shape market expectations.

The Future of Macroeconomics: Complexity and Adaptation

As the global economy evolves, so too must macroeconomic theory and practice. Emerging challenges—demographic shifts, technological disruption, climate change—demand new analytical models and policy responses.

Central banks now factor climate risk into macroprudential frameworks, while digital currencies reshape monetary transmission. “Macroeconomics is not static; it evolves with societal progress,” says Dr. Elena Torres, a leading economic policy scholar.

From data analytics to behavioral insights, modern macroeconomics embraces interdisciplinary approaches to maintain relevance in a rapidly changing world.

Understanding macroeconomics is no longer the domain of experts alone. Clear, evidence-based insight into how national economies grow, stumble, and recover empowers informed public discourse and sound decision-making—making it indispensable knowledge for anyone invested in the future of prosperity.

Related Post

Broken iPhone Screen Wallpaper Tricks: Turn Faults into Features

Aimee Garcia: Standing Tall—Height, Weight, and the Measurements Behind Her Article-Perfect Career

Top Crypto Apps in Brazil: Your Ultimate Guide to the Most Popular and Reliable Platforms

The Latest Battlefield Game Redefines Modern Warfare Combat in Unprecedented Ways