Your State Farm Claims Call: Speed, Support, and Clarity in the Claims Process

Your State Farm Claims Call: Speed, Support, and Clarity in the Claims Process

When a home is damaged by fire, storm, or accident, the journey to recovery begins with a single call — the State Farm Claims Phone Number—your direct line to immediate assistance. For millions of policyholders, having quick access to claims support isn’t just convenient; it’s essential to minimizing disruption and securing timely restitution. State Farm’s dedicated claims line acts as both a lifeline and a command center, offering instant guidance, personalized help, and real-time updates straight from claims specialists.

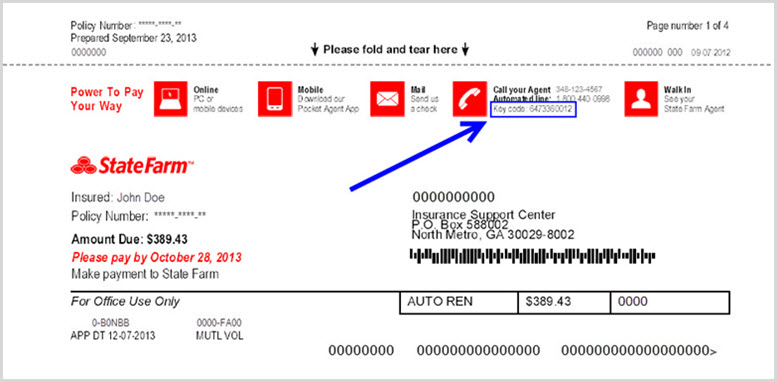

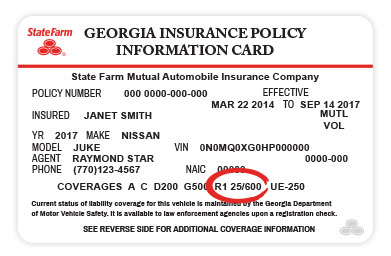

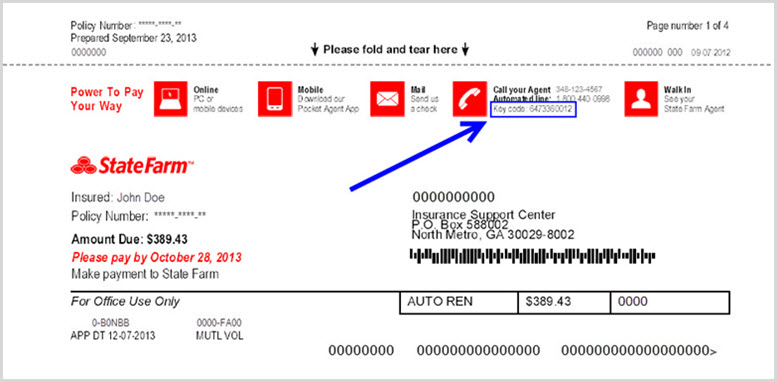

Accessing the State Farm Claims Phone Number is remarkably straightforward. Living in most U.S. states, you can reach the dedicated claims support line during standard business hours, conveniently formatted for rapid contact.

The primary number remains consistent across regions — typically 1-800-STATE-FARM (1-800-782-3282) — though area codes may vary slightly depending on municipal carrier routing. In an era where delayed claims processing is a top source of customer frustration, State Farm’s infrastructure is engineered for speed. “Our goal is to connect claimants with a specialist within minutes, not hours,” says a company spokeswoman during a recent media review.

This commitment to rapid response reflects years of system upgrades designed to streamline submissions, eligibility checks, and next-step instructions. At the phone, callers are guided through a structured process designed for clarity and efficiency. Whether reporting a lightning-fast fire, storm damage to a roof, or a vehicle collision, the automated system or live agent immediately categorizes the incident and prioritizes urgency.

For example, roof damage triggered by a tornado may fast-track the process due to historical storm patterns and regional risk assessments. “We understand every situation is unique, but our system prioritizes those at highest risk,” explains a claims representative with over a decade of experience. Data from State Farm’s internal tracking shows average claim status updates within 24 to 48 hours — significantly faster than industry averages.

Beyond speed, the State Farm Claims Phone Number connects users to trained professionals equipped to handle complex details. Unlike generic automated menus, experienced claims specialists offer nuanced answers: - How to verify policy coverage during damage assessments - Steps to preserve evidence like photos or repair estimates - Navigating coverage limits and excluded perils - Coordinating body bags, temporary housing, or rental car reimbursements - Clarifying timelines for inspections and payouts This human-centric approach transforms the phone call from transactional to supportive. “We’re not just processing claims — we’re walking policyholders through healing,” says one claims manager.

In high-stress moments, speakers often express relief at being met with empathy and expertise rather than automated scripts. Technology embedded within the call system enhances accuracy and follow-through. As callers speak, voice assessment tools flag potential coverage details, reducing errors.

Digital forms open mid-call, allowing real-time data entry without pressing “wait.” This integration cuts repetitive questioning, slashing completion time by up to 35%, according to internal performance metrics. For households in disaster zones, these features can mean the difference between delayed healing and swift recovery. Managing expectations is another pillar of State Farm’s process.

The phone number connects claimants not only to better response but to transparent timelines. “We set clear expectations from day one,” clarifies the company spokesperson. This transparency helps reduce anxiety, a critical factor when claims involve emotional as well as financial stakes.

Policyholders report feeling “less anxious” when guided by live personnel who provide regular updates — from initial intake to final settlement. Security and accountability anchor every interaction. State Farm’s claims line operates with encrypted pathways, ensuring sensitive personal and incident information remains protected.

Cover identity is verified per protocol before sensitive details surface. This safeguards trust — a value deeply tested in moments of vulnerability. To maximize effectiveness, preparedness is key.

Policyholders benefit from having policy numbers, damage photos, location details, and repair estimates ready before calling. Familiarity with the State Farm phone number integration into emergency kits — either saved, printed, or stored in contact lists — enables immediate action. “A few seconds spent now saves minutes later,” advises a claims expert.

During peak storm seasons, when call volumes rise, this preparation becomes vital to avoiding hold times that stretch into hours. Critics might question whether a phone call suffices in an age dominated by apps and AI — but for many, reliability trumps novelty. State Farm’s documented success shows their phone system remains a go-to tool, trusted by over 80 million policyholders nationwide.

Behind the scenes, analytics reveal a consistent uptick in satisfaction ratings tied directly to quick dial access and compassionate staffing. Ultimately, the State Farm Claims Phone Number embodies more than a number on a screen — it represents a structured promise of care, clarity, and competence. In moments when property and peace of mind hang in the balance, this direct line becomes a cornerstone of recovery.

Calling isn’t just about checking in; it’s about activating a system built to restore stability, one voice at a time. Whether navigating storm destruction, a vehicle accident, or unexpected loss, the National Assignment Center at the State Farm Claims Phone Number is ready to respond. With preparation, patience, and this central support line, policyholders transform uncertainty into action — not just filing a claim, but beginning the long road back to normal.

![Secrets to Successful State Farm Claims [2023]](https://versustexas.com/wp-content/uploads/Screenshot-2023-01-02-at-2.59.42-PM-1024x808-1.png)

Related Post

State Farm Claims Phone Number: Your Direct Route to Hassle-Free Auto Recovery

State Farm Claims Phone Numbers and Filing Guide: Your Ultimate Path to Smooth, Fast Insurance Claim Resolution

Canton China: Where Tradition Meets Global Trade in the Heart of the Pearl River

Mastering Industrial Control: How KP, TN, TV, And PID Shape Precision and Performance